No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

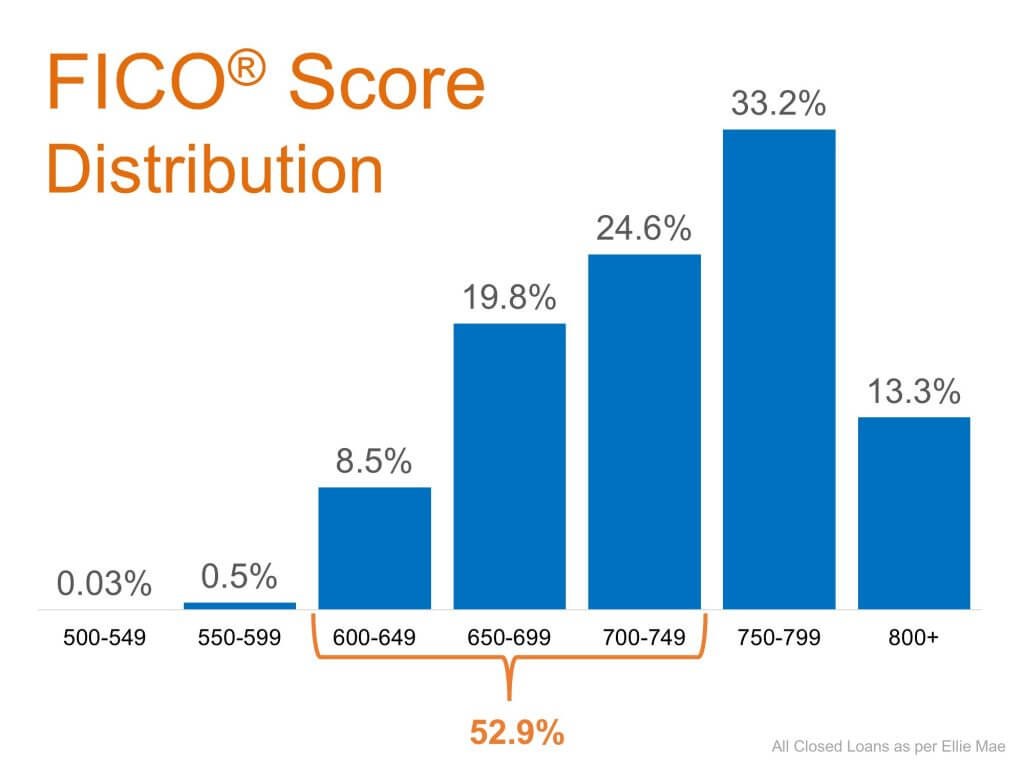

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

A Surprising Shift to the ‘Burbs May Be on the Rise

Today, moving outside the city limits is more feasible than ever, especially as Americans become accustomed to remote work.

Will Home Values Appreciate or Depreciate in 2020?

According to some experts, even though inventory is still low, it seems that home prices will remain stable throughout 2020.

Happy Mother’s Day

Happy Mother’s Day to all the wonderful women in our lives. We appreciate all the things you do for us each and every day! 🌷🌸💐 💞🌞

Why Home Equity Is a Bright Spark in the Housing Market

The fear and uncertainty we feel right now are very real, and this is not going to be easy.

Confused About the Economic Recovery? Here’s Why.

Experts project businesses will rebound, and a recovery will start to happen in the second half of this year.

U.S. Homeownership Rate Rises to Highest Point in 8 Years

Homeownership is an important part of the American dream, especially in moments like this.

How to Test-Drive a Neighborhood While Sheltering in Place

Check out these tips on how to explore other neighborhoods virtually in the homebuying process.

Why the Housing Market Is a Powerful Economic Driver

Buying a home is a driving financial force in the recovery of the U.S. economy. Are you ready to make a move?

Buying a Home Right Now: Easy? No. Smart? Yes.

Many families have decided not to postpone their plans to purchase a home, even in these difficult times.

What Impact Might COVID-19 Have on Home Values?

A big challenge facing the housing industry is determining what impact the current pandemic may have on home values.