Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

To view original article, visit Keeping Current Matters.

A Homeowner’s Net Worth Is 40x Greater Than a Renter’s

The housing market has made a full recovery, and all-time low interest rates are giving home buyers a big boost in purchasing power.

Is it Time to Move into a Single-Story Home?

Single-story homes have a lot of benefits and are often in higher demand. This bodes well for future resale opportunities.

Why Pricing Your House Right Is Essential

When it comes to pricing your home, the goal is to increase visibility and drive more buyers your way.

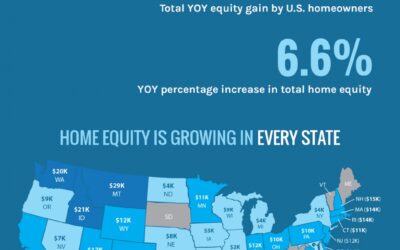

Rising Home Equity Can Power Your Next Move

Over the past year, the average homeowner gained $9,800 in equity, growing their overall net worth.

Buyers Are Finding More Space in the Luxury Home Market

Home offices, multi-purpose rooms, gyms, and theaters are becoming more popular.

Why Selling this Fall May Be Your Best Move

If you’re thinking about moving, selling your house this fall might be the way to go.

Where Are Home Values Headed Over the Next 12 Months?

The only major industry to display immunity to the economic impacts of the coronavirus is the housing market.

Housing Market on Track to Beat Last Year’s Success

Housing has experienced a strong V-shaped recovery and is now exceeding pre-pandemic levels.

Why Pricing Your Home Right Matters This Fall

To sell your home quickly and for the best possible price, you should price your home competitively right from the start.

Home Equity Gives Sellers Options in Today’s Market

Across the country, home equity was increasing before the health crisis swept our nation, and it continues to grow throughout the year.