“Recent data shows the supply of homes for sale is increasing, giving buyers like you additional options.”

If you put off your home search at any point over the past two years, you may want to consider picking it back up based on today’s housing market conditions. Recent data shows the supply of homes for sale is increasing, giving buyers like you additional options.

But it’s important to keep in mind that while inventory is improving, it’s still a sellers’ market. And that means you need to be prepared as you set out on your home search. Here are three tips for buying the home of your dreams today.

1. Understand How Mortgage Rates Impact Your Homebuying Power

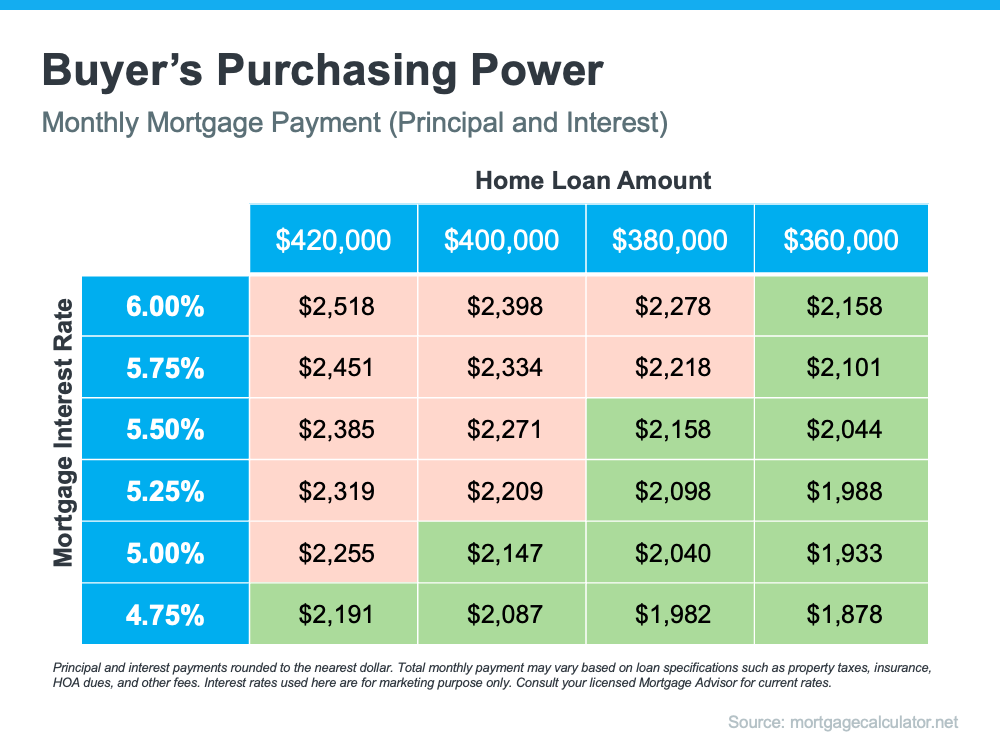

Mortgage rates have increased significantly this year, and over the past few weeks, they’ve been fluctuating quite a bit. It’s important to stay up to date on what’s happening with rates and understand how they can impact your purchasing power when you’re thinking of buying a home. The chart below can help.

Let’s say your budget allows for a monthly mortgage payment in the $2,100-$2,200 range. The green in the chart indicates a payment within or below that range, while the red is a payment that exceeds it.

As the chart shows, even a small change in mortgage rates can have a big impact on your monthly payments. If rates rise, you could exceed your budget unless you pursue a lower home loan amount. If rates fall, your purchasing power may increase, which could give you additional options for your search.

2. Be Open to Exploring Different Options During Your Search

The supply of homes for sale is improving, which gives you more homes to choose from. But historically, supply is still low. That means as you search for homes, if you still don’t find something that meets your needs, it may be worth expanding your search.

A recent article from the Washington Post highlights a few things buyers can consider today. It encourages opening yourself up to more areas. For example, if there’s a location you’ve previously ruled out (like a particular town, for example) it may be worth taking another look.

And if you’re able to, opening your search up to include other housing types, like newly built homes, condominiums, or townhomes can further increase your pool of options. Even as the inventory of homes for sale improves today, finding ways to cast a wider net during your search could help you find a hidden gem.

3. Work with a Local Real Estate Professional for Expert Guidance

Ultimately, you need to be prepared when you set out to buy a home. Jeff Ostrowski, Senior Mortgage Reporter for Bankrate, explains:

“Taking the leap to homeownership can provide a feeling of pride while boosting your long-term financial outlook, if you go in well-prepared and with your eyes open.”

No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional. If you’re just starting your search, a real estate professional can help you understand your local market and search for available homes. And when it’s time to make an offer, they’ll be an expert advisor and negotiator to help yours stand out above the rest.

Bottom Line

Strategically planning your home search by understanding today’s mortgage rates, casting a wide net, and building a team of experts can be the keys to finding the home of your dreams. To make sure you have expert advice each step of the way, let’s connect.

To view original article, visit Keeping Current Matters.

Want To Sell Your House? Price It Right.

In today’s more moderate market, how you price your house will make a big difference to not only your bottom line, but to how quickly your house could sell.

Pre-Approval in 2023: What You Need To Know

To understand why it’s such an important step, you need to understand what pre-approval is and what it does for you.

Think Twice Before Waiting for 3% Mortgage Rates

It’s important to have a realistic vision for what you can expect this year; advice of expert real estate advisors is critical.

Today’s Housing Market Is Nothing Like 15 Years Ago

In the 2nd half of 2022, there was a dramatic shift in real estate causing many people to make comparisons to the 2008 housing crisis.

The Truth About Negative Home Equity Headlines

News headlines focus on short-term equity numbers and fail to convey the long-term view.

What Experts Are Saying About the 2023 Housing Market

2023 likely will become a year of long-lost normalcy returning to the market with mortgage rates stabilizing.