“Making our way through the month of June and entering the second half of the year, we face an undersupply of homes on the market.”

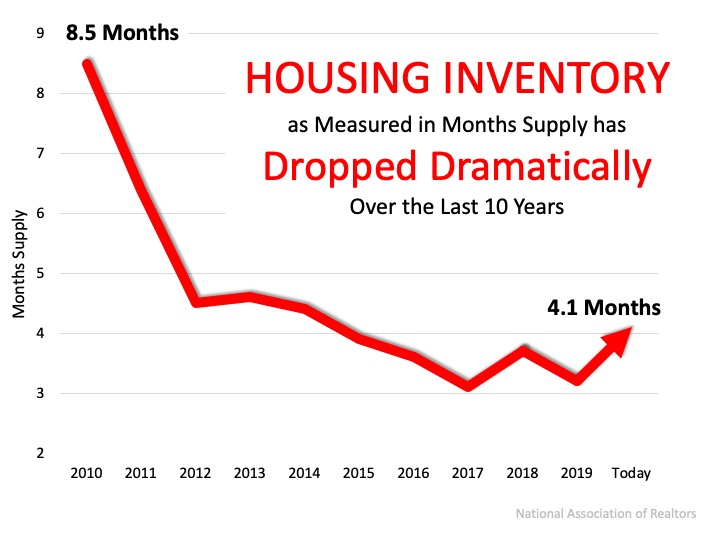

Making our way through the month of June and entering the second half of the year, we face an undersupply of homes on the market. Keep in mind, this undersupply is going to vary by location and by price point. According to the National Association of Realtors (NAR), across the country, we currently have a 4.1 months supply of homes on the market. Historically, 6 months of supply is considered a balanced market. Anything over 6 months is a buyer’s market, meaning prices will depreciate. Anything below 6 months is a seller’s market, where prices appreciate. The graph below shows inventory across the country since 2010 in months supply of homes for sale. Robert Dietz, Chief Economist for the National Home Builders Association (NAHB) says:

Robert Dietz, Chief Economist for the National Home Builders Association (NAHB) says:

“As the economy begins a recovery later in 2020, we expect housing to play a leading role. Housing enters this recession underbuilt, not overbuilt. Estimates vary, but based on demographics and current vacancy rates, the U.S. may have a housing deficit of up to one million units.”

Given the undersupply of homes on the market today, there is upward pressure on prices. Looking at simple economics, when there is less of an item for sale and the demand is high, consumers are willing to pay more for that item. The undersupply is also prompting bidding wars, which can drive price points higher in the home sale process. According to a recent MarketWatch article:

“As buyers return to the market as the country rebounds from the pandemic, a limited inventory of homes for sale could fuel bidding wars and push prices higher.”

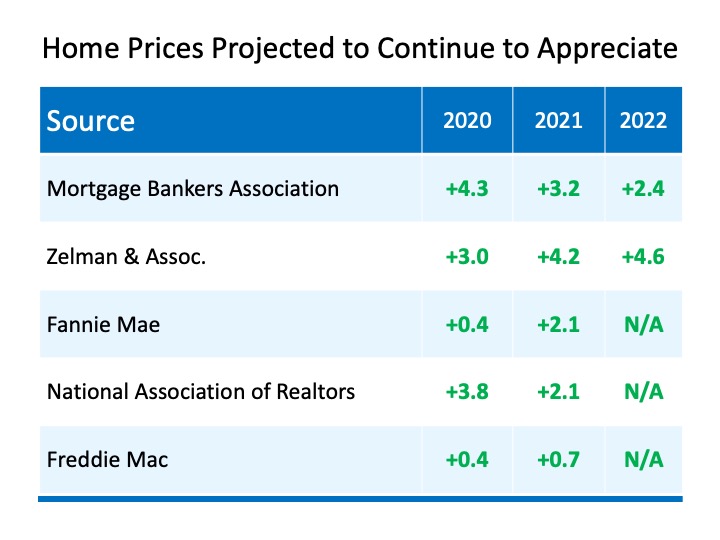

In addition, experts forecasting home prices have updated their projections given the impact of the pandemic. The major institutions expect home prices to appreciate through 2022. The chart below, updated as of earlier this week, notes these forecasts. As the year progresses, we may see these projections revised in a continued upward trend, given the lack of homes on the market. This could drive home prices even higher.

Bottom Line

Many may think home prices will depreciate due to the economic slowdown from the coronavirus, but experts disagree. As we approach the second half of this year, we may actually see home prices rise even higher given the lack of homes for sale.

To view original article, visit Keeping Current Matters.

How Co-Buying a Home Helps with Affordability Today

If you are an aspiring homeowner, buying a home with your family or friends could be an option.

Why Today’s Mortgage Debt Isn’t a Sign of a Housing Market Crash

Most homeowners today are employed and have low-interest mortgages they can afford, so they are able to make payments.

What’s Behind Today’s Mortgage Rate Volatility?

The best way to navigate this landscape is to have a team of real estate experts by your side.

Don’t Let These Two Concerns Hold You Back from Selling Your House

Working with a local real estate agent is the best way to see what inventory trends look like in your area.

More Homes, Slower Price Growth – What It Means for You as a Buyer

Having a real estate agent who knows the local area can be a big advantage when you start the buying process.

What’s Motivating Homeowners To Move Right Now

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future.