“Millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream”

In a recent article, First American shared how millennials are not really any different from previous generations when it comes to the goal of homeownership; it is still a huge part of their American Dream. The piece, however, also reveals,

“Saving for a down payment is one of the biggest obstacles faced by first-time home buyers. Dispelling the 20 percent down payment myth could open the path to homeownership for many more.”

Myth #1: “I Need a 20% Down Payment”

Buyers often overestimate how much they need to qualify for a home loan. According to the same article:

“Americans still overestimate the qualifications needed to get a mortgage, resulting in qualified potential buyers not even considering homeownership. Indeed, the Urban Institute report revealed that 16 percent of consumers believed that the minimum down payment required by lenders is 20 percent or more, and another 40 percent didn’t know at all.”

While many potential buyers still think they need to put at least 20% down for the home of their dreams, they often don’t realize how many assistance programs are available with as little as 3% down. With a little research, many renters may actually be able to enter the housing market sooner than they ever imagined.

Myth #2: “I Need a 780 FICO® Score or Higher”

In addition to down payments, buyers are also often confused about the FICO® score it takes to qualify for a mortgage, believing a ‘good’ credit score is 780 or higher.

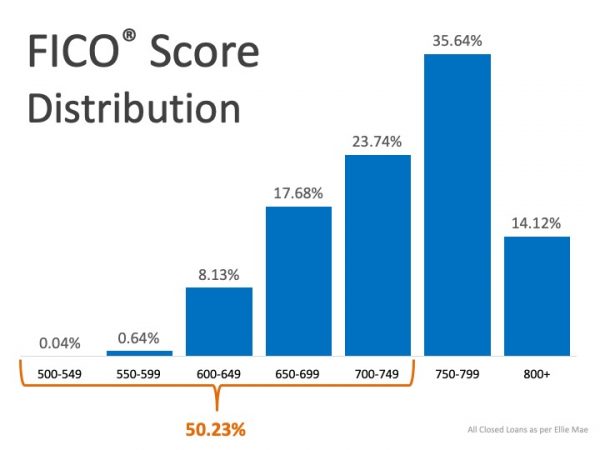

To debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

As indicated in the chart above, 50.23% of approved mortgages had a credit score of 500-749.

Bottom Line

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Believe it or not – your dream home may already be within your reach.

To view original article, visit Keeping Current Matters.

Housing Experts Say This Market Isn’t a Bubble

Lending standards are tighter due to lessons learned and new regulations enacted after the last crisis.

Expert Housing Market Forecasts for the Second Half of the Year

Housing supply is increasing, but there are still more buyers than there are homes for sale, maintaining the upward pressure on home prices.

The Drop in Mortgage Rates Brings Good News for Homebuyers

A decrease in mortgage rates means an increase in your purchasing power.

Is Homeownership Still the American Dream?

Your home is your stake in the community and a strong financial investment, something you can be proud of.

If You’re Selling Your House This Summer, Hiring a Pro Is Critical

Today’s market is at a turning point, making it more essential than ever to work with a real estate professional.

Two Reasons Why Today’s Housing Market Isn’t a Bubble

Today, there’s still a shortage of inventory, which is causing ongoing home price appreciation.