Slaying the Hardest Homebuying Myths Today

Some Highlights:

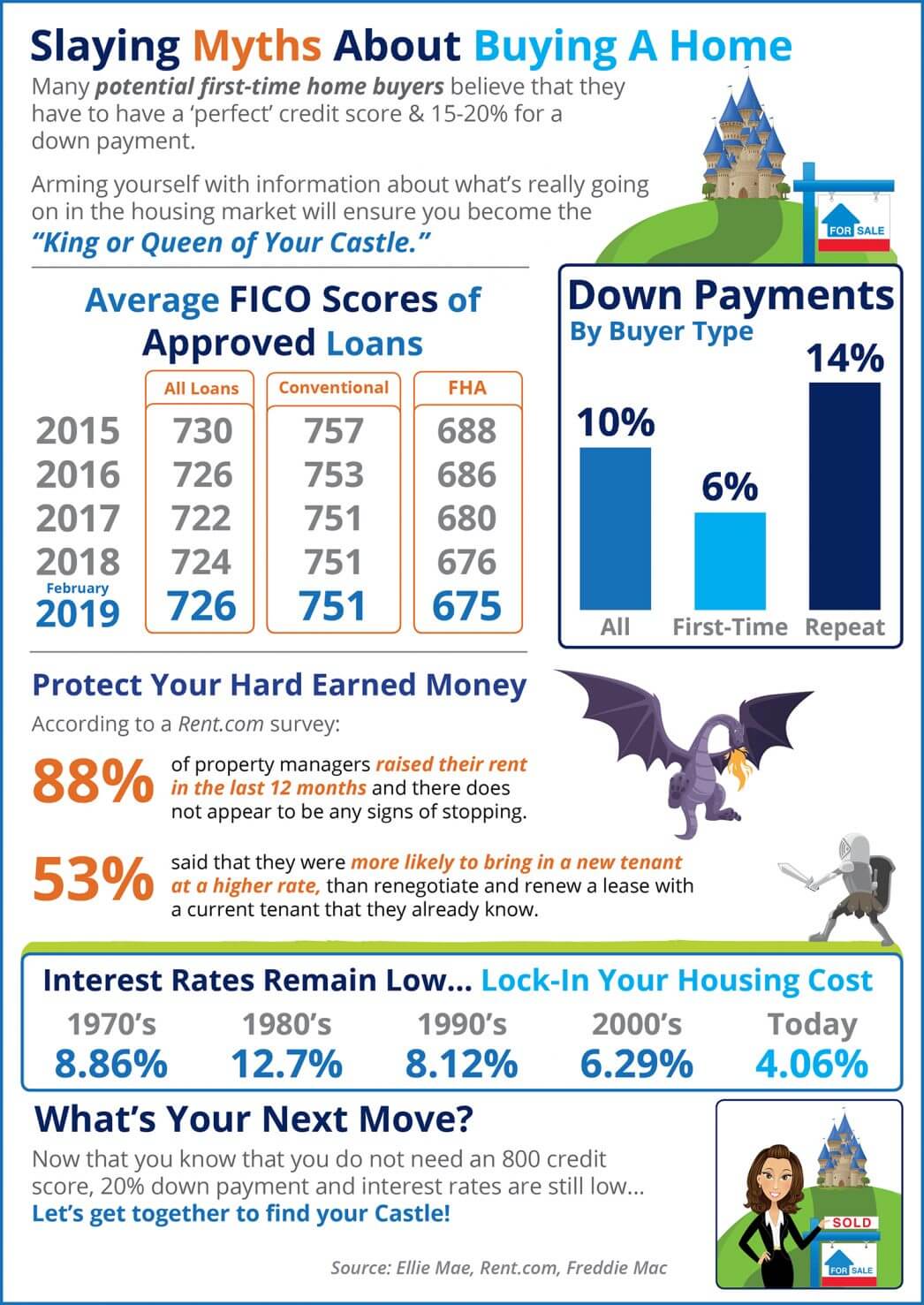

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

Why Today’s Foreclosure Numbers Are Nothing Like 2008

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis.

What Are the Experts Saying About the Spring Housing Market?

Buyers are going to see more competition than they might expect because there are not many homes on the market.

The Power of Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.

What’s the Difference Between a Home Inspection and an Appraisal?

Your trusted real estate professional will help you navigate both the inspection as well as any issues that arise during the buying process.

5 Reasons Millennials Are Buying Homes

The top reasons include building equity, a change in life stage, wanting stability, rising home values, and wanting to make somewhere truly their own.

Think Twice Before Waiting for Lower Home Prices

The best way to understand what home values are doing is to work with a local real estate agent who can give you the latest insights.