Housing Prices are Not Heading for Another Crash

As home values continue to increase at levels greater than historic norms, some are concerned that we are heading for another crash like the one we experienced ten years ago. We recently explained that the lenient lending standards of the previous decade (which created false demand) no longer exist. But what about prices?

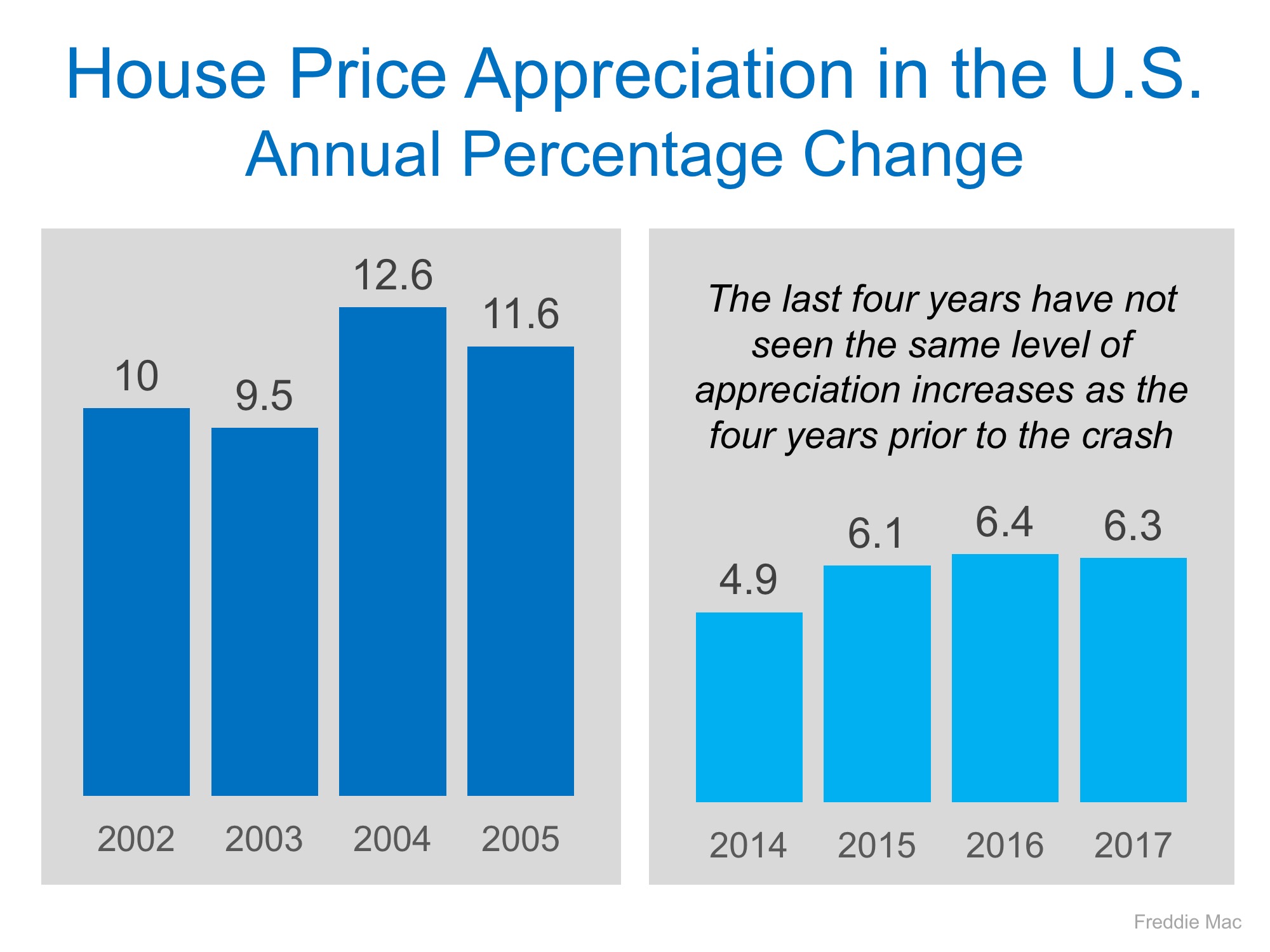

Are prices appreciating at the same rate that they were prior to the crash of 2006-2008? Let’s look at the numbers as reported by Freddie Mac:

The levels of appreciation we have experienced over the last four years aren’t anywhere near the levels that were reached in the four years prior to last decade’s crash.

We must also realize that, to a degree, the current run-up in prices is the market trying to catch up after that dramatically dropped prices for five years.

Bottom Line

Prices are appreciating at levels greater than historic norms. However, we are not at the levels that led to the housing bubble and bust.

To view original article, please visit Keeping Current Matters.

Home Prices Are Climbing in These Top Cities

Persistent demand coupled with limited housing supply are key drivers pushing home values upward.

How Buying or Selling a Home Benefits Your Community

It makes sense that housing creates a lot of jobs because so many different kinds of work are involved in the industry.

Tips for Younger Homebuyers: How To Make Your Dream a Reality

An agent will help you prioritize your list of home features and find houses that can deliver on the top ones.

What Is Going on with Mortgage Rates?

Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year.

What More Listings Mean When You Sell Your House

if you’re considering whether or not to list your house, today’s limited supply is one of the biggest advantages you have right now.

Now’s a Great Time To Sell Your House

Late spring and early summer are generally considered the best times to sell a house as these are the seasons most people move and buyer demand grows.

Is a Multi-Generational Home Right for You?

Looking for the perfect multi-generational home is a bit trickier than finding a regular house. A local real estate agent can help you out.

What You Really Need To Know About Home Prices

If you’re worried about if home prices will be coming down, here’s what you need to know.

Is It Getting More Affordable To Buy a Home?

Mortgage rates are expected to come down by the end of the year, making homebuying a little more affordable.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.