Renters Paying Substantially More While Owning Costs Less

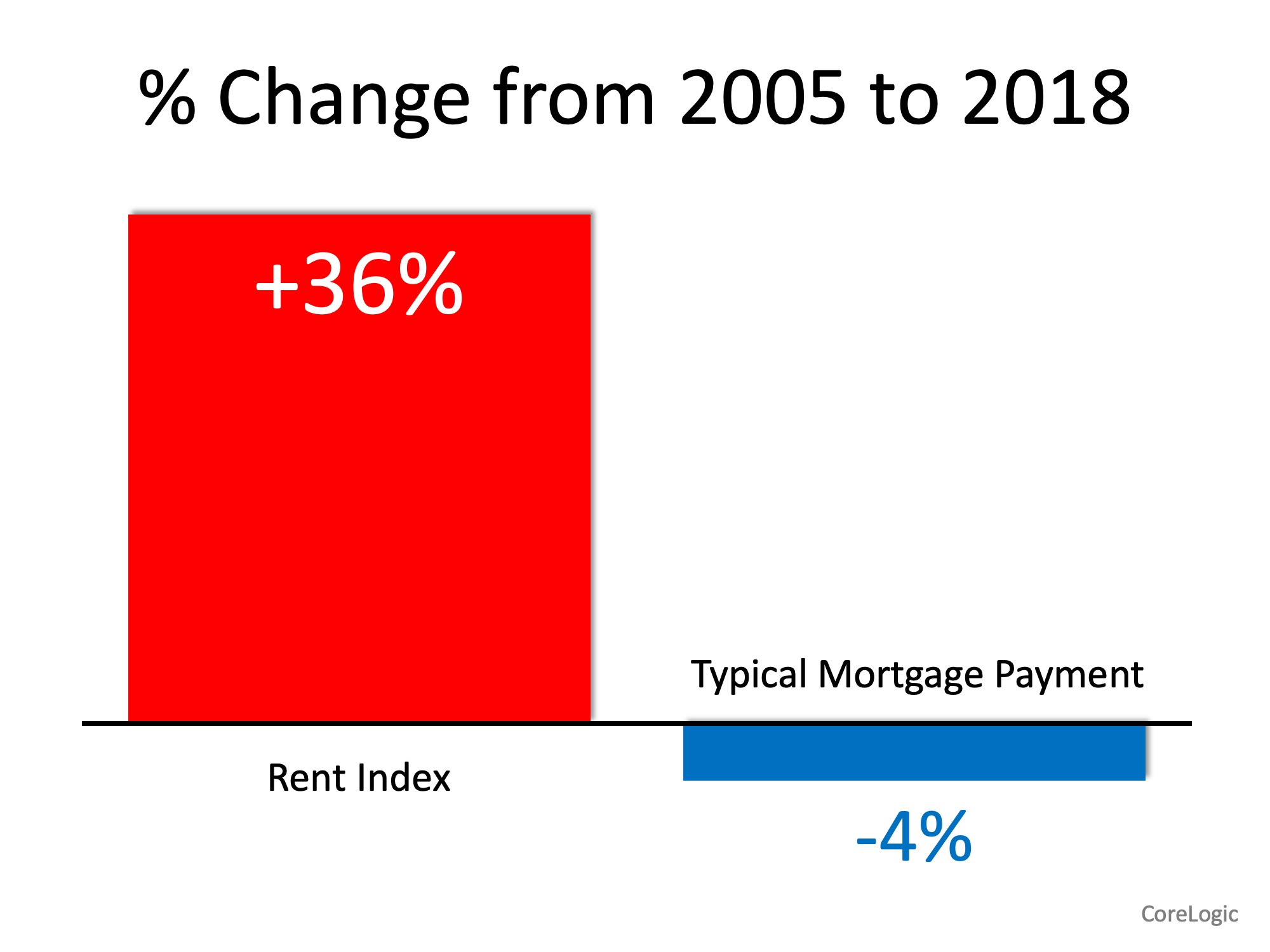

In a recent Insights Blog, CoreLogic reported that rent prices have skyrocketed since 2005. Meanwhile, the typical mortgage payment has actually decreased.

“CoreLogic’s national rent index was up 36% in December 2018 compared with December 2005, while the typical mortgage payment was down 4% over that period.”

Why the difference between the costs of renting versus owning?

It makes sense that rents have risen. However, how did mortgage payments decrease? CoreLogic explained:

“It’s mainly because mortgage rates back in December 2005 were significantly higher, averaging 6.3% for a fixed-rate 30-year loan, compared with 4.6% in December 2018.

The national median sale price in December 2005 – $190,000 – was lower than the $220,305 median in December 2018, but because of higher mortgage rates in 2005 the typical monthly mortgage payment was slightly higher back then – $941 – compared with $904 in December 2018.”

Additionally, a recent report by the National Association of Realtors (NAR) showed that purchasing a home requires less of your monthly paycheck.

According to the Economists’ Outlook Blog, NAR’s February 2019 Housing Affordability Index showed that the “percentage of income needed” to pay the typical mortgage has decreased the last three months.

- November – 17.3%

- December – 16.9%

- January – 16.2%

- February – 15.9%

Bottom Line

What does this all mean to the current housing market? We think First American said it best in a post last week:

“The mortgage rate-driven affordability surge has arrived just in time… Rising affordability has already benefited home buyers and, if the lower rate environment persists, we’re in for a great spring home-buying season.”

To view original article, visit Keeping Current Matters.

Why Pre-Approval Is a Game Changer for Homebuyers

Pre-approval from a lender helps you understand your true price range and how much money you can borrow for your loan.

Wondering Where You’ll Move if You Sell Your House Today?

A trusted real estate agent will help you think through the pros and cons of new and existing homes to help you make your best decision.

Housing Experts Say This Market Isn’t a Bubble

Lending standards are tighter due to lessons learned and new regulations enacted after the last crisis.

Expert Housing Market Forecasts for the Second Half of the Year

Housing supply is increasing, but there are still more buyers than there are homes for sale, maintaining the upward pressure on home prices.

The Drop in Mortgage Rates Brings Good News for Homebuyers

A decrease in mortgage rates means an increase in your purchasing power.

Is Homeownership Still the American Dream?

Your home is your stake in the community and a strong financial investment, something you can be proud of.