“Remarkably, the residential real estate market (including existing homes and new construction) has flourished over the last twelve months.”

Last year started off with a bang. Unemployment was under 4%, forecasters were giddy with their projections for the economy, and the residential housing market had the strongest January and February activity in over a decade.

Then came the announcement on March 11, 2020, from the World Health Organization declaring COVID-19 a worldwide pandemic. Two days later, the White House declared it a national emergency. Businesses and schools were forced to close, shelter-in-place mandates were enacted, and the economy came to a screeching halt. As a result, unemployment in this country skyrocketed to 14.9%.

A year later, the economy is recovering, and the U.S. has regained more than half of the jobs that were originally lost. However, some businesses are still closed, and many schools are still struggling to reopen. Despite the past and current challenges, there is one industry that’s proven to be a tailwind helping to counter all of these headwinds to our economy. That industry is housing. Remarkably, the residential real estate market (including existing homes and new construction) has flourished over the last twelve months. Sales are up, prices are appreciating, and more new homes are being built. The housing market has been a pillar of strength in an otherwise slowly recovering economy.

How does the real estate market help the economy?

At the beginning of the pandemic, the National Association of Realtors (NAR) released a report that explained:

“Real estate has been, and remains, the foundation of wealth building for the middle class and a critical link in the flow of goods, services, and income for millions of Americans. Accounting for nearly 18% of the GDP, real estate is clearly a major driver of the U.S. economy.”

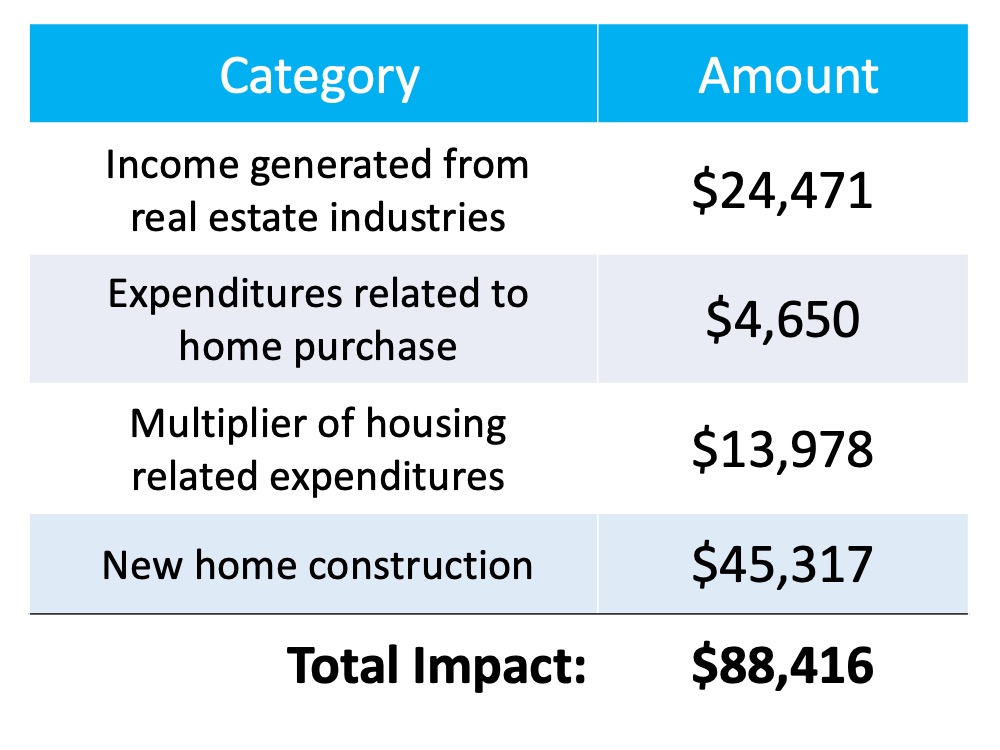

The report calculated the total economic impact of real estate-related industries on the economy as well as the expenditures that resulted from a single home sale. At a national level, their research revealed that a single newly constructed home had an economic impact of $88,416.

Here’s how it breaks down: The map below shows the impact by state:

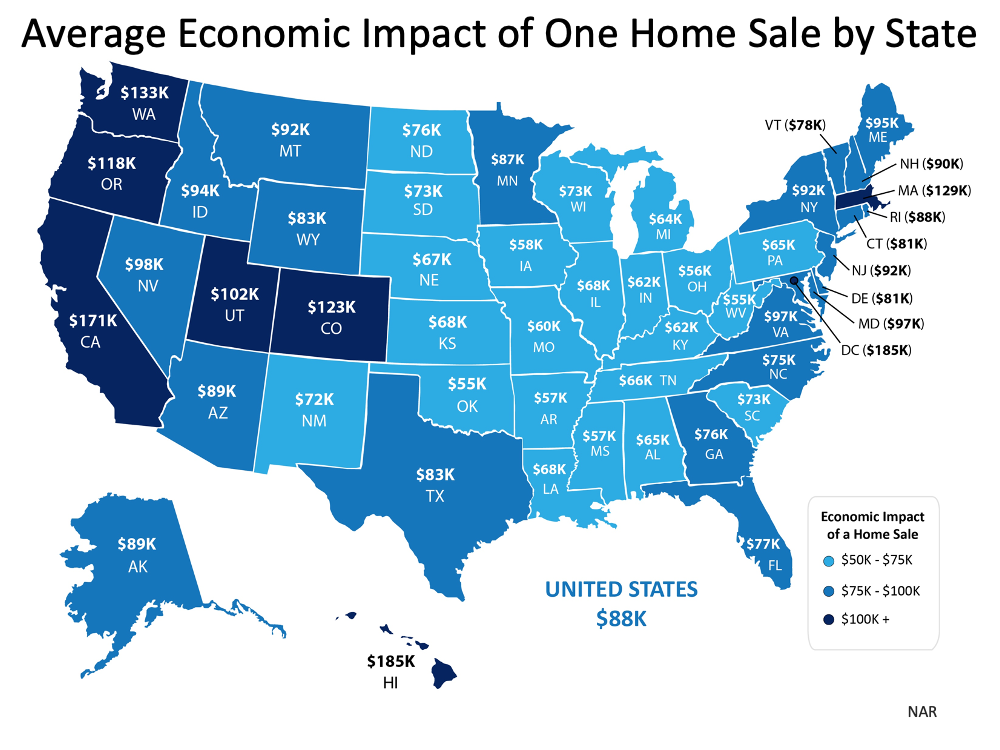

The map below shows the impact by state: The impact of an existing home sale is approximately $40,000.

The impact of an existing home sale is approximately $40,000.

Real estate has done more for our economic wellbeing than virtually any other industry over the last year. It’s been a beacon of light during a very challenging time in our nation’s history.

Bottom Line

Whether you’re buying a newly constructed home or one that already exists, you’re making a positive economic impact in your local community – and it’s a step toward your homeownership goals as well.

To view original article, visit Keeping Current Matters.

If You’re Selling Your House This Summer, Hiring a Pro Is Critical

Today’s market is at a turning point, making it more essential than ever to work with a real estate professional.

Two Reasons Why Today’s Housing Market Isn’t a Bubble

Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation.

The Average Homeowner Gained $64K in Equity over the Past Year

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home.

More Americans Choose Real Estate as the Best Investment Than Ever Before

Your house is also an asset that typically increases in value over time, even during inflation.

Why You Need an Expert To Determine the Right Price for Your House

Your goal is to aim directly for the center – not too high, not too low, but right at market value.

What Does the Rest of the Year Hold for the Housing Market?

Home prices are forecast to keep appreciating because there are still fewer homes for sale than there are buyers in the market.