No… You Do Not Need 20% Down to Buy NOW!

The Aspiring Home Buyers Profile from the National Association of Realtors (NAR) found that the American public is still somewhat confused about what is required to qualify for a home mortgage loan in today’s housing market. The results of the survey show that non-homeowners cite the main reason for not currently owning a home, as not being able to afford one.

This brings us to two major misconceptions that we want to address today.

1. Down Payment

NAR’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 39% of non-homeowners say they believe they need more than 20% for a down payment on a home purchase. In actuality, there are many loans written with a down payment of 3% or less.

Many renters may actually be able to enter the housing market sooner than they ever imagined with new programs that have emerged allowing less cash out of pocket.

2. FICO® Scores

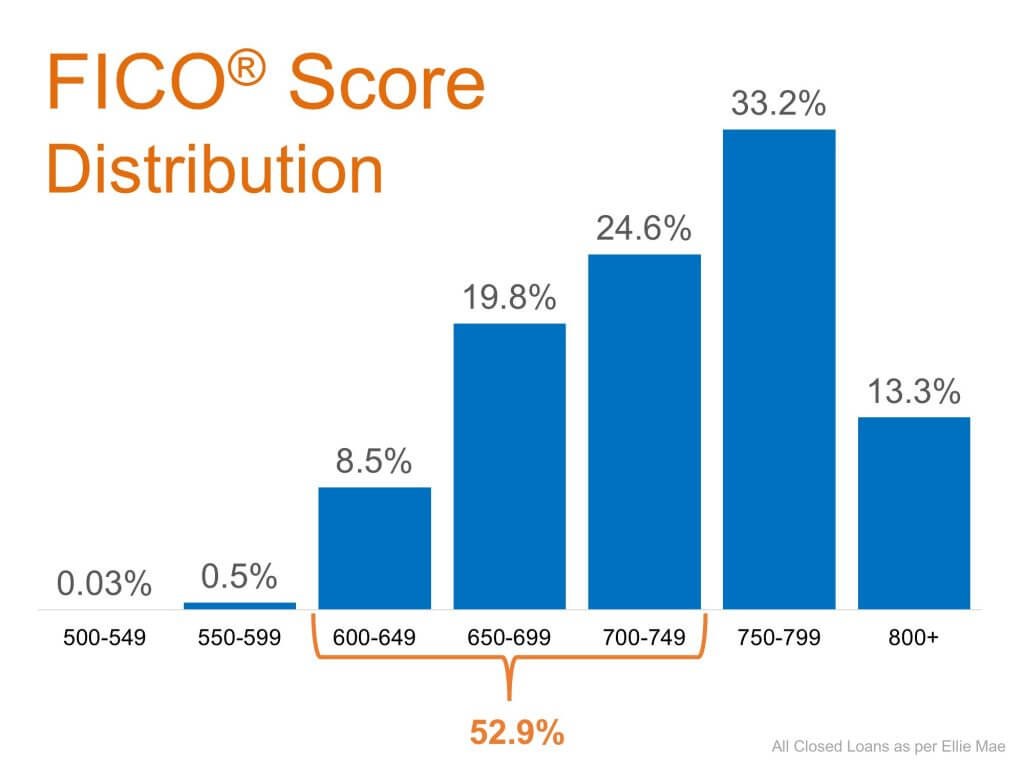

An Ipson survey revealed that 62% of respondents believe they need excellent credit to buy a home, with 43% thinking a “good credit score” is over 780. In actuality, the average FICO® scores of approved conventional and FHA mortgages are much lower.

The average conventional loan closed in August had a credit score of 752, while FHA mortgages closed with a score of 683. The average across all loans closed in August was 724. The chart below shows the distribution of FICO® Scores for all loans approved in August.

Bottom Line

If you are a prospective buyer who is ‘ready’ and ‘willing’ to act now, but are not sure if you are ‘able’ to, let’s sit down to help you understand your true options.

To see original article please visit Keeping Current Matters.

Where Will You Go If You Sell? You Have Options.

By working with a trusted real estate agent, you can be confident you’re making the most educated, informed decision.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Today’s Housing Market Is Nothing Like 15 Years Ago

In the 2nd half of 2022, there was a dramatic shift in real estate causing many people to make comparisons to the 2008 housing crisis.

3 Best Practices for Selling Your House This Year

A real estate professional can help you with tips to get your house ready to sell.

Why It Makes Sense to Move Before Spring

If you’re ready to buy a home, right now is the best time to do so before your competition grows and more buyers enter the market.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.

The Truth About Negative Home Equity Headlines

News headlines focus on short-term equity numbers and fail to convey the long-term view.

The 3 Factors That Affect Home Affordability

When you think about affordability, the full picture includes more than just mortgage rates and prices. Wages need to be factored in too.

Think Twice Before Waiting for 3% Mortgage Rates

It’s important to have a realistic vision for what you can expect this year; advice of expert real estate advisors is critical.

What Experts Are Saying About the 2023 Housing Market

2023 likely will become a year of long-lost normalcy returning to the market with mortgage rates stabilizing.