3 Questions You Need To Ask Before Buying A Home

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family have your best interests at heart, they may not be fully aware of your needs and what is currently happening in the real estate market.

Ask yourself the following three questions to help determine if now is a good time for you to buy in today’s market.

1. Why am I buying a home in the first place?

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a study by realtor.com found that “73% said buying in a good school district was “important” in their search.”

This report supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. The actual reasons are:

- A good place to raise children and provide them with a good education

- A place where you and your family feel safe

- More space for you and your family

- Control of that space

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

2. Where are home values headed?

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in February (the latest data available) was $249,500. This is up 3.6% from last year. The increase also marks the 84th consecutive month with year-over-year gains.

Looking at home prices year over year, CoreLogic is forecasting an increase of 4.6%. In other words, a home that costs you $250,000 today will cost you an additional $11,500 if you wait until next year to buy it.

What does that mean to you?

Simply put, with prices increasing, it may cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

3. Where are mortgage interest rates headed?

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

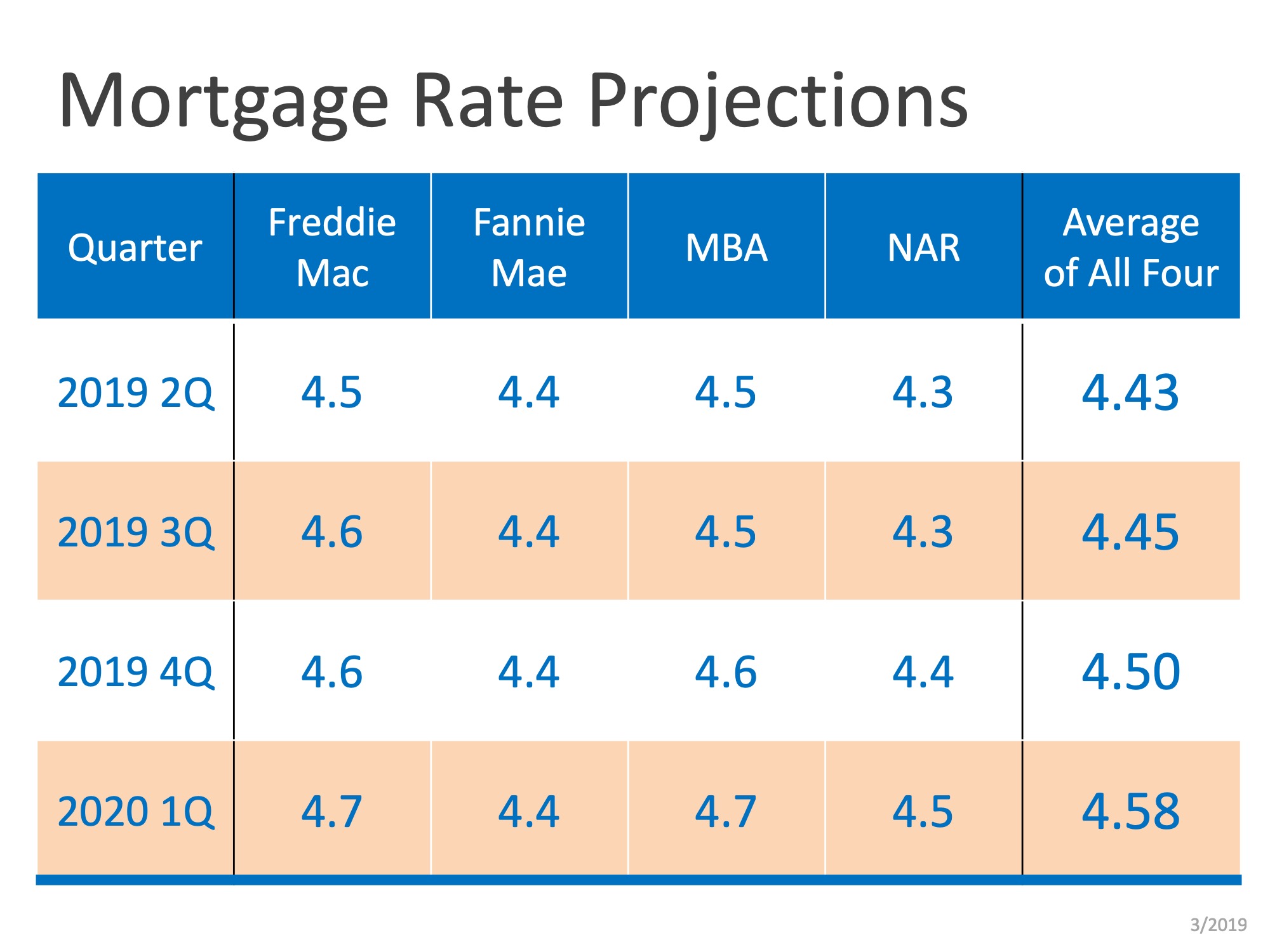

Freddie Mac, Fannie Mae, the Mortgage Bankers Association and NAR have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Bottom Line

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

To view original article, visit Keeping Current Matters.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Best Week To List Your House Is Almost Here – Are You Ready?

A seller listing a well-priced, move-in ready home is likely to find success.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

4 Things To Expect from the Spring Housing Market

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must to protect your home and your investment.