Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

To view original article, visit Keeping Current Matters.

Two Important Impacts of Home Equity

According to the most recent data from CoreLogic, the average homeowner gained $9,800 in equity over the past year which can make moving up a real possibility.

Home Values Projected to Keep Rising

Looking at the big picture, the rules of supply and demand will give us the clearest idea of what is to come. Buyer demand is high, inventory is low driving home prices higher.

Why Today’s Options Will Save Homeowners from Foreclosure

Homeowners now have a large amount of equity in their homes and may decide to sell rather than wait for the bank to foreclose.

Real Estate Continues to Show Unprecedented Strength This Year

Home sales continue to amaze industry experts, and there are plenty of buyers in the pipeline ready to enter the market.

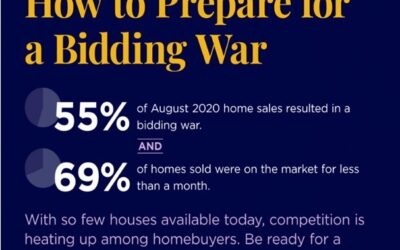

How to Prepare for a Bidding War

From pre-approval to making your best offer, here are three tips to make sure you can act quickly and confidently when you find the perfect home.

Do You Need to Know More about Forbearance and Mortgage Relief Options?

Know your options! Call your mortgage provider.

The #1 Reason Not to Wait to List Your House for Sale

Let’s connect today to get your house on the market at this optimal time to sell.

Do You Have Enough Money Saved for a Down Payment?

Be careful not to let big myths keep you and your family out of the housing market. Let’s connect to discuss your options today.

6 Reasons You’ll Win by Selling with a Real Estate Agent This Fall

There are many benefits to working with a real estate professional when selling your house. Find out why.

Should You Buy a Retirement Home Sooner Rather than Later?

If you’re a retiree with a single-family home and want to move closer to your family, now is the time to put your house on the market.