“Millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream”

In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream. The piece, however, also reveals,

“Saving for a down payment is one of the biggest obstacles faced by first-time home buyers. Dispelling the 20 percent down payment myth could open the path to homeownership for many more.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate how much they need to qualify for a home loan. According to the same article:

“Americans still overestimate the qualifications needed to get a mortgage, resulting in qualified potential buyers not even considering homeownership. Indeed, the Urban Institute report revealed that 16 percent of consumers believed that the minimum down payment required by lenders is 20 percent or more, and another 40 percent didn’t know at all.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a little research, many renters may actually be able to enter the housing market sooner than they ever imagined.

Myth #2: “I Need a 780 FICO® Score or Higher”

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing a ‘good’ credit score is 780 or higher.

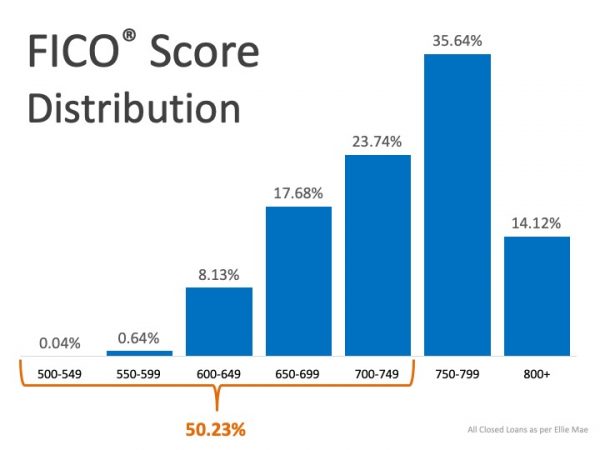

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Believe it or not – your dream home may already be within your reach.

To view original article, visit Keeping Current Matters.

Why Are People Moving Today?

While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors.

A Window of Opportunity for Homebuyers

The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic.

What’s Causing Ongoing Home Price Appreciation?

Experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand.

Think Home Prices Are Going To Fall? Think Again

If you’re planning to buy a home, you shouldn’t wait for home prices to drop to make your purchase.

Why Pre-Approval Is a Game Changer for Homebuyers

Pre-approval from a lender helps you understand your true price range and how much money you can borrow for your loan.

Wondering Where You’ll Move if You Sell Your House Today?

A trusted real estate agent will help you think through the pros and cons of new and existing homes to help you make your best decision.