Whether You Rent or Buy, Either Way You’re Paying a Mortgage!

There are some people who have not purchased homes because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize, however, that unless you are living with your parents rent-free, you are paying a mortgage – either yours or your landlord’s.

As Entrepreneur Magazine, a premier source for small business, explained in their article, “12 Practical Steps to Getting Rich”:

“While renting on a temporary basis isn’t terrible, you should most certainly own the roof over your head if you’re serious about your finances. It won’t make you rich overnight, but by renting, you’re paying someone else’s mortgage. In effect, you’re making someone else rich.”

Christina Boyle, Senior Vice President and head of the Single-Family Sales & Relationship Management organization at Freddie Mac, explains another benefit of securing a mortgage as opposed to paying rent:

“With a 30-year fixed rate mortgage, you’ll have the certainty & stability of knowing what your mortgage payment will be for the next 30 years – unlike rents which will continue to rise over the next three decades.”

As an owner, your mortgage payment is a form of ‘forced savings’ which allows you to build equity in your home that you can tap into later in life. As a renter, you guarantee the landlord is the person building that equity.

Interest rates are still at historic lows, making it one of the best times to secure a mortgage and make a move into your dream home. Freddie Mac’s latest report shows that rates across the country were at 4.22% last week.

Bottom Line

Whether you are looking for a primary residence for the first time or are considering a vacation home on the shore, now may be the time to buy.

To view original article, visit Keeping Current Matters.

In Center Moriches, 19th century farmhouse asks $699,900

88 Lake Avenue, Center Moriches featured in the Real Estate section of Newsday! Interested in this home? Give Steve and Marc a call today.

Today’s Buyers Are Serious about Purchasing a Home

As demand for homes to buy grows and millennials enter the market with buying power, the opportunity to sell your house grows too.

Experts Weigh-In on the Remarkable Strength of the Housing Market

Here’s a look at what the experts have said about the housing market over the past few weeks.

Where Is the Housing Market Headed for the Rest of 2020?

Historically low mortgage rates are creating great potential for homebuyers, and home sales are on the rise.

Will We See a Surge of Homebuyers Moving to the Suburbs?

With the ongoing health crisis, it’s no surprise that many people are starting to consider moving out of bigger cities.

Homeownership Rate Continues to Rise in 2020

There are many reasons why the homeownership rate in this country is rising, and one of the key factors is historically-low mortgage rates.

Guidance and Support Are Key When Buying Your First Home

If you’re not sure where to begin or you simply want help in figuring out how to save for a home, we are here to help you! Call us today 🙂

Three of the Latest Reports Show Housing Market Is Strong

The residential real estate market is remaining resilient as the country still struggles to beat the COVID-19 pandemic.

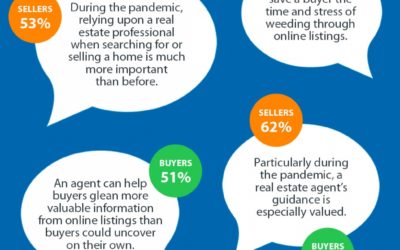

A Real Estate Pro Is More Helpful NOW than Ever

A recent study shared by NAR notes that both buyers and sellers think an agent is more helpful than ever during the current health crisis.

Home Sales Hit a Record-Setting Rebound

Home prices rose during the lockdown and could rise even further due to heavy buyer competition and a significant shortage of supply.