“Homeownership is a catalyst for building wealth for people from all walks of life.”

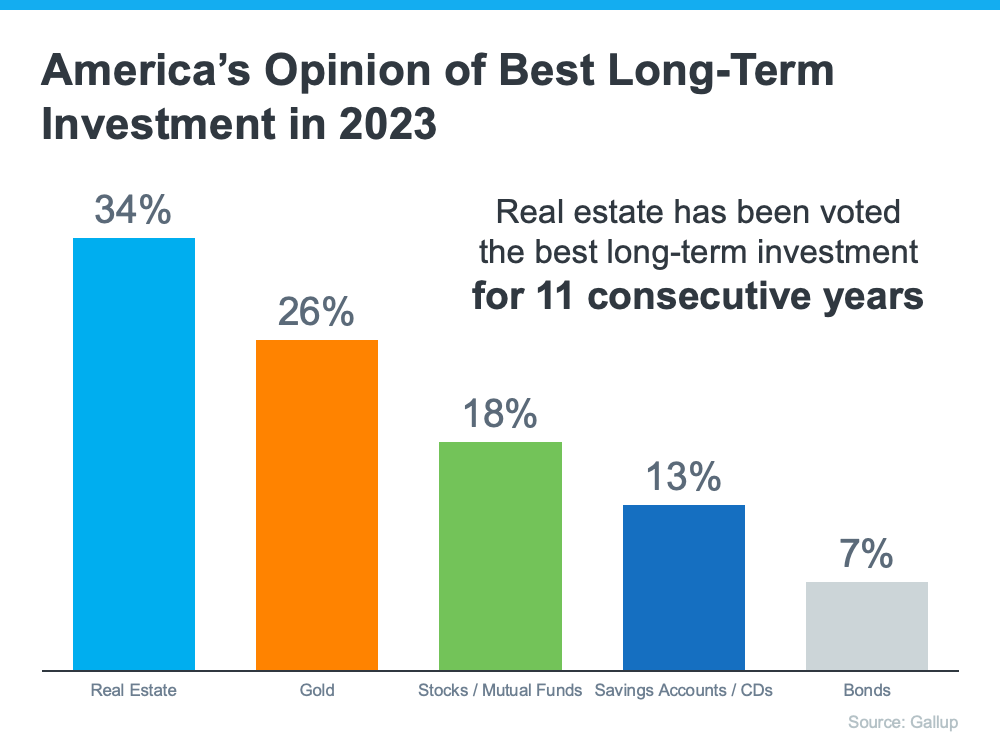

With all the headlines circulating about home prices and rising mortgage rates, you may wonder if it still makes sense to invest in homeownership right now. A recent poll from Gallup shows the answer is yes. In fact, real estate was voted the best long-term investment for the 11th consecutive year, consistently beating other investment types like gold, stocks, and bonds (see graph below):

If you’re thinking about purchasing a home, let this poll reassure you. Even with everything happening today, Americans recognize owning a home is a powerful financial decision.

Why Do Americans Still Feel So Positive About the Value of Investing in a Home?

Purchasing real estate has typically been a solid long-term strategy for building wealth in America. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), notes:

“. . . homeownership is a catalyst for building wealth for people from all walks of life. A monthly mortgage payment is often considered a forced savings account that helps homeowners build a net worth about 40 times higher than that of a renter.”

That’s because owning a home grows your net worth over time as your home appreciates in value and as you pay down your mortgage. And, since building that wealth takes time, it may make sense to start as soon as you can. If you wait to buy and keep renting, you’ll miss out on those monthly housing payments going toward your home equity.

Bottom Line

Buying a home is a powerful decision. So, it’s no wonder so many people view real estate as the best long-term investment. If you’re ready to start on your own journey toward homeownership, let’s connect today.

To view original article, visit Keeping Current Matters.

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

Why You May Want To Seriously Consider a Newly Built Home

Newly built homes are becoming an increasingly significant part of today’s housing inventory.