“The current situation makes it extremely difficult to project the future of the economy. “

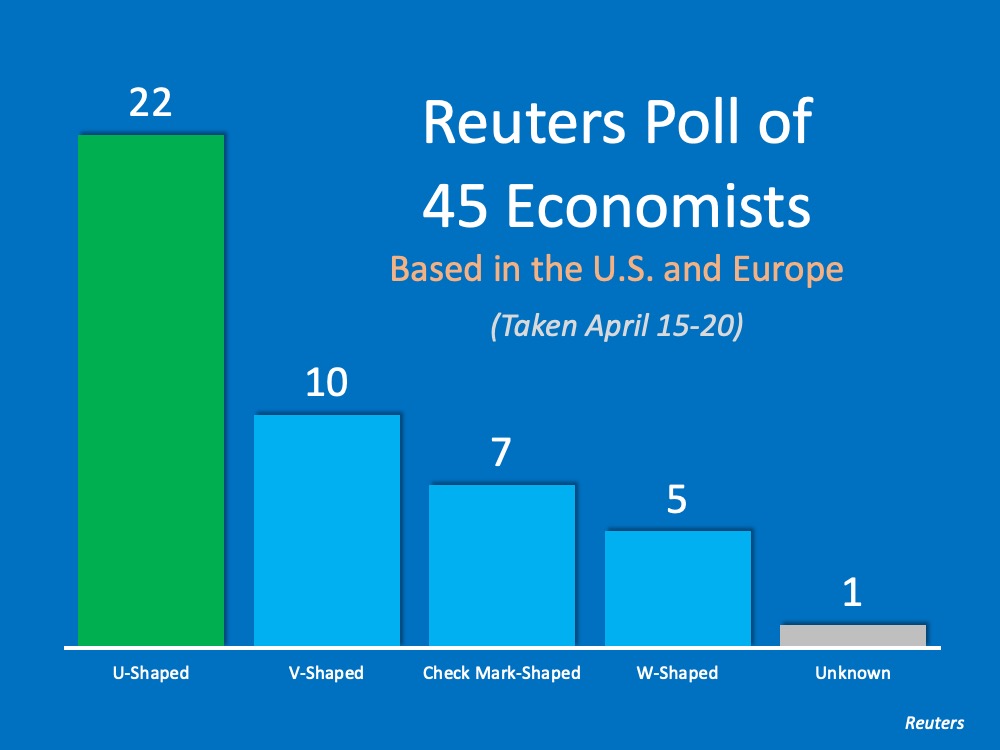

In addition, we noted how there are some in the business community who believe we may instead be headed for a U-shaped recovery, where the return to previous levels of economic success won’t occur until the middle of next year. Yesterday, Reuters released a poll of U.S. and European economists which revealed that most surveyed are now leaning more toward a U-shaped recovery.

Here are the results of that poll:

Why the disparity in thinking among different groups of economic experts?

The current situation makes it extremely difficult to project the future of the economy. Analysts normally look at economic data and compare it to previous slowdowns to create their projections. This situation, however, is anything but normal.

Today, analysts must incorporate data from three different sciences into their recovery equation:

1. Business Science – How has the economy rebounded from similar slowdowns in the past?

2. Health Science – When will COVID-19 be under control? Will there be another flareup of the virus this fall?

3. Social Science – After businesses are fully operational, how long will it take American consumers to return to normal consumption patterns? (Ex: going to the movies, attending a sporting event, or flying).

The challenge of accurately combining the three sciences into a single projection has created uncertainty, and it has led to a wide range of opinions on the timing of the recovery.

Bottom Line

Right now, the vast majority of economists and analysts believe a full recovery will take anywhere from 6-18 months. No one truly knows the exact timetable, but it will be coming.

To view original article, visit Keeping Current Matters.

What You Should Do Before Interest Rates Rise

Whether you’re looking to make a move up or downsize to a home that better suits your needs, now is the time!

Why This Isn’t Your Typical Summer Housing Market

As the economy rebounds and life is returning to normal, the real estate market is expected to have an unusually strong summer.

Housing Supply Is Rising. What Does That Mean for You?

We are seeing a slow but steady increase in homes coming up for sale. What does that mean for buyers and sellers?

4 Major Incentives To Sell This Summer

With supply challenges, low mortgage rates and motivated buyers, sellers are well-positioned to take advantage of current market conditions right now.

Selling Your House? Make Sure You Price It Right.

While it may be tempting to price your house on the high side to capitalize on this trend, doing so could limit your house’s potential.

The Truths Young Homebuyers Need To Hear

Here are three key concepts about homeownership you should understand before you start your home search.