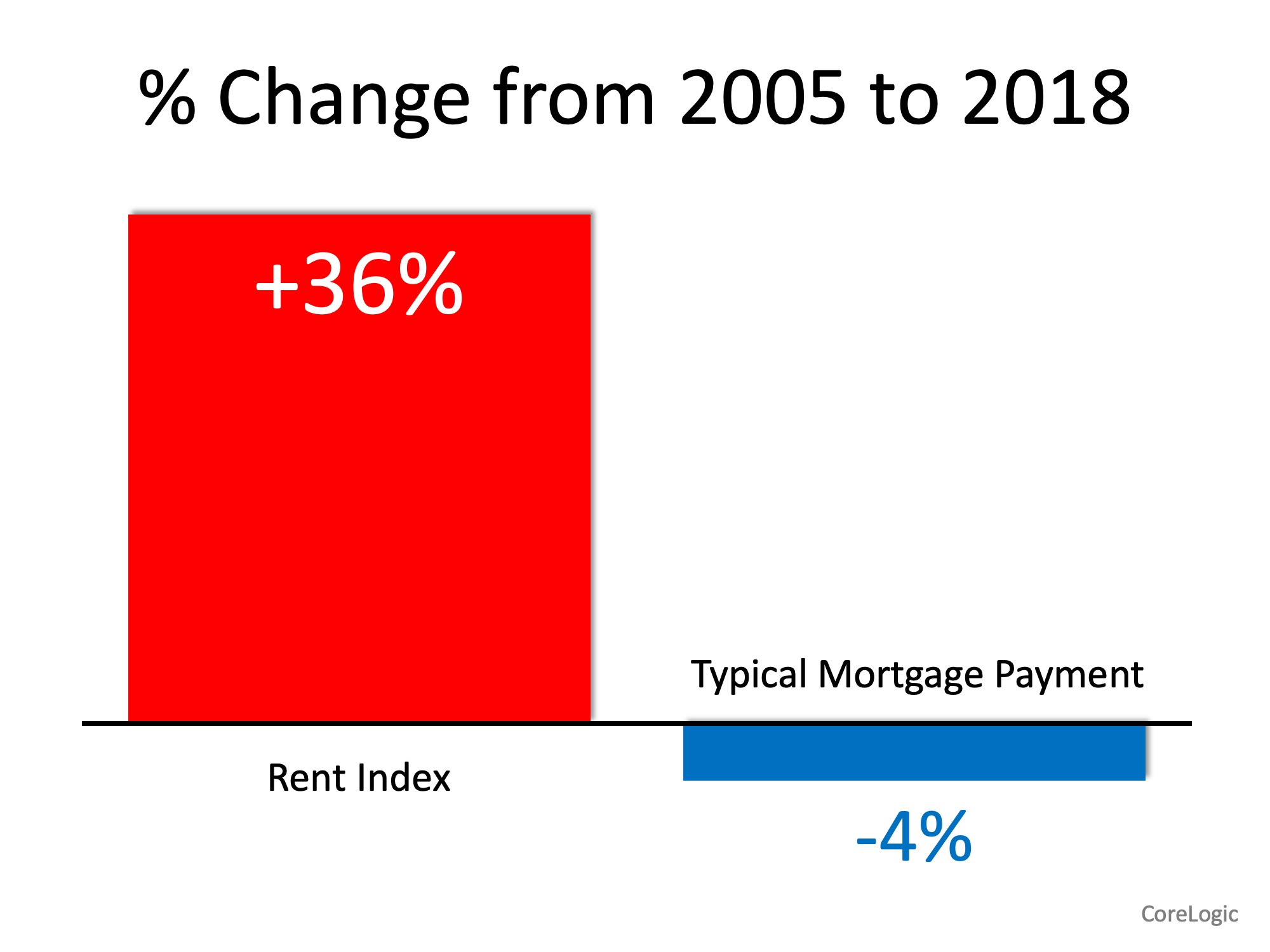

Renters Paying Substantially More While Owning Costs Less

In a recent Insights Blog, CoreLogic reported that rent prices have skyrocketed since 2005. Meanwhile, the typical mortgage payment has actually decreased.

“CoreLogic’s national rent index was up 36% in December 2018 compared with December 2005, while the typical mortgage payment was down 4% over that period.”

Why the difference between the costs of renting versus owning?

It makes sense that rents have risen. However, how did mortgage payments decrease? CoreLogic explained:

“It’s mainly because mortgage rates back in December 2005 were significantly higher, averaging 6.3% for a fixed-rate 30-year loan, compared with 4.6% in December 2018.

The national median sale price in December 2005 – $190,000 – was lower than the $220,305 median in December 2018, but because of higher mortgage rates in 2005 the typical monthly mortgage payment was slightly higher back then – $941 – compared with $904 in December 2018.”

Additionally, a recent report by the National Association of Realtors (NAR) showed that purchasing a home requires less of your monthly paycheck.

According to the Economists’ Outlook Blog, NAR’s February 2019 Housing Affordability Index showed that the “percentage of income needed” to pay the typical mortgage has decreased the last three months.

- November – 17.3%

- December – 16.9%

- January – 16.2%

- February – 15.9%

Bottom Line

What does this all mean to the current housing market? We think First American said it best in a post last week:

“The mortgage rate-driven affordability surge has arrived just in time… Rising affordability has already benefited home buyers and, if the lower rate environment persists, we’re in for a great spring home-buying season.”

To view original article, visit Keeping Current Matters.

On the Fence of Whether or Not To Move This Spring? Consider This.

When buyers have to compete with one another like this, they’ll do everything they can to make their offer stand out.

Is It Time to Buy a Smaller Home?

There are many reasons to buy a smaller home—or to downsize from your present home—but sometimes, the idea that “less is more” is what propels homeowners to buy a smaller home.

Why a Real Estate Professional is Key When Selling Your House

Real Estate professionals have the skills, experience and expertise to navigate the highly detailed and involved process of selling a home.

Using Your Tax Refund To Achieve Your Homeownership Goals This Year

If you’re getting a refund this year, here are a few tips to help with your home purchase or sale this season.

Balancing Your Wants and Needs as a Homebuyer Today

Crafting your home search checklist may seem like a small task, but it can save you time and money.

There Are Several Great Reasons to Consider Buying a Condo Today

Talking with an expert real estate advisor is the best first step to determining if condo living might work for you.