No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

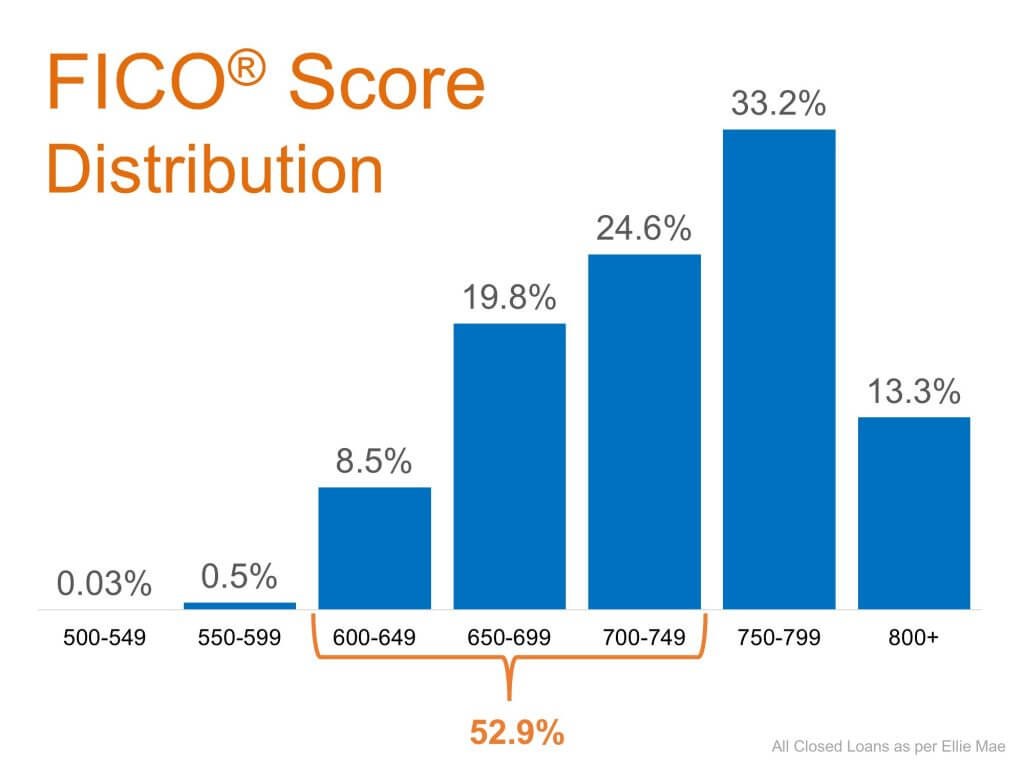

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

Americans Rank Real Estate Best Investment for 7 Years Running

Real estate has outranked stocks, savings accounts, and gold as the best long-term investment among Americans for the past 7 years.

Not All Agents Are Created Equal

Hiring a trusted professional who has a finger on the pulse of the market and is eager to help you learn will make your experience an informed and educated one.

Best Time to Sell? When Competition Is at an All-Time Low

Home purchasers are still very active despite the disruptions American families have experienced this year.

Taking Advantage of Homebuying Affordability in Today’s Market

If you’re considering purchasing a new home, it’s important to understand how affordability plays into the overall cost of your home.

Latest Unemployment Report: Great News…for the Most Part

U.S. job growth surged last month, underscoring the economy’s capacity for a quick rebound if businesses continue to reopen.

Is the Health Crisis Driving Buyers Out of Urban Areas?

Many consumers are on the move! It appears that a percentage of people are preparing to leave many American cities.

A Historic Rebound for the Housing Market

If you decided not to sell this spring due, maybe it’s time to jump back into the market while buyers are actively looking for homes.

What Are Experts Saying About the Rest of 2020?

Many economists are revising their forecasts for the remainder of 2020 – and the outlook is extremely encouraging.

New Index Reveals Impact of COVID-19 on Real Estate

It’s clear that the housing market is showing promising signs of recovery from the economic cuts we experienced earlier this spring.

Should We Be Looking at Unemployment Numbers Differently?

The hope and the goal is for those temporarily unemployed due to COVID-19 will return to their old jobs.