Housing Prices are Not Heading for Another Crash

As home values continue to increase at levels greater than historic norms, some are concerned that we are heading for another crash like the one we experienced ten years ago. We recently explained that the lenient lending standards of the previous decade (which created false demand) no longer exist. But what about prices?

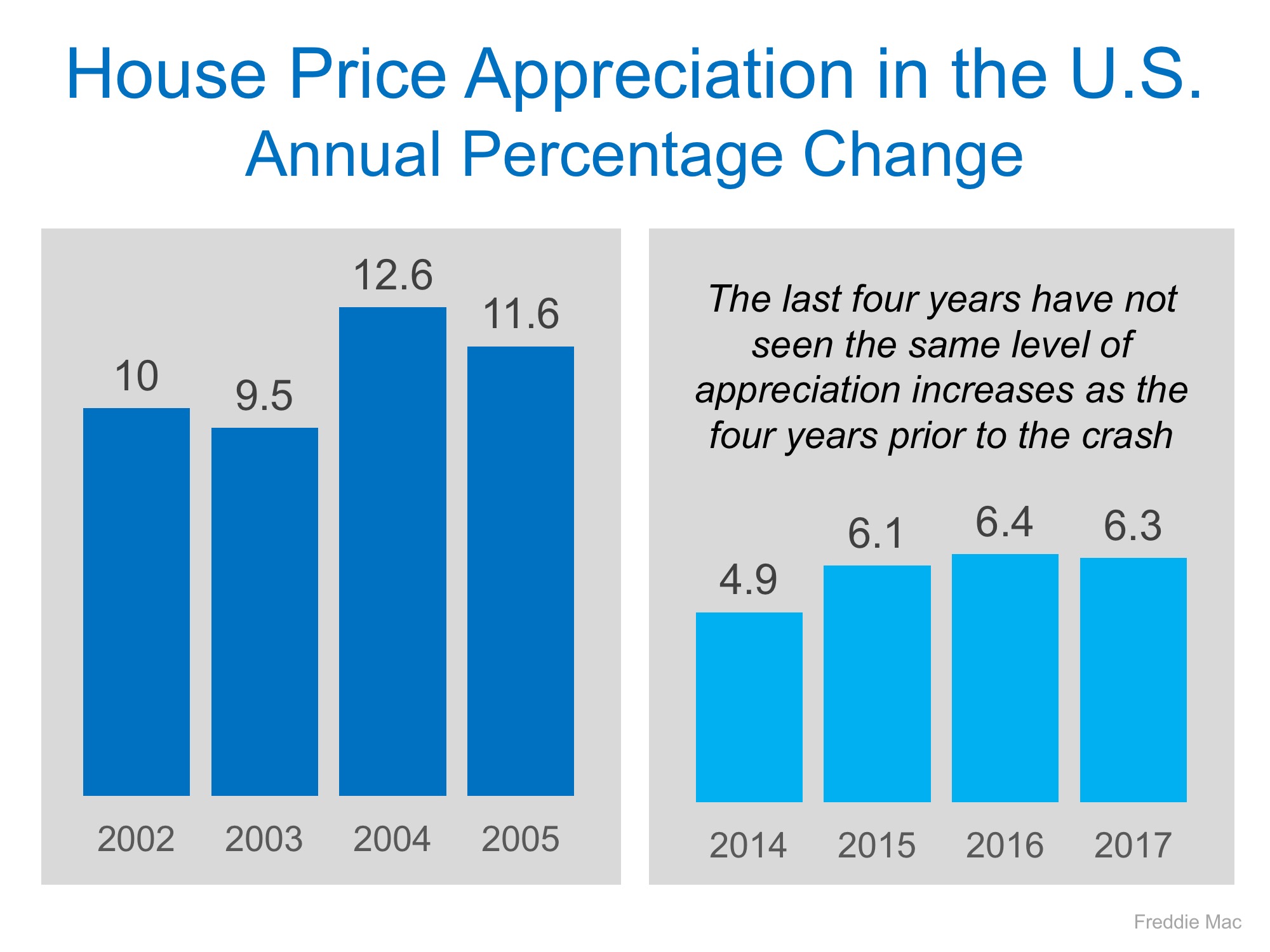

Are prices appreciating at the same rate that they were prior to the crash of 2006-2008? Let’s look at the numbers as reported by Freddie Mac:

The levels of appreciation we have experienced over the last four years aren’t anywhere near the levels that were reached in the four years prior to last decade’s crash.

We must also realize that, to a degree, the current run-up in prices is the market trying to catch up after that dramatically dropped prices for five years.

Bottom Line

Prices are appreciating at levels greater than historic norms. However, we are not at the levels that led to the housing bubble and bust.

To view original article, please visit Keeping Current Matters.

Do You Know How Much Your Home Is Worth?

The only way to get an accurate look at what your house is really worth is to talk to a local real estate agent.

Buying a Home May Help Shield You from Inflation

A fixed-rate mortgage protects your budget, and home price appreciation grows your net worth.

Home Price Growth Is Moderating – Here’s Why That’s Good for You

It’s crucial to understand what’s happening in your local market and a local real estate agent can really help.

The Secret To Selling? Using an Agent To Get Your House Noticed

The way your agent markets your house can be the difference between whether or not it stands out and gets attention from buyers.

Are Investors Actually Buying Up All the Homes?

The idea that Wall Street investors are buying up all the homes and making it impossible for you to compete is a myth

Are You Asking Yourself These Questions About Selling Your House?

The market isn’t at a standstill. Every day, thousands of people buy, and they’re looking for homes like yours.

Buyer Bright Spot: There Are More Homes on the Market

The number of homes for sale has grown a whole lot lately and that’s true for both existing and newly built homes.

How To Buy a Home Without Waiting for Lower Rates

Even if mortgage rates don’t drop substantially, there are still ways to make buying a home more affordable.

A Record Percent of Buyers Are Planning To Move in 2025 – Are You?

Find the right agent to make sure your house is prepped, priced, and marketed well, so you can get ahead of the competition!

The Real Benefits of Buying a Home This Year

Let’s break down why homeownership is worth considering in 2025 and beyond, and how it can help set you up for the future.