“Millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream”

In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream. The piece, however, also reveals,

“Saving for a down payment is one of the biggest obstacles faced by first-time home buyers. Dispelling the 20 percent down payment myth could open the path to homeownership for many more.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate how much they need to qualify for a home loan. According to the same article:

“Americans still overestimate the qualifications needed to get a mortgage, resulting in qualified potential buyers not even considering homeownership. Indeed, the Urban Institute report revealed that 16 percent of consumers believed that the minimum down payment required by lenders is 20 percent or more, and another 40 percent didn’t know at all.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a little research, many renters may actually be able to enter the housing market sooner than they ever imagined.

Myth #2: “I Need a 780 FICO® Score or Higher”

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing a ‘good’ credit score is 780 or higher.

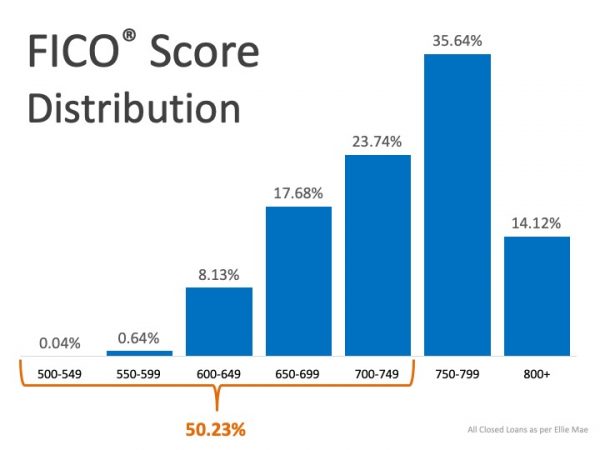

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Believe it or not – your dream home may already be within your reach.

To view original article, visit Keeping Current Matters.

The Majority of Americans Still View Homeownership as the American Dream

Buying a home is a powerful decision, and it remains a key part of the American Dream.

Key Factors Affecting Home Affordability Today

When you think about affordability, remember the full picture includes mortgage rates, home prices and wages.

Sell Your House Before the Holidays

A trusted real estate advisor can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

3 Trends That Are Good News for Today’s Homebuyers

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too.

Taking the Fear out of Saving for a Home

If you’re planning to buy a home, knowing what to budget for and how to save may sound scary at first but a trusted real estate professional can help.

What’s Ahead for Home Prices?

The housing market is shifting, and it’s a confusing place right now. Let’s connect so you have a trusted professional to help you make an informed decisions about what’s happening in our market.