No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

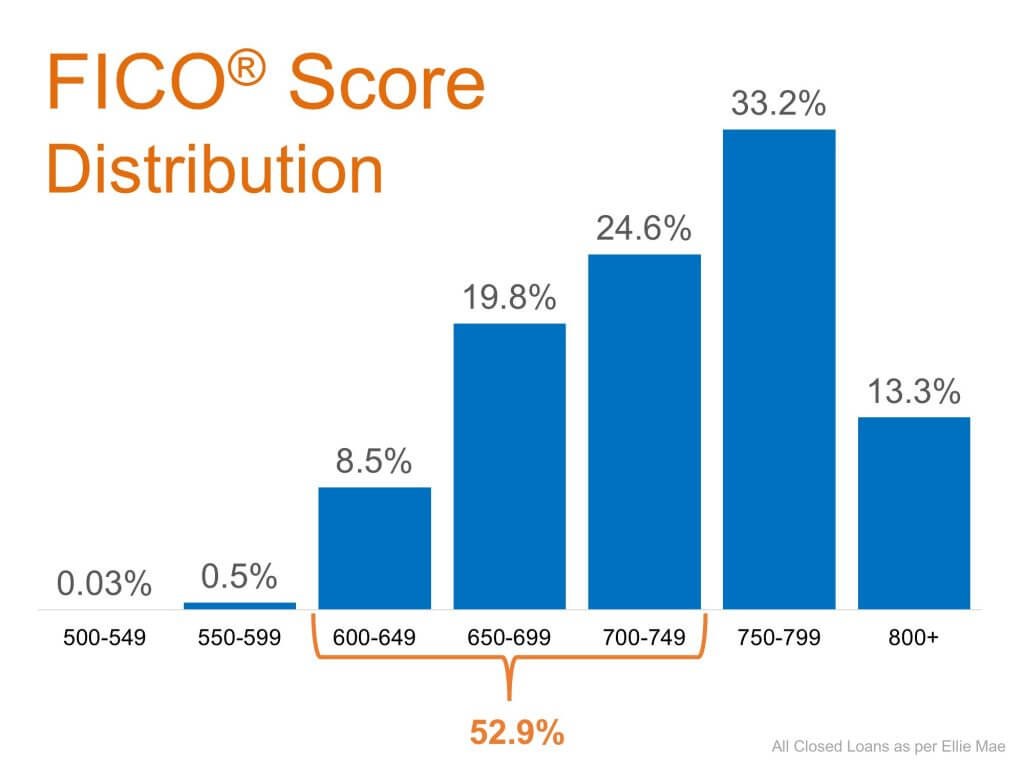

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

What Are the Experts Saying About Future Home Prices?

The virus and other challenges currently impacting the industry have created a wide range of thoughts regarding the future of home prices.

Homebuyers Are in the Mood to Buy Today

If you’re thinking of selling, know that the motivation for buyers to purchase right now is as high as ever with rates where they are today.

Want to Make a Move? Homeowner Equity is Growing Year-Over-Year

Having equity to re-invest in your next home is a major force that can make moving a reality.

Three Reasons Homebuyers Are Ready to Purchase This Year

The demand for lousing will keep growing this year. This may be your moment to list your house and make a move!

Real Estate Tops Best Investment Poll for 7th Year Running

For the seventh year in a row, real estate has come out on top as the best long-term investment.

New Listing! 32 Sagebrush Lane, Islandia

Check out the latest listing by BrookHampton Realty! You won’t want to miss this spacious 3-4 bedroom farmhouse! Call Donna today to schedule your private showing!

Are You Ready for the Summer Housing Market?

Summer is gearing up to be the 2020 buying season, so including your house in the mix may be your best opportunity to sell yet.

Is a Recession Here? Yes. Does that Mean a Housing Crash? No.

While we may be in a recession, the housing industry is much different than it was in 2008.

New York State COVID-19 Phase 2 Reopening

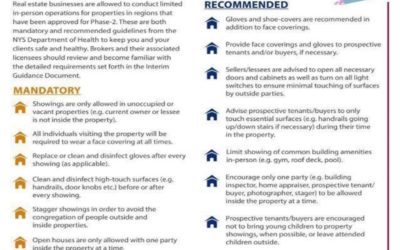

Beginning Wed., June 10, 2020, as NY enters Phase 2 of reopening, we will resume in-person showings following mandatory guidelines.

Real Estate Will Lead the Economic Recovery

Experts say the economy will begin to recover later this year. With real estate as a driver, that recovery may start sooner than we think.