Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

To view original article, visit Keeping Current Matters.

Sellers Are Returning to the Housing Market

With sellers starting to get back into the market, if you want to sell your house for the best possible price, now is a great time to do so.

The Beginning of an Economic Recovery

Overwhelmingly, economists are projecting GDP growth in the third quarter of 2020, some indicating over 20% growth along with improved consumer spending.

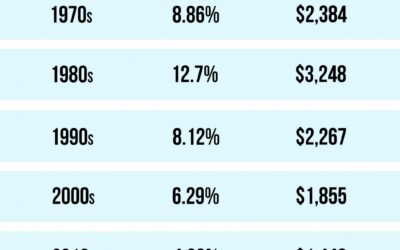

Mortgage Rates & Payments by Decade

Today’s low rates mean it’s less expensive to borrow money, so the savings over the life of your loan is significant.

#brookhamptonrealty

Homes Are More Affordable Right Now Than They Have Been in Years

If you’re thinking of making a move, now is the time to take advantage of the affordability that comes with low mortgage rates.

Why Foreclosures Won’t Crush the Housing Market Next Year

Homeowners today have many options to avoid foreclosure, and equity is surely helping to keep many afloat.

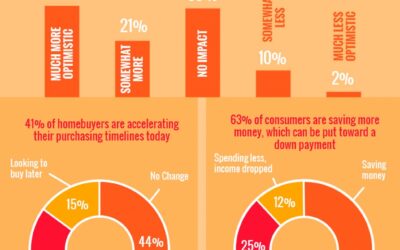

Current Buyer & Seller Perks in the Housing Market

Today’s housing market is making an impressive turnaround. It’s also setting up some outstanding opportunities for buyers and sellers.

The Latest Unemployment Report: Slow and Steady Improvement

There is, however, still a long way to go before the job market fully recovers.

2020 Homebuyer Preferences

If your needs have changed recently and you’re thinking of making a move, taking advantage of today’s low mortgage rates is an opportunity you won’t want to miss!

How Is Remote Work Changing Homebuyer Needs?

Mortgage rates hovering at historical lows may enable you to purchase more home for your money, just when your family needs it most.

Why Homeowners Have Great Selling Power Today

With average home sale profits growing, it’s a great time to leverage your equity and make a move!