Slaying the Hardest Homebuying Myths Today

Some Highlights:

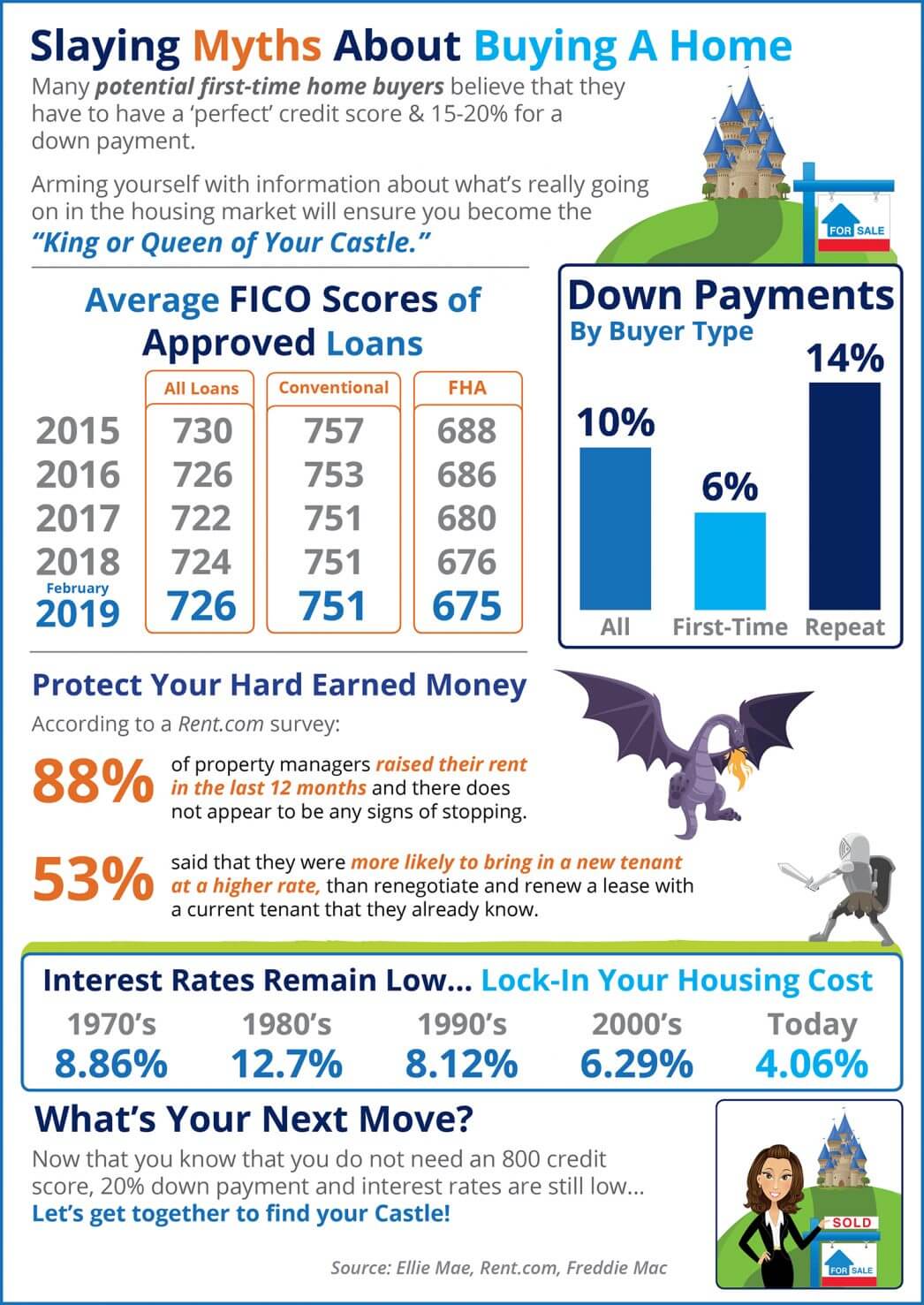

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Reasons Your Home May Not Be Selling

If you’re thinking of selling, lean on your real estate agent for expert advice based on your unique situation and feedback you get from buyers throughout the process.

Today’s Housing Inventory Is a Sweet Spot for Sellers

Buyers have fewer choices now than they did in more normal years, and that’s continuing to impact statistics in the housing market.

Evaluating Your Wants and Needs as a Homebuyer Matters More Today

So, if you’re looking to buy a home, take some time to consider what’s truly essential for you in your next house.

Where Will You Go If You Sell? Newly Built Homes Might Be the Answer.

New home construction is up and is becoming an increasingly significant part of the housing inventory.

Why Homeownership Wins in the Long Run

It’s important to think about the long-term benefits of homeownership when deciding whether or not to buy a home.

The True Cost of Selling Your House on Your Own

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide.