“Using a tax refund is a common tactic for buyers and sellers.”

If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re probably working on a bit of spring cleaning and maintenance to spruce up your house before you list it.

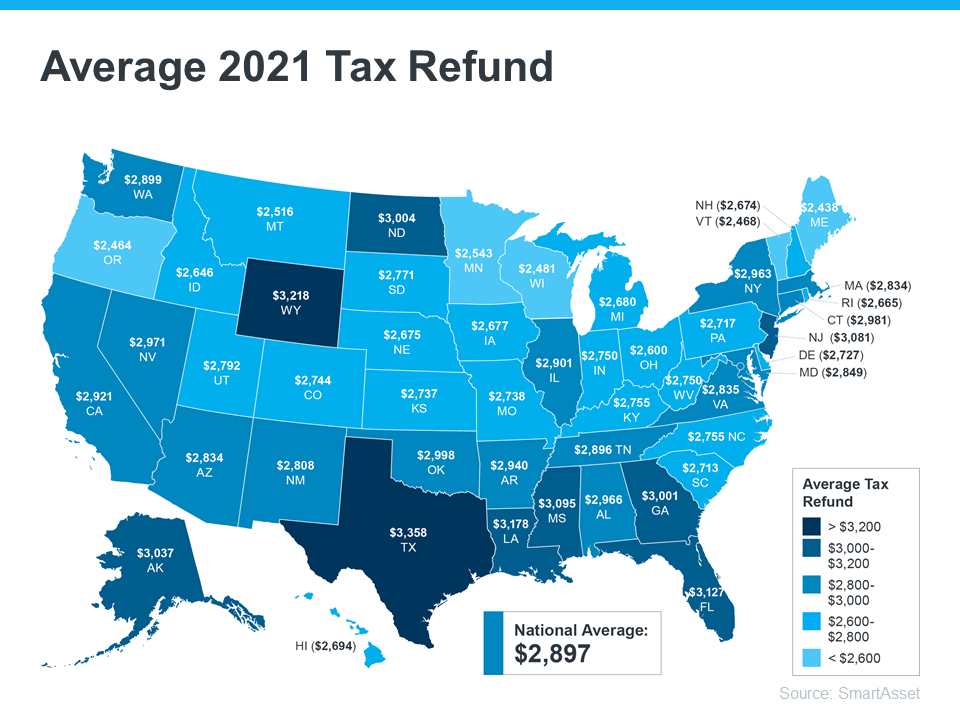

Either way, any money you get back from your taxes can help you achieve your goals. Using a tax refund is a common tactic for buyers and sellers. SmartAsset estimates the average American will receive a $2,897 tax refund this year. The map below provides a more detailed estimate by state:

If you’re getting a refund this year, here are a few tips to help with your home purchase or sale this season.

How Buyers Can Use Their Tax Refund

According to American Financing, there are multiple ways your refund check can help you as a homebuyer. A few include:

- Growing your down payment fund – If you haven’t started saving for your down payment, let your tax refund kick off the process. And if you have a fund already, the money you get back could put you closer to your goal.

- Paying for your home inspection – Your home inspection can save you a lot of headaches down the road by helping you determine the condition of the house. As a buyer, you’ll typically be responsible for paying for your inspection, and it’s definitely worth the investment.

- Saving for closing costs – Closing costs are additional expenses you’ll need to pay once it’s time to close. They average anywhere between 2-5% of the purchase price of your home.

This list is a great start, but it isn’t exhaustive of all the costs you may encounter as you set out on your homebuying journey. The best way to prepare is to work with a trusted real estate professional to make sure you understand what’s to come in the process.

How Sellers Can Use Their Tax Refund

If you own a home and are planning to sell this spring, your tax refund can help you make sure your home is ready to list. Here are a few ways current homeowners can put their tax refund to good use:

- Making small upgrades – NerdWallet provides a list of great ways to use your tax refund, including tackling small projects or boosting your curb appeal to help your home stand out.

- Making repairs – If there’s anything in your house that needs to be fixed, American Financing notes that completing repairs is another great use of that money.

- Buying your next home – Whether you’re selling to move up or downsize, you can use your tax refund to help pay for any costs on the purchase of your next home.

Of course, it’s important to talk with your trusted real estate advisor before taking on any projects. They’ll make sure you can focus on areas that’ll help you receive the best possible price when you sell.

Bottom Line

Funding your home purchase or sale can feel like a daunting task, but it doesn’t have to be. Your tax refund can help you reach your goals. Let’s connect to discuss how you can start on your journey.

To view original article, visit Keeping Current Matters.

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Here’s what’s really happening with home prices.

Your Equity Could Make a Move Possible

Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Equity can help you make your move.

More Than a House: The Emotional Benefits of Homeownership

Here’s a look at just a few of those more emotional or lifestyle perks, to help anchor you to why homeownership is one of your goals.

The Biggest Mistakes Buyers Are Making Today

There’s one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice.

How Do Climate Risks Affect Your Next Home?

How can you be sure your investment is safe from the elements? Work with a local real estate agent!

Questions You May Have About Selling Your House

If you’ve been considering selling your house, and have some questions, call us today for some clarity.