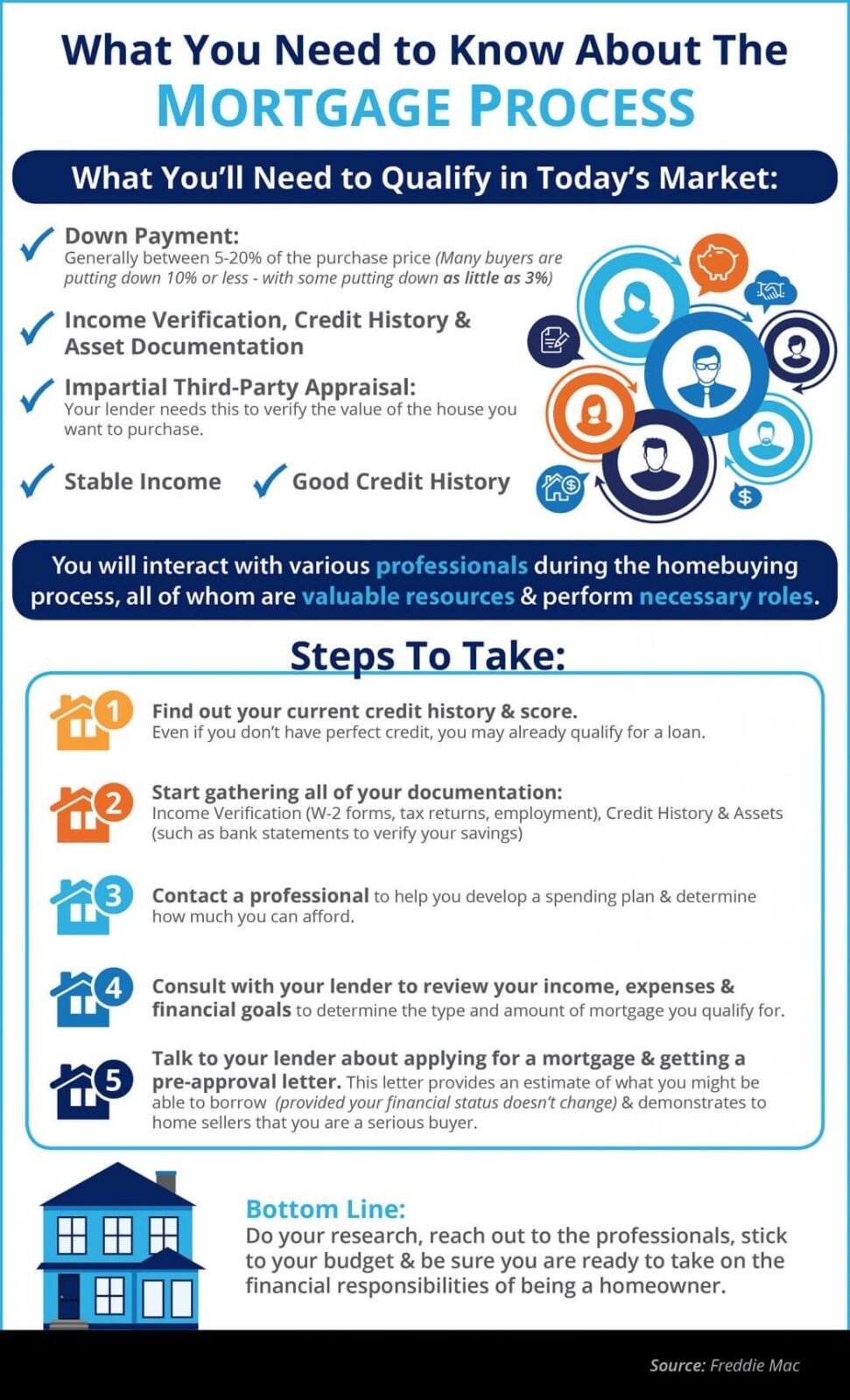

The Mortgage Process: What You Need to Know

Some Highlights:

-

Many buyers are purchasing a home with a down payment as little as 3%.

-

You may already qualify for a loan, even if you don’t have perfect credit.

-

Take advantage of the knowledge of your local professionals who are there to help you determine how much you can afford.

To see original article please visit Keeping Current Matters.

Forget the Price of the Home. The Cost is What Matters.

The reacceleration of home values may raise concerns about affordability. Discover how market factors impact purchasing power.

Millennials: Here’s Why the Process is Well Worth It

Millennials…a generation of those who favor fast-paced, real-time answers – and results.

Planning on Buying a Home? Be Sure You Know Your Options.

If you’re thinking of buying a home, you may want to consider a new build to meet your family’s needs.

The #1 Reason to List Your House in the Winter

Debating whether or not to sell your house and are curious about market conditions in your area? Let’s figure it out together!

The Difference an Hour Will Make This Fall

Take a look to see what is happening every hour in the housing market!

Taking the Fear Out of the Mortgage Process

Do your research, reach out to professionals and be sure you’re ready to take on the financial responsibilities of becoming a homeowner.

How to Determine If You Can Afford to Buy a Home

Though the price of homes may still be rising, the cost of purchasing a home is actually falling.

Thinking of Selling Your Home? The Waiting Is The Hardest Part.

If you’re considering selling your home, don’t wait – now is the time to make your move!

4 Reasons to Buy a Home This Fall

Buying a home sooner rather than later could lead to substantial savings. Let’s get together to determine if homeownership is the right choice for you and your family this fall.

5 Reasons to Consider Living in a Multigenerational Home

If you’re considering a multigenerational home, let’s get together to discuss the options available in our area.