No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

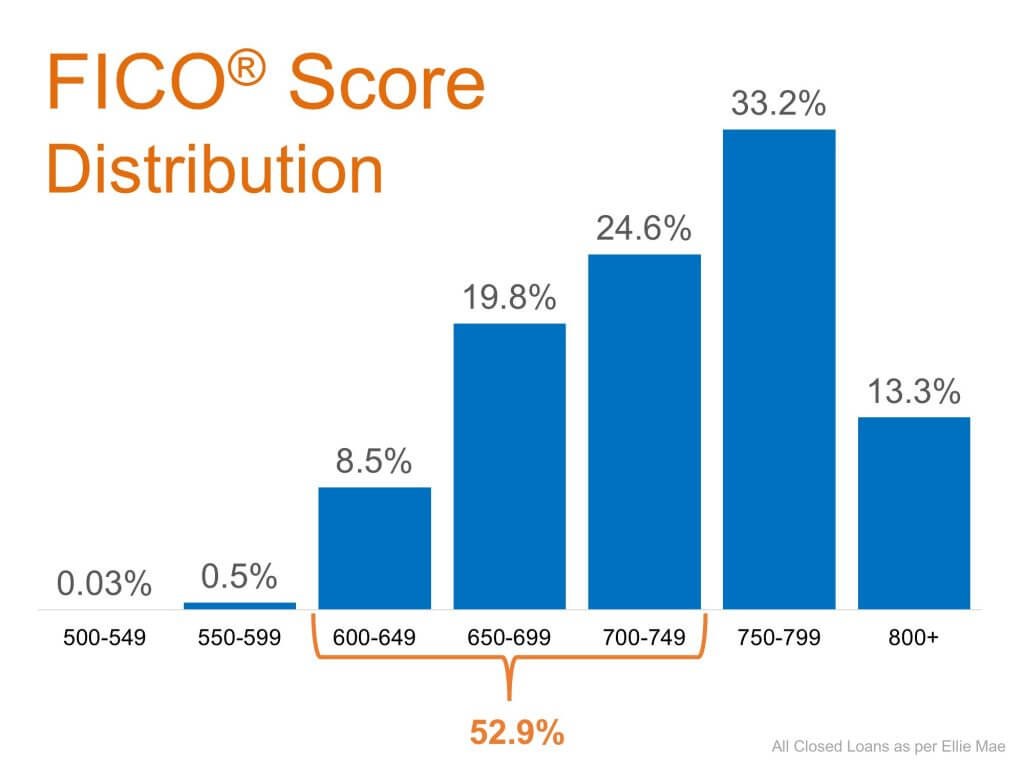

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

Guidance and Support Are Key When Buying Your First Home

If you’re not sure where to begin or you simply want help in figuring out how to save for a home, we are here to help you! Call us today 🙂

Three of the Latest Reports Show Housing Market Is Strong

The residential real estate market is remaining resilient as the country still struggles to beat the COVID-19 pandemic.

A Real Estate Pro Is More Helpful NOW than Ever

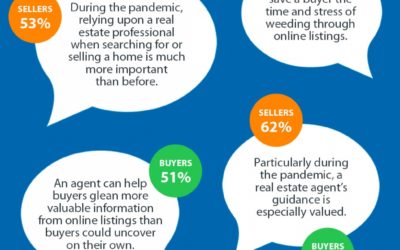

A recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.

Home Sales Hit a Record-Setting Rebound

Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.

Two Reasons We Won’t See a Rush of Foreclosures This Fall

Many think we may see a rush of foreclosures this fall, but the facts just don’t add up in this case.

A Remarkable Recovery for the Housing Market

Many experts have said the housing market will lead the way to a recovery, and today we’re seeing signs of that coming to light.

Thinking of Selling Your House? Now May be the Right Time

Housing inventory is down 18.8% from one year ago, and the houses that do come to the market are selling very quickly.

Does Your Home Have What Buyers Are Looking For?

The housing market has plenty of buyers who would benefit from a few more sellers. Are you ready to sell?

Mortgage Rates Hit Record Lows for Three Consecutive Weeks

A lower monthly payment means savings that can add up significantly over the life of a home loan.

Buyers: Are You Ready for a Bidding War?

The imbalance between supply and demand is pushing home prices upward while driving more bidding wars and multiple-offer scenarios.