Housing Prices are Not Heading for Another Crash

As home values continue to increase at levels greater than historic norms, some are concerned that we are heading for another crash like the one we experienced ten years ago. We recently explained that the lenient lending standards of the previous decade (which created false demand) no longer exist. But what about prices?

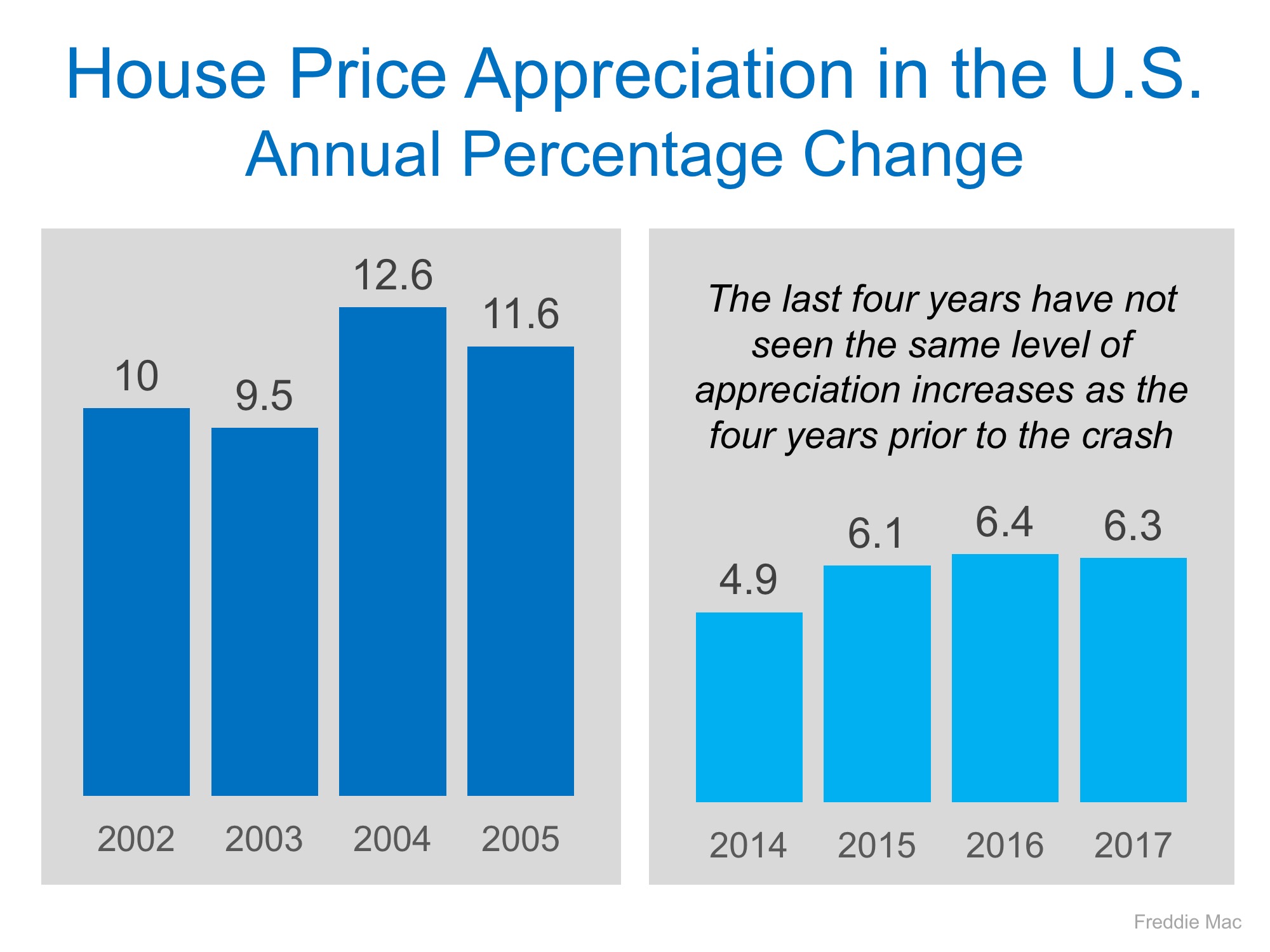

Are prices appreciating at the same rate that they were prior to the crash of 2006-2008? Let’s look at the numbers as reported by Freddie Mac:

The levels of appreciation we have experienced over the last four years aren’t anywhere near the levels that were reached in the four years prior to last decade’s crash.

We must also realize that, to a degree, the current run-up in prices is the market trying to catch up after that dramatically dropped prices for five years.

Bottom Line

Prices are appreciating at levels greater than historic norms. However, we are not at the levels that led to the housing bubble and bust.

To view original article, please visit Keeping Current Matters.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

What You Need To Know About Homeowner’s Insurance

Homeowner’s insurance is a must to protect your home and your investment.

Is the Housing Market Starting To Balance Out?

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years.

Do You Know How Much Your Home Is Worth?

The only way to get an accurate look at what your house is really worth is to talk to a local real estate agent.

The Best Week To List Your House Is Almost Here – Are You Ready?

A seller listing a well-priced, move-in ready home is likely to find success.

Is It Time To Put Your House Back on the Market?

Since January, demand has picked up – and that should continue as spring draws even closer.

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

If you’re debating whether to buy now or wait, remember: real estate rewards those in the market, not those who try to time it perfectly.

4 Things To Expect from the Spring Housing Market

With more inventory, slowing price growth, and stabilizing mortgage rates, buyers are gaining confidence and coming back into the market.

Rising Inventory Means This Spring Could Be Your Moment

If you’ve been on the sidelines, waiting for the right time to buy, this spring could be the opening you’ve been hoping for.

Is a Newly Built Home Right for You? The Pros and Cons

An agent can walk you through the pros and cons of considering a newly built home and help you decide if it makes sense for you.