“Many first-time buyers still believe they need a 20% down payment to buy a home in today’s market.”

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

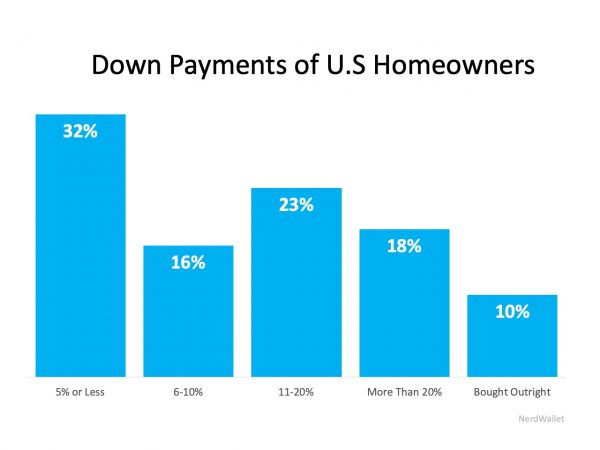

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

Bottom Line

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.

To view original article, visit Keeping Current Matters.

Why It’s Still a Sellers’ Market

While buyer demand is softening due to higher mortgage rates, homes that are priced right are still selling fast. That means your window of opportunity to list your house hasn’t closed.

3 Graphs To Show This Isn’t a Housing Bubble

It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. Today’s market is nothing like that.

Why Are People Moving Today?

While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors.

A Window of Opportunity for Homebuyers

The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic.

What’s Causing Ongoing Home Price Appreciation?

Experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand.

Think Home Prices Are Going To Fall? Think Again

If you’re planning to buy a home, you shouldn’t wait for home prices to drop to make your purchase.