Slaying the Hardest Homebuying Myths Today

Some Highlights:

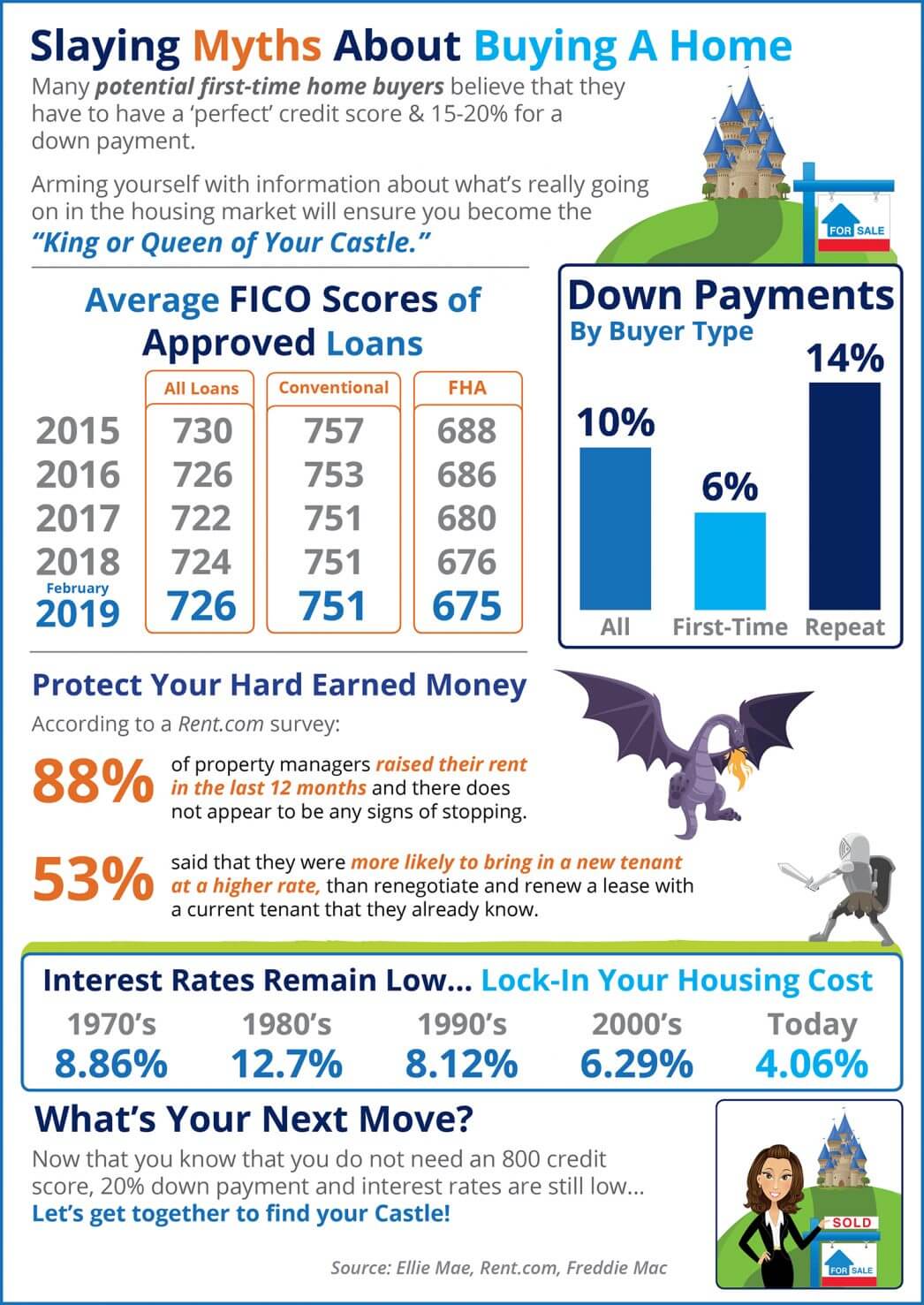

- The average down payment for first-time homebuyers is only 6%!

- Mortgage interest rates have been on the decline since November! Hop in now to lock in a low rate!

- 88% of property managers raised their rents in the last 12 months!

- The average credit score on approved loans continues to fall across many loan types!

Bottom Line

Slaying myths about about buying a home. Arming yourself with information about what’s really going on in the housing market will ensure you become the ‘King or Queen of Your Castle.’

To view original article, visit Keeping Current Matters.

The Truth About Negative Home Equity Headlines

News headlines focus on short-term equity numbers and fail to convey the long-term view.

What Experts Are Saying About the 2023 Housing Market

2023 likely will become a year of long-lost normalcy returning to the market with mortgage rates stabilizing.

3 Best Practices for Selling Your House This Year

A real estate professional can help you with tips to get your house ready to sell.

Wondering How Much You Need To Save for a Down Payment?

A real estate professional and trusted lender can show you options that could help you get closer to your down payment goal.

Homeowners Still Have Positive Equity Gains over the Past 12 Months

While equity helps increase your overall net worth, it can also help you achieve other goals, like buying your next home.

Mortgage Rates Are Dropping. What Does That Mean for You?

It’s important to work with a trusted real estate professional who follows what experts are projecting for the months, and year ahead.