“Being mindful of these three things and prepared for the process can help you avoid some of the most common mishaps when selling your house.”

It’s exciting to put a house on the market and to think about making new memories in new spaces, but we can have deep sentimental attachments to the homes we’re leaving behind, too. Growing emotions can help or hinder a sale, depending on how we manage them.

When it comes to the bottom line, homeowners need to know what it takes to avoid costly mistakes. Being mindful of these things and prepared for the process can help you avoid some of the most common mishaps when selling your house.

1. Overpricing Your Home

When inventory is low, like it is in the current market, it’s common to think buyers will pay whatever we ask for when we price our homes. Believe it or not, that’s far from the truth. Don’t forget that the buyer’s bank will send an appraisal to determine the fair value for your home. The bank will not lend more than what the house is worth, so be mindful that you might need to renegotiate the price after the appraisal. A real estate professional will help you to set the true value of your home.

2. Letting Your Emotions Interfere with the Sale

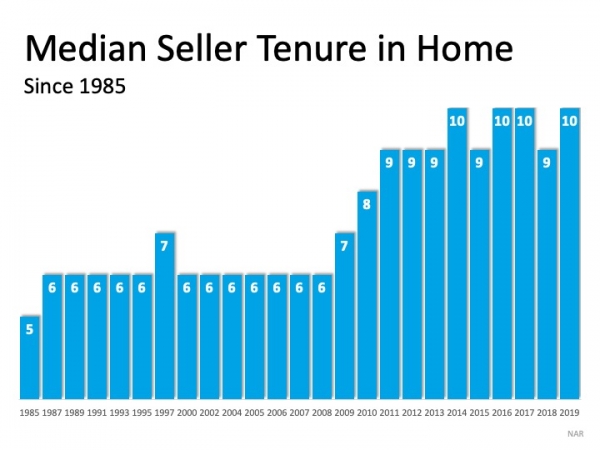

Today, most homeowners have been living in their houses for an average of 10 years (as shown in the graph below): This is several years longer than what used to be the norm, since many homeowners have been recouping from negative equity situations over the past 10 years. The side effect, however, is when you live for so long in one place, you may get even more emotionally attached to your space. If it’s the first home you bought after you got married or the house where your children grew up, it very likely means something extra special to you. Every room has memories and it’s hard to detach from the sentimental value.

This is several years longer than what used to be the norm, since many homeowners have been recouping from negative equity situations over the past 10 years. The side effect, however, is when you live for so long in one place, you may get even more emotionally attached to your space. If it’s the first home you bought after you got married or the house where your children grew up, it very likely means something extra special to you. Every room has memories and it’s hard to detach from the sentimental value.

For some homeowners, that makes it even harder to negotiate, separating the emotional value of the home from the fair market price. That’s why you need a real estate professional to help you with the negotiations in the process.

3. Not Staging Your Home

We’re generally quite proud of our décor and how we’ve customized our houses to make them our own personalized homes, but not all buyers will feel the same way about your design. That’s why it’s so important to make sure you stage your home with the buyer in mind. Buyers want to envision themselves in the space, so it truly feels like their own. They need to see themselves in the space with their furniture and keepsakes – not your pictures and decorations. Stage and declutter your home so they can visualize their own dreams as they walk through your house. A real estate professional can help you with tips to get your home ready to stage and sell.

Bottom Line

Today’s seller’s market might be your best chance to make a move. If you’re considering selling your house, let’s get together to help you navigate through the process while avoiding common seller mistakes.

To view original article, visit Keeping Current Matters.

Home Sales About To Surge? We May See a Winter Like Never Before.

Buyer demand is still extremely strong, and we may soon see an uncharacteristic increase in the number of homes for sale.

4 Things Every Renter Needs To Consider

if you’d like to learn more about the benefits of homeownership, let’s connect so you can make a confident, informed decision and have a trusted advisor along the way.

Retirement May Be Changing What You Need in a Home

Whatever your home goals are, a trusted real estate advisor can help you to find the best option for your situation.

Sellers: You’ll Likely Get Multiple Strong Offers This Season

If you’re on the fence about when to sell, remember your house is a hot commodity this season.

What’s Happening with Home Prices?

While the projected rate of appreciation varies among the experts, due to things like supply chain challenges, virus variants, and more, it’s clear that home values will continue to appreciate next year.

VA Loans: Helping Veterans Achieve Their Homeownership Dreams

Our veterans sacrifice so much in service to our nation and deserve to achieve their homeownership goals.