“Has your home gained equity?”

Studies have shown that, in many cases, the largest asset a family owns is the house they live in. Over the last twelve months, that asset has gained substantial value.

CoreLogic just released their 2019 3rd Quarter Homeowner Equity Insights Report. The report revealed that:

“U.S. homeowners with mortgages (roughly 64% of all properties) have seen their equity increase by a total of nearly $457 billion since the third quarter 2018, an increase of 5.1%, year over year.”

The equity in a property is determined by comparing the current value of the property against the outstanding mortgage debt. As prices rise, the equity in a home increases.

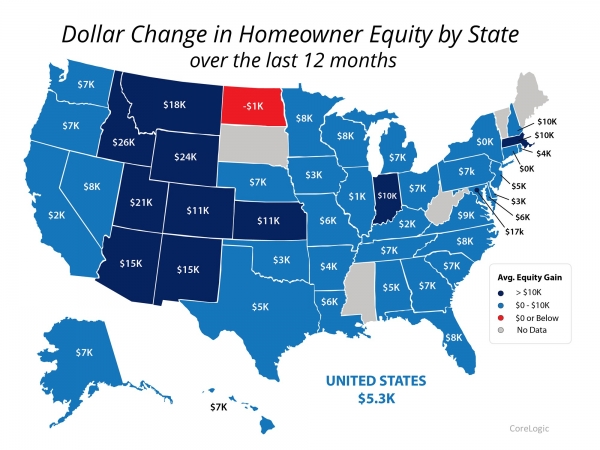

The report went on to explain that the average homeowner gain in equity over the last twelve months was $5,300.

Here’s a map showing the average equity gain by state: Since the housing crash in 2008, many homeowners have felt trapped in their current houses, as they didn’t have enough equity to sell. The gains in equity over the past few years may have freed some homeowners who have a desire to move.

Since the housing crash in 2008, many homeowners have felt trapped in their current houses, as they didn’t have enough equity to sell. The gains in equity over the past few years may have freed some homeowners who have a desire to move.

Bottom Line

If you’re curious about your home’s equity, let’s get together to do a market analysis on the current value of your house. You may be pleasantly surprised.

To view original article, visit Keeping Current Matters.

When Is the Perfect Time To Move?

No matter when you buy, there’s always some benefit and some sort of trade-off – and that’s not a bad thing.

That’s just the reality of it.

What To Save for When Buying a Home

Planning ahead and understanding the costs you may encounter upfront can make buying a home less intimidating and allow you to take control of the process.

One Homebuying Step You Don’t Want To Skip: Pre-Approval

A preapproval means you’ve cleared the hurdles necessary to be approved for a mortgage up to a certain dollar amount.

Expert Forecasts for the 2025 Housing Market

If you want to find out what’s happening where you live, you need to lean on an agent who can explain the latest trends.

The Truth About Credit Scores and Buying a Home

You don’t need perfect credit to buy a home, but your score can have an impact on your loan options and the terms you’re able to get.

Time in the Market Beats Timing the Market

If you want to buy a home and you’re able to make the numbers work, doing it sooner rather than later is usually worth it.