“If you’re on the fence about whether to buy a home or not, it’s helpful to know exactly how mortgage rate shifts affect your purchasing power.”

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

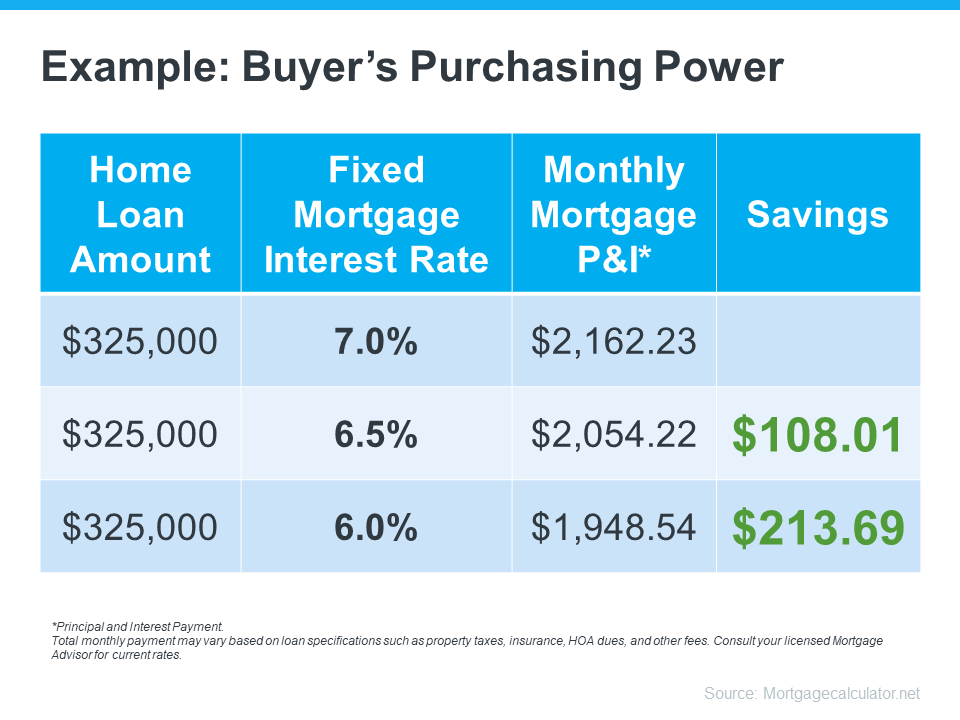

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

What This Means for You

You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Bottom Line

Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.

Memorial Day 2020

Take some time today to recognize and honor those who lost their lives fighting for our freedom. #brookhamptonrealty #memorialdayweekend #grateful #memorialday2020 #USA

Just Listed! 45 Crystal Beach Boulevard

Check out the latest listing by BrookHampton Realty! You won’t want to miss this spacious 4 bedroom, 2.5 waterfront colonial! Call Kevin today!

Experts Predict Economic Recovery Should Begin in the Second Half of the Year

It may be a bumpy ride, but a turnaround will begin sooner than later.

6 Reasons Why Selling Your House on Your Own Is a Mistake

During challenging times like the one we face today, it becomes even more important to have an expert help guide you through the process.

Housing Market Positioned to Bring Back the Economy

As the economy begins a recovery later in 2020, economists expect housing to play a leading role.

#1 Financial Benefit of Homeownership: Family Wealth

While home price growth will moderate during the pandemic, most experts agree that will change again once a vaccine is available.