“One of the biggest questions right now is whether this historic unemployment rate will initiate a new surge of foreclosures in the market.”

One of the biggest questions right now is whether this historic unemployment rate will initiate a new surge of foreclosures in the market. It’s a very real fear. Despite the staggering number of claims, there are actually many reasons why we won’t see a significant number of foreclosures like we did during the housing crash twelve years ago. The amount of equity homeowners have today is a leading differentiator in the current market.

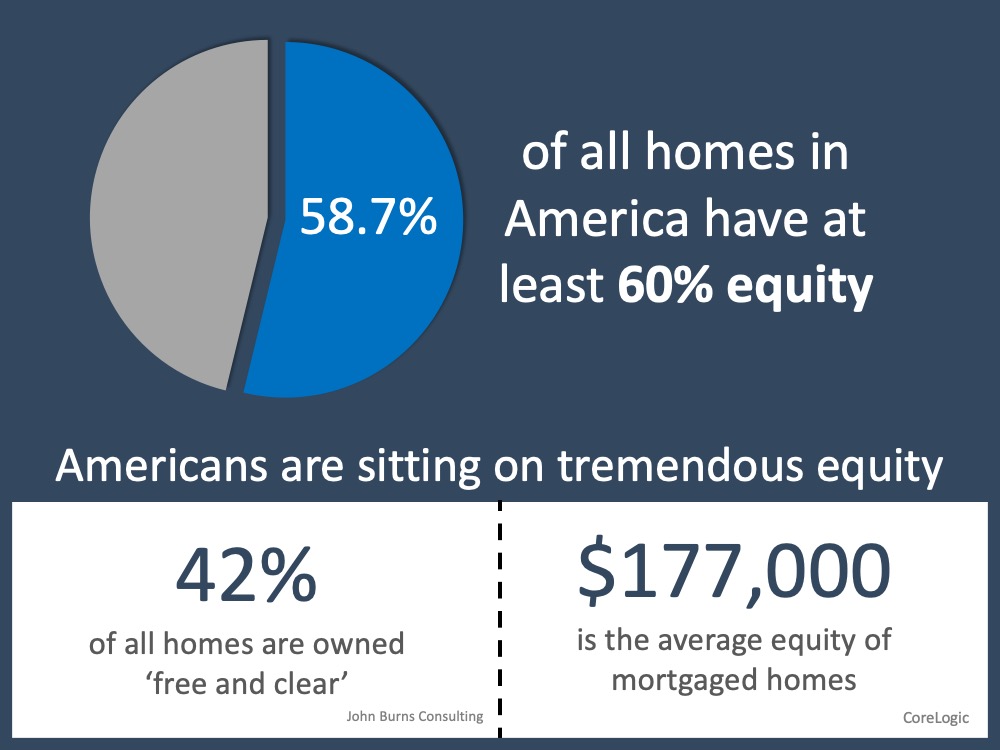

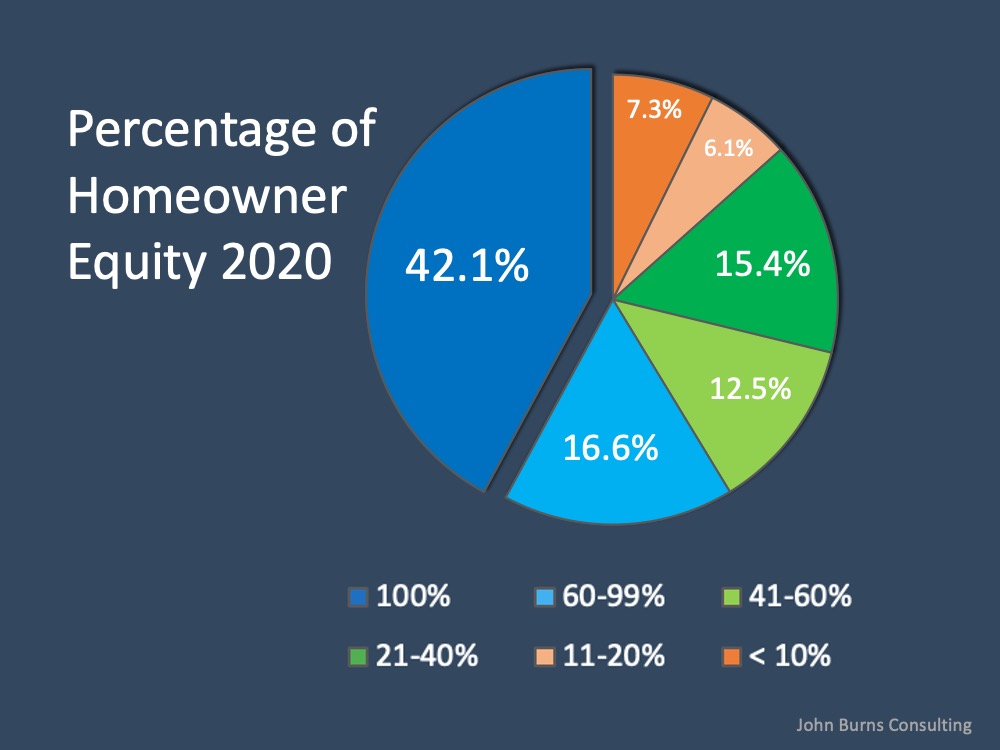

Today, according to John Burns Consulting, 58.7% of homes in the U.S. have at least 60% equity. That number is drastically different than it was in 2008 when the housing bubble burst. The last recession was painful, and when prices dipped, many found themselves owing more on their mortgage than what their homes were worth. Homeowners simply walked away at that point. Now, 42.1% of all homes in this country are mortgage-free, meaning they’re owned free and clear. Those homes are not at risk for foreclosure (see graph below):  In addition, CoreLogic notes the average equity mortgaged homes have today is $177,000. That’s a significant amount that homeowners won’t be stepping away from, even in today’s economy (see chart below):

In addition, CoreLogic notes the average equity mortgaged homes have today is $177,000. That’s a significant amount that homeowners won’t be stepping away from, even in today’s economy (see chart below): In essence, the amount of equity homeowners have today positions them to be in a much better place than they were in 2008.

In essence, the amount of equity homeowners have today positions them to be in a much better place than they were in 2008.

Bottom Line

The fear and uncertainty we feel right now are very real, and this is not going to be easy. We can, however, see strength in our current market through homeowner equity that has not been there in the past. That may be a bright spark to help us make it through.

To view original article, visit Keeping Current Matters.

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

Find the right agent to make sure your house is prepped, priced, and marketed well, so you can get ahead of the competition!

The Real Benefits of Buying a Home This Year

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.

Home Price Growth Is Moderating – Here’s Why That’s Good for You

It’s crucial to understand what’s happening in your local market and a local real estate agent can really help.

The Secret To Selling? Using an Agent To Get Your House Noticed

The way your agent markets your house can be the difference between whether or not it stands out and gets attention from buyers.

Buyer Bright Spot: There Are More Homes on the Market

The number of homes for sale has grown a whole lot lately and that’s true for both existing and newly built homes.

How Home Equity Can Help Fuel Your Retirement

Your agent will help you understand how much equity to have and how you can use it and help you navigate the entire process.