“Despite the facts, misleading headlines persist, and they impact how hopeful homebuyers perceive the market.”

Headlines matter. Right now, it’s hard to read about real estate without seeing a headline that suggests homes have become unaffordable for most Americans. In reality, there’s hard evidence that shows how owning a home is more affordable than renting in most parts of the country, as record-low interest rates are keeping monthly mortgage payments about 23% lower than the typical payment of 20 years ago. Despite the facts, misleading headlines persist, and they impact how hopeful homebuyers perceive the market.

In a recent survey by realtor.com, home shoppers indicated they were surprised by what they could actually afford when buying their first home. In fact, 47% discovered their budget was larger than they expected. George Ratiu, Senior Economist at realtor.com, explains:

“For first-time buyers, especially, the drop in the 30-year mortgage rate…has provided unexpected leverage. Lower rates allowed many buyers to stretch and buy more expensive homes while keeping their monthly budget the same.”

So why do these negative headlines that cast doubt on affordability continue to exist?

Most analysts only look at two of the three elements that make up the affordability equation: price and income. It’s true that incomes haven’t kept up with the price of houses. However, affordability is about the cost of the home, not just the price. For that reason, mortgage rates, the third element of the affordability equation, are important to consider.

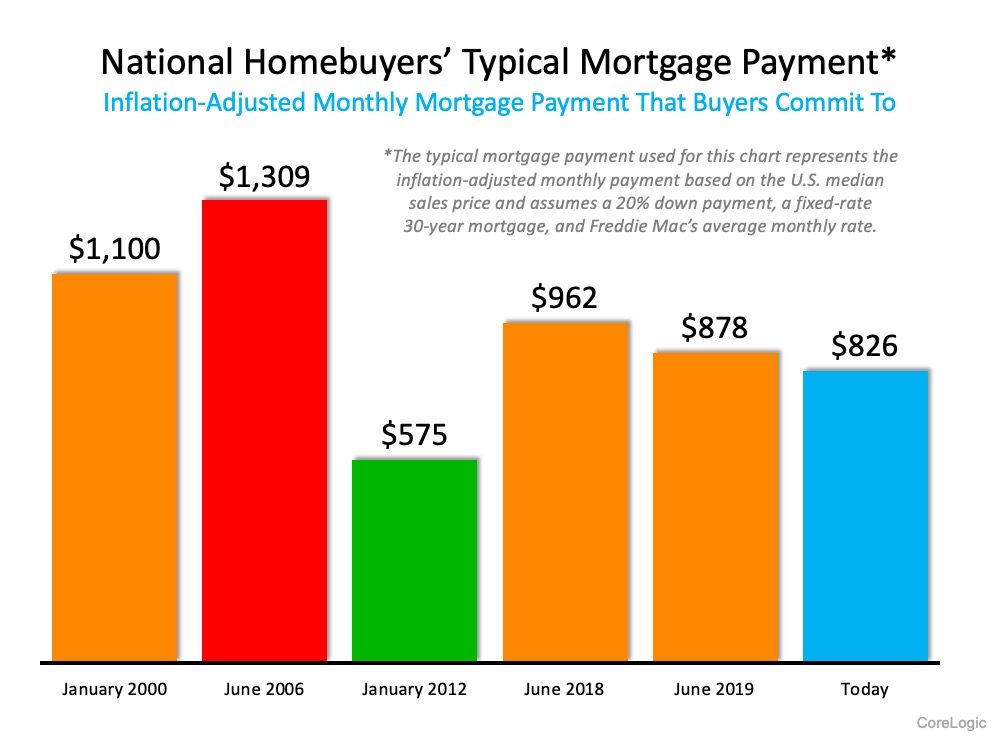

For example, here’s the typical mortgage payment for assorted dates going back to 2000, as calculated by CoreLogic: Outside of the housing crash (when short sales and foreclosures drove prices down), it’s more affordable to buy a home today when you consider all three elements of the affordability equation: price, income, and mortgage rate.

Outside of the housing crash (when short sales and foreclosures drove prices down), it’s more affordable to buy a home today when you consider all three elements of the affordability equation: price, income, and mortgage rate.

Bottom Line

Whether you’re a first-time buyer or a move-up buyer, don’t let the headlines scare you away from your dream of homeownership. Instead, connect with mortgage and real estate professionals to determine what you can afford and what’s available at that price. Like almost half of the buyers in the survey, you may be pleasantly surprised.

To view original article, visit Keeping Current Matters.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.

People Want Less Expensive Homes – And Builders Are Responding

Builders producing smaller, less expensive newly built homes give you more affordable options at a time when that’s really needed.

Don’t Expect a Flood of Foreclosures

Before there can be a significant rise in foreclosures, the number of people who can’t pay their mortgage would need to rise. Since buyers are making their payments today, a wave of foreclosures isn’t likely.

Where Are People Moving Today and Why?

If you’re thinking of moving, you may be considering the inventory and affordability challenges in the housing market and how to offset these.

There’s Only Half the Inventory of a Normal Housing Market Today

If you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year.