“If you’re a renter with a desire to become a homeowner, you may be hoping that waiting a year might mean better market conditions to purchase a home.”

If you’re a renter with a desire to become a homeowner, or a homeowner who’s decided your current house no longer fits your needs, you may be hoping that waiting a year might mean better market conditions to purchase a home.

To determine if you should buy now or wait, you need to ask yourself two simple questions:

- What will home prices be like in 2022?

- Where will mortgage rates be by the end of 2022?

Let’s shed some light on the answers to both of these questions.

What will home prices be like in 2022?

Three major housing industry entities project continued home price appreciation for 2022. Here are their forecasts:

- Freddie Mac: 5.3%

- Fannie Mae: 5.1%

- Mortgage Bankers Association: 8.4%

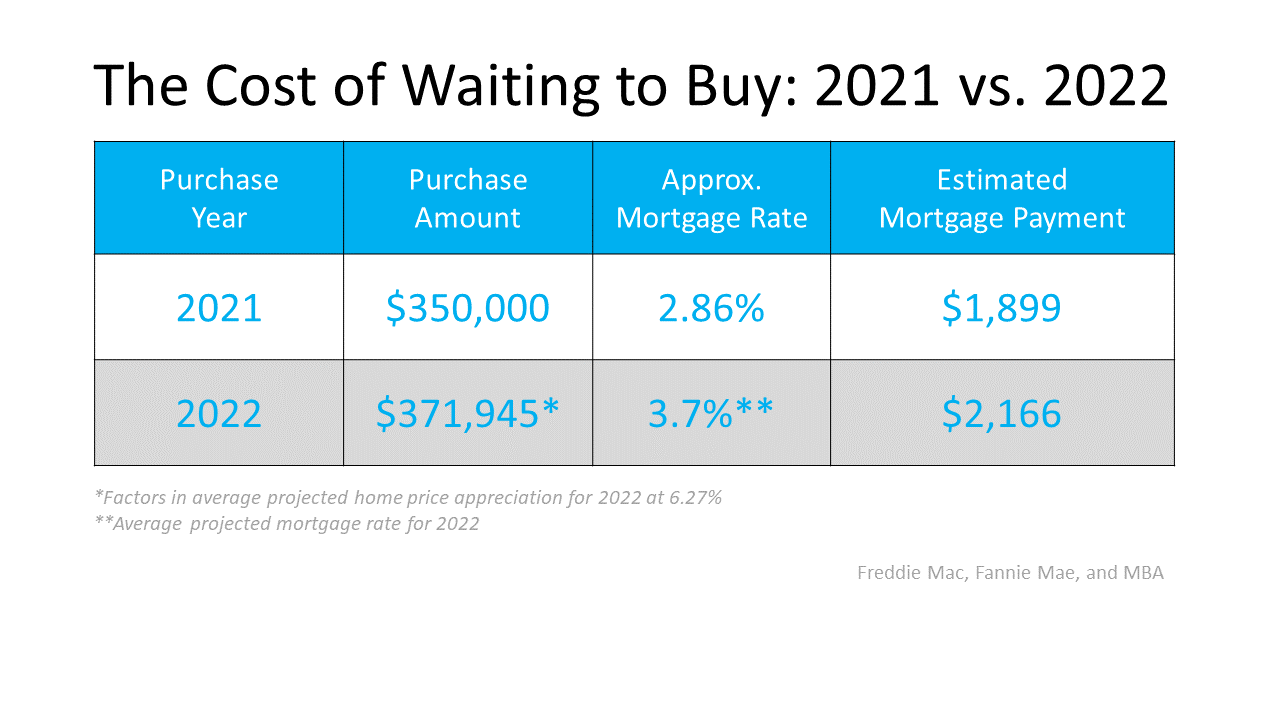

Using the average of the three projections (6.27%), a home that sells for $350,000 today would be valued at $371,945 by the end of next year. That means, if you delay, it could cost you more. As a prospective buyer, you could pay an additional $21,945 if you wait.

Where will mortgage rates be by the end of 2022?

Today, the 30-year fixed mortgage rate is hovering near historic lows. However, most experts believe rates will rise as the economy continues to recover. Here are the forecasts for the fourth quarter of 2022 by the three major entities mentioned above:

- Freddie Mac: 3.8%

- Fannie Mae: 3.2%

- Mortgage Bankers Association: 4.2%

That averages out to 3.7% if you include all three forecasts, and it’s nearly a full percentage point higher than today’s rates. Any increase in mortgage rates will increase your cost.

What does it mean for you if both home values and mortgage rates rise?

You’ll pay more in mortgage payments each month if both variables increase. Let’s assume you purchase a $350,000 home this year with a 30-year fixed-rate loan at 2.86% after making a 10% down payment. According to the mortgage calculator from Smart Asset, your monthly mortgage payment (including principal and interest payments, and estimated home insurance, taxes in your area, and other fees) would be approximately $1,899.

That same home could cost $371,945 by the end of 2022, and the mortgage rate could be 3.7% (based on the industry forecasts mentioned above). Your monthly mortgage payment, after putting down 10%, would increase to $2,166.

The difference in your monthly mortgage payment would be $267. That’s $3,204 more per year and $96,120 over the life of the loan.

If you consider that purchasing now will also let you take advantage of the equity you’ll build up over the next calendar year, which is approximately $22,000 for a house with a similar value, then the total net worth increase you could gain from buying this year is over $118,000.

Bottom Line

When asking if you should buy a home, you probably think of the non-financial benefits of owning a home as a driving motivator. When asking when to buy, the financial benefits make it clear that doing so now is much more advantageous than waiting until next year.

To view original article, visit Keeping Current Matters.

Two Graphs That Show Why You Shouldn’t Be Upset About 3% Mortgage Rates

3% mortgage rates shouldn’t deter you from your homebuying goals.

Sellers Have Incredible Leverage in Today’s Market

With buyers eager to purchase, sellers who list their houses this fall have a tremendous advantage when negotiating with buyers.

Renters Missed Out on $51,500 This Past Year

By renting this year, you missed out on the potential wealth gain of $51,500 you could have had by owning your own home.

There Are More Homes Available Now Than There Were This Spring

While it’s impossible to say what the future holds, we do know buyers and sellers have opportunities this season based on the latest data.

Knowledge Is Power When It Comes to Appraisals and Inspections

Both the appraisal and the inspection are important steps in the homebuying process and protect you as a buyer.

Looking To Move? It Could Be Time To Build Your Dream Home.

If you’re ready to sell but are waiting, newly built homes and those under construction can provide the options you’ve been waiting for.

.jpg )