Slaying the Hardest Homebuying Myths Today

Some Highlights:

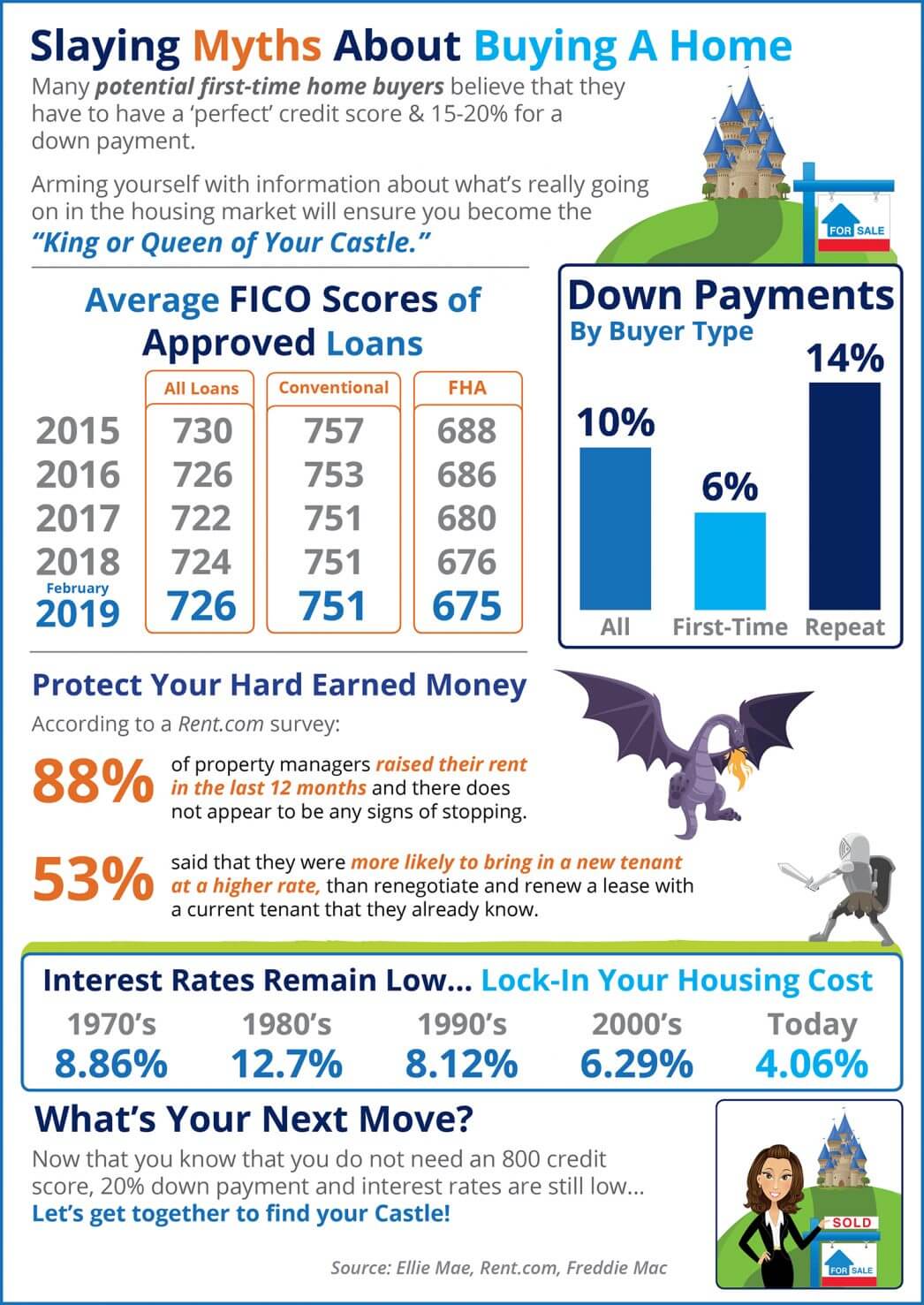

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Don’t Fall for the Next Shocking Headlines About Home Prices

In the coming months, you’re going to see even more headlines that either get what’s happening with home prices wrong or are misleading.

Foreclosure Numbers Today Aren’t Like 2008

Today, foreclosures are far below the record-high number that was reported when the housing market crashed.

Explaining Today’s Mortgage Rates

Factors such as inflation, other economic drivers, and the policy and decisions from the Federal Reserve are all influencing mortgage rates today.

Homebuyers Are Getting Used to the New Normal

One positive trend right now is homebuyers are adapting to today’s mortgage rates and getting used to them as the new normal.

Home Prices Are Rebounding

Experts believe one of the reasons prices didn’t crash like some expected is because there aren’t enough available homes for the number of people who want to buy them.

Momentum Is Building for New Home Construction

If you’re looking to move right now, reach out to a local real estate professional to explore the homes that were recently completed.