“One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.”

Rising home prices have been in the news a lot lately, and much of the focus is on whether they’re accelerating too quickly and how sustainable the growth in prices really is. One of the often-overlooked benefits of rising prices, however, is the impact they have on a homeowner’s equity position.

Home equity is defined as the difference between a home’s fair market value and the outstanding balance of all liens on the property. While homeowners pay down their mortgages, the amount of equity they have in their homes climbs each time the value increases.

Today, the number of homeowners that currently have significant equity in their homes is growing. According to the Census Bureau, 38% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 54.5 million homes with a mortgage, 26.7% of them have at least 50% equity. That number has been increasing over the last eight years.

CoreLogic also notes:

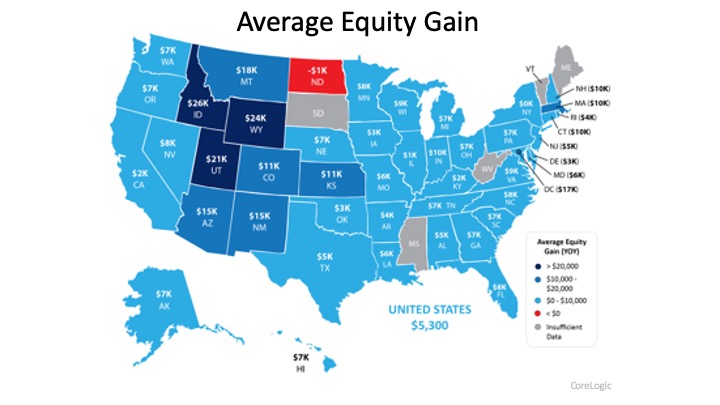

“…the average homeowner gained approximately $5,300 in equity during the past year.”

The map below shows a breakdown of the increasing equity gain across the country, painting a clear picture that home equity is growing in nearly every state.

Bottom Line

This may be the year to take advantage of your home equity by applying it forward, either as you downsize or as you move up to a new home.

To view original article, visit Keeping Current Matters.

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

Why You May Want To Seriously Consider a Newly Built Home

Newly built homes are becoming an increasingly significant part of today’s housing inventory.