“Many first-time buyers still believe they need a 20% down payment to buy a home in today’s market.”

According to the ‘2019 Home Buyer Report’ conducted by Nerdwallet, many first-time buyers still believe they need a 20% down payment to buy a home in today’s market:

“More than 6 in 10 (62%) Americans believe you must put at least 20% down in order to purchase a home.”

When potential homebuyers think they need a 20% down payment to enter the market, they also tend to think they’ll have to wait several years (in some markets) to come up with the necessary funds to buy their dream homes. The report continues to say,

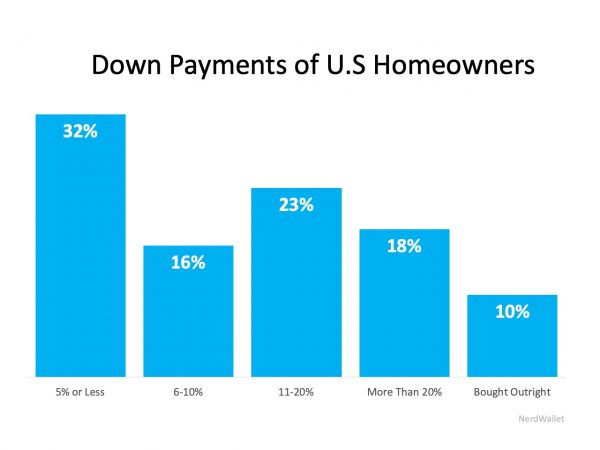

“The truth: 32% of current U.S. homeowners put 5% or less down on their home, according to census data.” (as shown below):

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

The lack of knowledge about the home-buying process is unfortunately keeping many motivated buyers on the sidelines.

Bottom Line

Don’t let a lack of understanding keep you and your family out of the housing market. Let’s get together to discuss your options today.

To view original article, visit Keeping Current Matters.

Home Equity: A Source of Strength for Homeowners Today

If you’re facing difficulties yourself, it can help to understand your options. A real estate professional can help you!

Open House! 67 Hawkins Avenue, Center Moriches

Sunday, November 13, 2022

12PM – 2PM

The Majority of Americans Still View Homeownership as the American Dream

Buying a home is a powerful decision, and it remains a key part of the American Dream.

Key Factors Affecting Home Affordability Today

When you think about affordability, remember the full picture includes mortgage rates, home prices and wages.

Sell Your House Before the Holidays

A trusted real estate advisor can help you determine how much home equity you have and how you can use it to achieve your goal of making a move.

3 Trends That Are Good News for Today’s Homebuyers

As the market has cooled this year, some of the intensity buyers faced during the peak frenzy of the pandemic has cooled too.