“Many first-time buyers still believe they need a 20% down payment to buy a home in today’s market.”

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

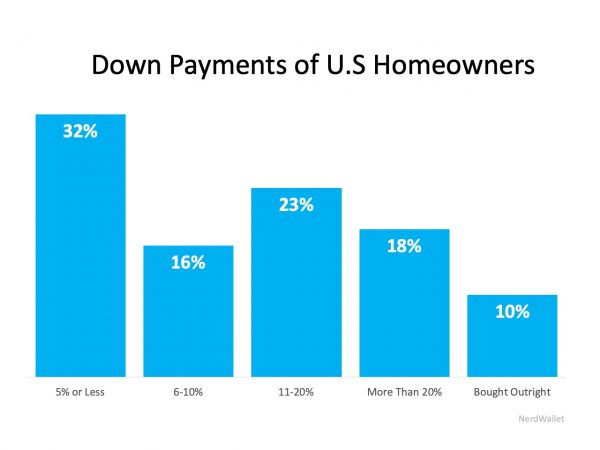

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

Bottom Line

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.

To view original article, visit Keeping Current Matters.

When a House Becomes a Home

Whether it’s a familiar scent or a favorite chair, the feel-good connections to our own homes can be more important to us than the financial ones.

The Average Homeowner Gained $56,700 in Equity over the Past Year

Understanding the importance of equity can help you realize why homeownership is a worthwhile goal.

Homebuyers: Be Ready To Act This Winter

Competition among buyers will remain fierce as there still won’t be enough homes for sale to meet the demand. so be ready to act!

What Everyone Wants To Know: Will Home Prices Decline in 2022?

it’s important to note that price increases won’t be as monumental as they were in 2021 – but they certainly won’t decline anytime soon.

Advice for First-Generation Homebuyers

Your dream of homeownership has far-reaching impacts and if you’re about to be the first person in your family to buy a home, let that motivate you throughout the process.

If You Think the Housing Market Will Slow This Winter, Think Again.

All signs point to the winter housing market picking up steam, making it much busier than in a more typical year.