“The challenge today is to understand exactly what’s going on with the economy and what it means relative to the road ahead.”

The news these days seems to have a mix of highs and lows. We may hear that an economic recovery is starting, but we’ve also seen some of the worst economic data in the history of our country. The challenge today is to understand exactly what’s going on and what it means relative to the road ahead. We’ve talked before about what experts expect in the second half of this year, and today that progress largely hinges upon the continued course of the virus.

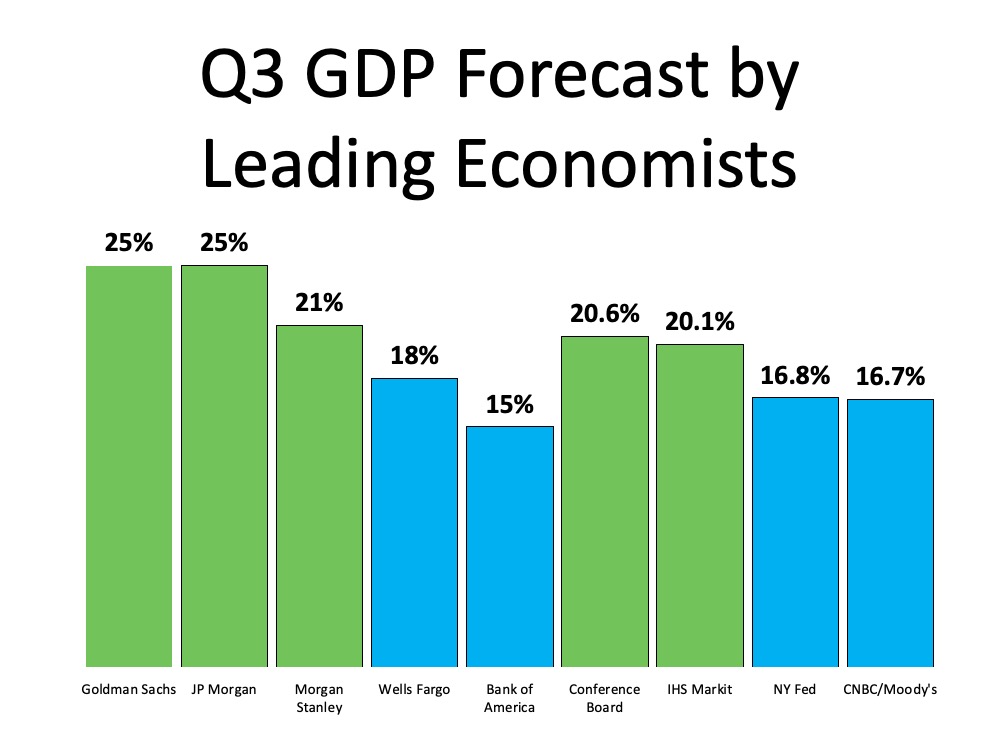

A recent Wall Street Journal survey of economists noted, “A strong economic recovery depends on effective and sustained containment of Covid-19.” Given the uncertainty around the virus, we can also see what economists are forecasting for GDP in the third quarter of this year (see graph below):

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, with 5 of the 9 experts indicating over 20% growth.

Lisa Shalett, Chief Investment Officer for Morgan Stanley puts it this way:

“Indeed, the ‘worst ever’ GDP reading could be followed by the ‘best ever’ growth in the third quarter.”

As we look forward, we can expect consumer spending to improve as well. According to Opportunity Insights, as of August 1, consumer spending was down just 7.8% as compared to January 1 of this year.

Bottom Line

An economic recovery is beginning to happen throughout the country. While there are still questions that need to be answered about the road ahead, we can expect to see improvement this quarter.

To view original article, visit Keeping Current Matters.

Mortgage Rates Drop to Lowest Level in over a Year and a Half

Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.

2025 Housing Market Forecasts: What To Expect

Looking ahead to 2025, it’s important to know what experts are projecting for the housing market.

The Best Time to Buy a Home This Year

Mortgage rates just hit their lowest point in 19 months, and that goes a long way to help with your purchasing power and affordability. Are you ready to buy?

Could a 55+ Community Be Right for You?

the number of listings tailored for homebuyers in this age group has increased by over 50% compared to last year.

Why Pre-Approval Should Be at the Top of Your Homebuying To-Do List

While home affordability is finally starting to show signs of improving, it’s still tight. Your lender can help you.

Are We Heading into a Balanced Market?

Whether you’re buying or selling, understanding how the market is changing gives you a big advantage. Your agent has the latest data and local insights.