Homebuyers Shouldn’t Worry About 2008 All Over Again

Last week, realtor.com released a survey of active home shoppers (those who plan to purchase their next home in 1 year or less). The survey asked their opinion on an impending recession and its possible impact on the housing market.

Two major takeaways from the survey:

- 42% believe a recession will occur this year or next (another 16% said 2021)

- 59% believe the housing market would fare the same or worse than it did in 2008

Why all the talk about a recession recently?

Over the last year, four separate surveys have been taken asking when we can expect the next recession to occur:

- The Pulsenomics Survey of Market Analysts

- The Wall Street Journal Survey of Economists

- The Duke University Survey of American CFOs

- The National Association of Business Economics

70% of all respondents to the four surveys believe that a recession will occur in 2019 or 2020 with an additional 18% saying 2021.

However, we must realize that a recession does not mean we will experience another housing crash. According to the dictionary definition, a recession is:

“A period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.”

During the last recession, a dramatic fall in home values helped cause it.

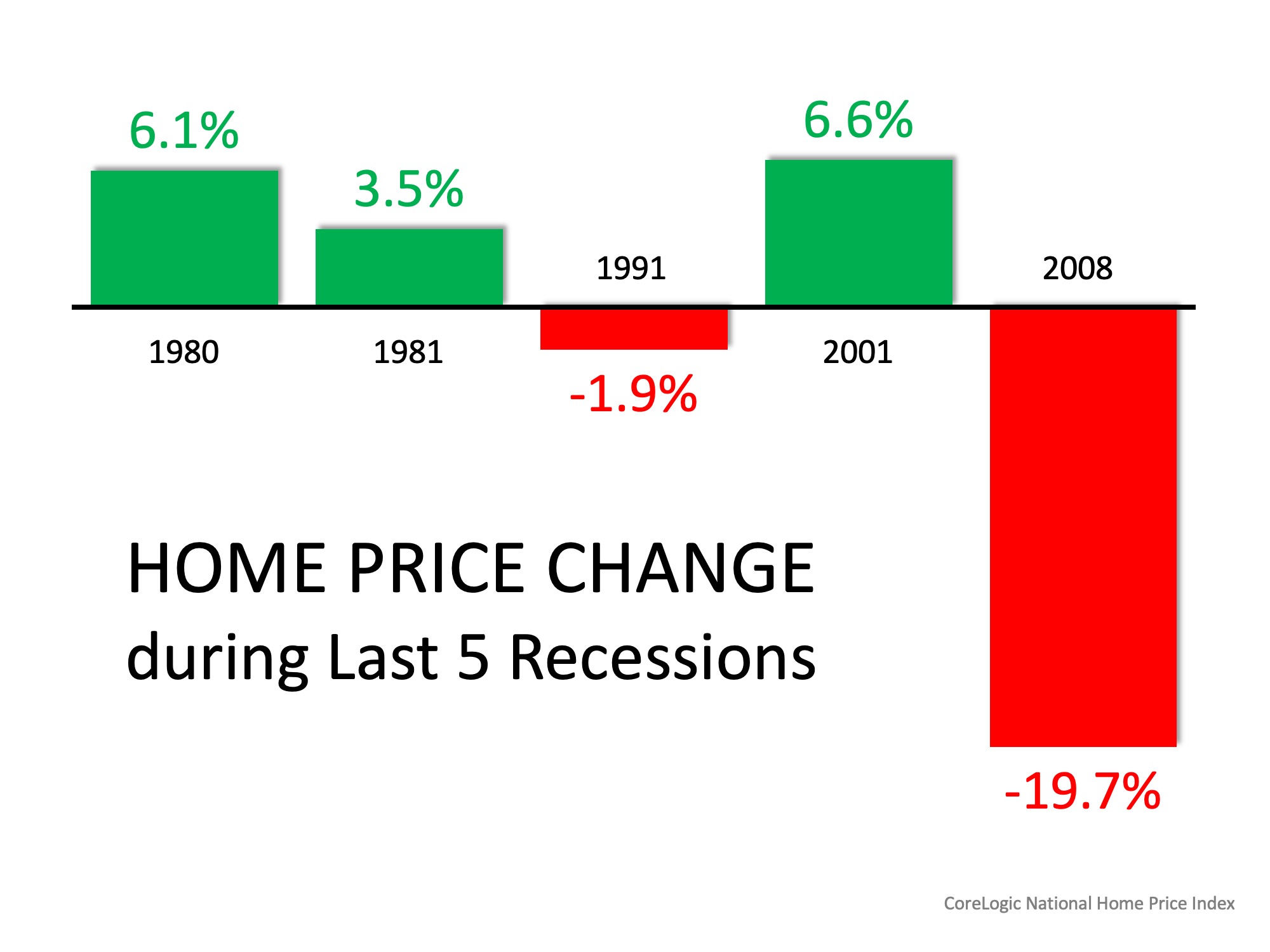

However, according to research done by CoreLogic, home values weren’t negatively impacted as they were in 2008 during the previous four recessions:

During the four recessions prior to 2008, home values depreciated only once (at a level that was less than 2%). The other three times home values appreciated, twice well above the historic norm of 3.6%.

Bottom Line

If there is an economic slowdown in our near future, there is no need for fear to set in. Most experts agree with Ralph McLaughlin, CoreLogic’s Deputy Chief Economist, who recently explained that there’s no reason to panic right now, even if we may be headed for a recession.

“We’re seeing a cooling of the housing market, but nothing that indicates a crash.”

To view original post, visit Keeping Current Matters.

Where Will You Go If You Sell? Newly Built Homes Might Be the Answer.

New home construction is up and is becoming an increasingly significant part of the housing inventory.

Why Homeownership Wins in the Long Run

It’s important to think about the long-term benefits of homeownership when deciding whether or not to buy a home.

The True Cost of Selling Your House on Your Own

When it comes to selling your most valuable asset, consider the invaluable support that a real estate agent can provide.

What Homebuyers Need To Know About Credit Scores

Your credit score is one of the most important factors lenders consider when you apply for a mortgage.

Why the Median Home Price Is Meaningless in Today’s Market

Using the median home price as a gauge of what’s happening with home values isn’t worthwhile right now.

Saving for a Down Payment? Here’s What You Need To Know.

One of the biggest misconceptions among housing consumers is what the typical down payment is.