“Here are a few reasons condos may be something you’ll want to consider.”

If you’re a first-time buyer looking to break into the housing market but struggling to find a home to buy, condominiums (or condos) could be a great alternative for you.

Here are a few reasons condos may be something you’ll want to consider.

Exploring Condos Could Add Options That Fit Your Budget

Supply challenges are a reality across the board in today’s housing market. Broadening your home search to include condos could increase your overall pool of options. Just keep in mind, condos generally differ from single-family homes in average space and floorplans.

In a recent article, Bankrate covers some of these differences:

“Condos are generally more affordable because they come with less space — you likely won’t have your own backyard, for example, and the interior tends to be smaller than the square footage of a single-family home.”

But if the size of a condominium meets your needs, they could match your budget as well. Data from the National Association of Realtors (NAR) shows the difference in the median price for both housing types. For single-family homes, the median price is $363,800. And for condominiums, the median price is lower at $305,400.

So, if budget is top of mind for you, a condominium could be a great fit within your target price range.

Not to mention, buying a condo is a great way to break into the market and start building equity that can help power a future move up. The condo you purchase today may not be your forever home, but it can be a great stairstep that can help you buy your dream home later on.

Find Out if Condo Living Is Right for You

In addition, owning and living in a condo is also a lifestyle choice. While it’s true they may be smaller than single-family homes, the amenities condos provide could be a draw for many buyers. Less space in your home might mean minimal upkeep, lower maintenance, and more time for you to spend doing the things you enjoy.

To understand if condo life is for you, Bankrate recommends asking yourself a few simple questions:

“Hate to mow the lawn and trim the hedges? What about pressure washing your driveway? Are your finances such that having to lay out $5,000 or more for a new roof will be a burden? . . . Condos tend to work best for those comfortable with most of the aspects of apartment living, minus the built-in maintenance.”

Ultimately, talking with an expert real estate advisor is the best first step to determining if condo living might work for you.

Bottom Line

Condominiums are a great option for many buyers, especially those looking to buy their first home. If you’re willing to consider condos in your search, you could find something that’s in line with your target numbers and your needs. To learn more, let’s connect so you have an expert in the condo-buying process on your side.

To view original article, visit Keeping Current Matters.

Did You Outgrow Your Home in 2020?

It may seem hard to imagine that the home you’re in today might not be your forever home. Many needs have changed in 2020 and your home may no longer fit your lifestyle.

Happy Holidays!

May your holiday season be filled with health,

happiness and laughter through the New Year!

#brookhamptonrealty

The Difference a Year Makes for Homeownership

Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home.

The Do’s and Dont’s after Applying for a Mortgage

Once you’ve found the right home and applied for a mortgage, there are some key things to keep in mind before you close.

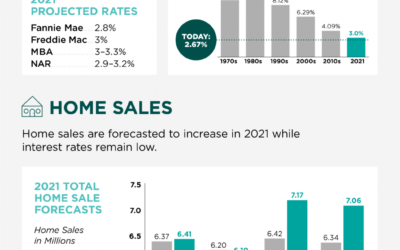

2021 Housing Forecast – Infographic

With mortgage rates forecasted to remain low, high buyer demand is expected to fuel more home sales and continue to increase home prices.

Homeowner Equity Increases an Astonishing $1 Trillion

Over the past year, strong home price growth has created a record level of home equity for homeowners.