No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

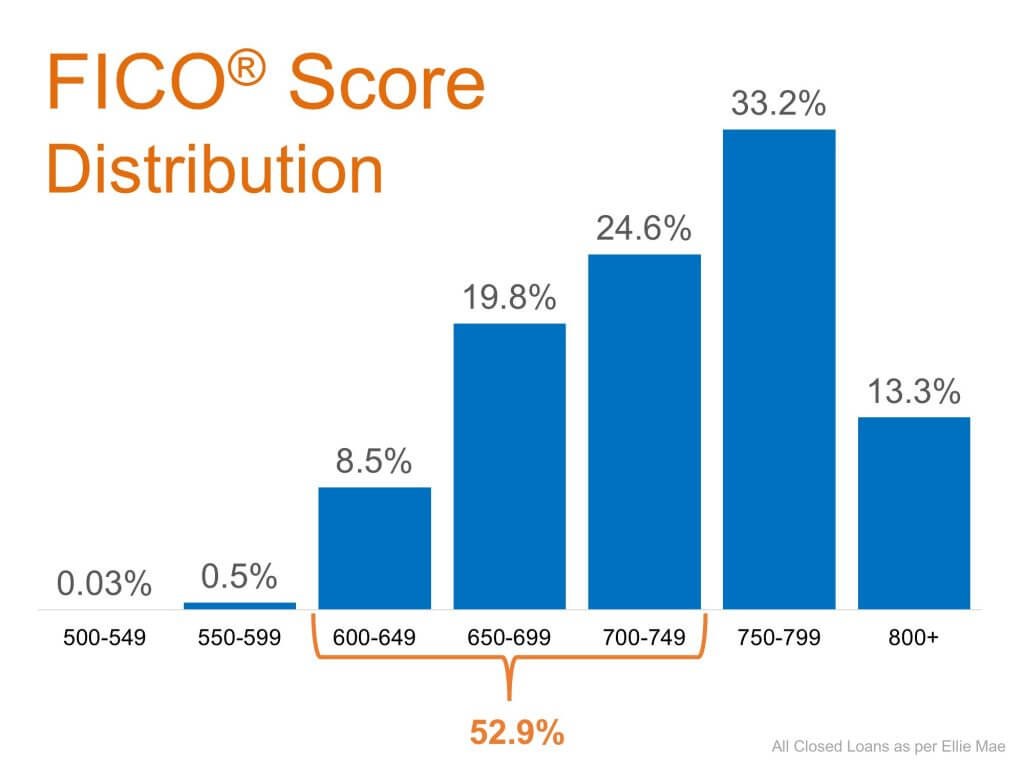

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

The Latest Unemployment Report: Slow and Steady Improvement

There is, however, still a long way to go before the job market fully recovers.

2020 Homebuyer Preferences

If your needs have changed recently and you’re thinking of making a move, taking advantage of today’s low mortgage rates is an opportunity you won’t want to miss!

How Is Remote Work Changing Homebuyer Needs?

Mortgage rates hovering at historical lows may enable you to purchase more home for your money, just when your family needs it most.

Why Homeowners Have Great Selling Power Today

With average home sale profits growing, it’s a great time to leverage your equity and make a move!

In Center Moriches, 19th century farmhouse asks $699,900

88 Lake Avenue, Center Moriches featured in the Real Estate section of Newsday! Interested in this home? Give Steve and Marc a call today.

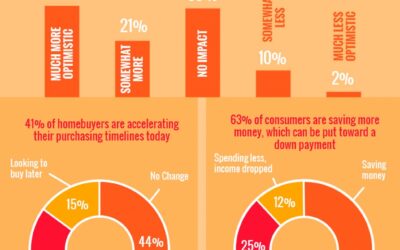

Today’s Buyers Are Serious about Purchasing a Home

As demand for homes to buy grows and millennials enter the market with buying power, the opportunity to sell your house grows too.

Experts Weigh-In on the Remarkable Strength of the Housing Market

Here’s a look at what the experts have said about the housing market over the past few weeks.

Where Is the Housing Market Headed for the Rest of 2020?

Historically low mortgage rates are creating great potential for homebuyers, and home sales are on the rise.

Will We See a Surge of Homebuyers Moving to the Suburbs?

With the ongoing health crisis, it’s no surprise that many people are starting to consider moving out of bigger cities.

Homeownership Rate Continues to Rise in 2020

There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates.