“Despite the facts, misleading headlines persist, and they impact how hopeful homebuyers perceive the market.”

Headlines matter. Right now, it’s hard to read about real estate without seeing a headline that suggests homes have become unaffordable for most Americans. In reality, there’s hard evidence that shows how owning a home is more affordable than renting in most parts of the country, as record-low interest rates are keeping monthly mortgage payments about 23% lower than the typical payment of 20 years ago. Despite the facts, misleading headlines persist, and they impact how hopeful homebuyers perceive the market.

In a recent survey by realtor.com, home shoppers indicated they were surprised by what they could actually afford when buying their first home. In fact, 47% discovered their budget was larger than they expected. George Ratiu, Senior Economist at realtor.com, explains:

“For first-time buyers, especially, the drop in the 30-year mortgage rate…has provided unexpected leverage. Lower rates allowed many buyers to stretch and buy more expensive homes while keeping their monthly budget the same.”

So why do these negative headlines that cast doubt on affordability continue to exist?

Most analysts only look at two of the three elements that make up the affordability equation: price and income. It’s true that incomes haven’t kept up with the price of houses. However, affordability is about the cost of the home, not just the price. For that reason, mortgage rates, the third element of the affordability equation, are important to consider.

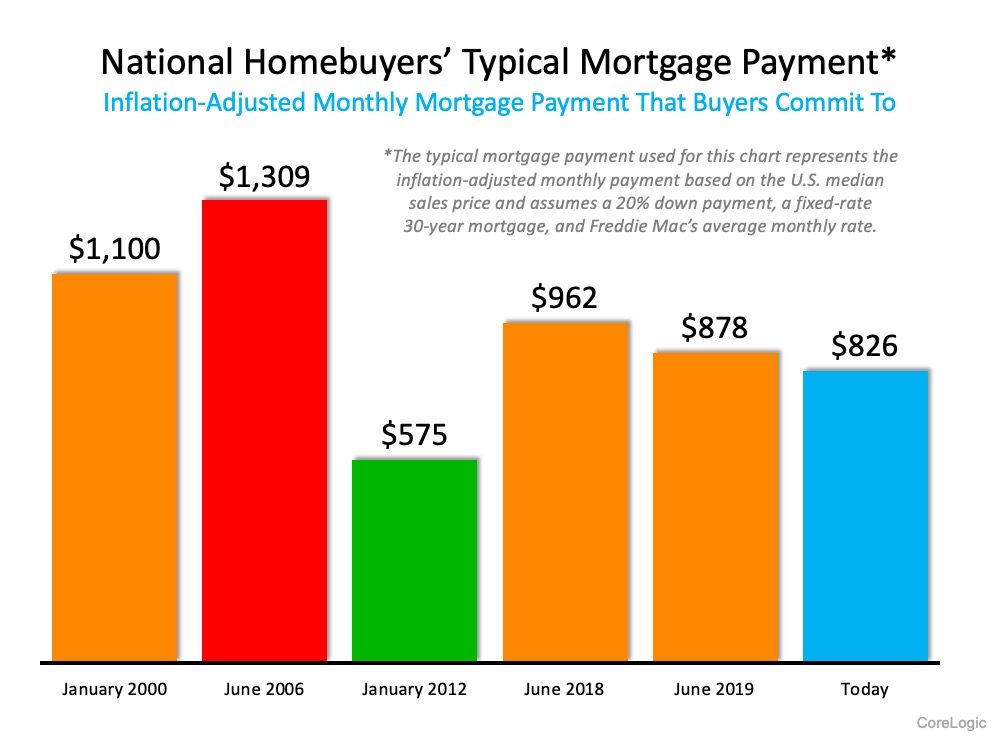

For example, here’s the typical mortgage payment for assorted dates going back to 2000, as calculated by CoreLogic: Outside of the housing crash (when short sales and foreclosures drove prices down), it’s more affordable to buy a home today when you consider all three elements of the affordability equation: price, income, and mortgage rate.

Outside of the housing crash (when short sales and foreclosures drove prices down), it’s more affordable to buy a home today when you consider all three elements of the affordability equation: price, income, and mortgage rate.

Bottom Line

Whether you’re a first-time buyer or a move-up buyer, don’t let the headlines scare you away from your dream of homeownership. Instead, connect with mortgage and real estate professionals to determine what you can afford and what’s available at that price. Like almost half of the buyers in the survey, you may be pleasantly surprised.

To view original article, visit Keeping Current Matters.

What You Need To Know About Home Price News

More ‘less-expensive’ houses are selling right now, and that’s causing the median price to decline.

The Worst Home Price Declines Are Behind Us

If we take a yearly view, home prices stayed positive – they just appreciated more slowly than they did at the peak of the pandemic.

Homeowners Have Incredible Equity To Leverage Right Now

A real estate professional can help you understand the value of your home, so you’ll get a clearer picture of how much equity you have.

It May Be Time To Consider a Newly Built Home

When housing inventory is as low as it is right now, it can feel like a bit of an uphill battle to find the perfect home.

Why Buying a Home Makes More Sense Than Renting Today

With rents much higher now than they were in more normal, pre-pandemic years, owning your home may be a better option.

Why Today’s Foreclosure Numbers Are Nothing Like 2008

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis.