“With mortgage rates hovering at such compelling places, ongoing buyer interest is bound to keep driving the housing market forward.”

According to the latest FreddieMac Quarterly Forecast, mortgage interest rates have fallen to historically low levels this spring and they’re projected to remain low. This means there’s a huge incentive for buyers who are ready to purchase. And homeowners looking for eager buyers can take advantage of this opportune time to sell as well.

There’s a very positive outlook on interest rates going forward, as the projections from the FreddieMac report indicate continued lows into 2021:

“Going forward, we forecast the 30-year fixed-rate mortgage to remain low, falling to a yearly average of 3.4% in 2020 and 3.2% in 2021.”

With mortgage rates hovering at such compelling places, ongoing buyer interest is bound to keep driving the housing market forward. Rates also reached another record low last week, so homebuyers are in what FreddieMac is identifying as the buying mood:

“While the rebound in the economy is uneven, one segment that is exhibiting strength is the housing market. Purchase demand activity is up over twenty percent from a year ago, the highest since January 2009. Mortgage rates have hit another record low due to declining inflationary pressures, putting many homebuyers in the buying mood. However, it will be difficult to sustain the momentum in demand as unsold inventory was at near record lows coming into the pandemic and it has only dropped since then.”

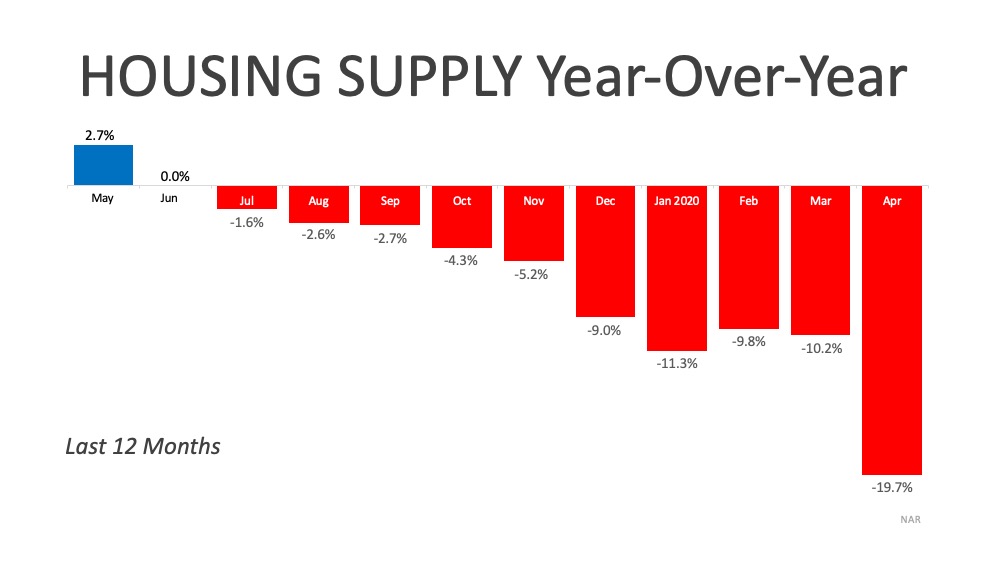

There’s no doubt that even though buyers are ready to purchase, it’s hard for many of them to find a home to buy today. Mortgage rates aren’t the only thing hovering near all-time lows; homes available for sale are too. With housing inventory as scarce as it is today – a nearly 20% year-over-year decline in available homes to purchase – keeping buyers in the purchasing mood may be tough if they can’t find a home to buy (See graph below):

What does this mean for buyers?

Competition is hot with so few homes available for purchase and low mortgage rates are helping to drive affordability as well. Getting pre-approved now will help you gain a competitive advantage and accelerate the homebuying process, so you’re ready to go when you find that perfect home you’d like to buy. Working quickly and efficiently with a trusted real estate professional will help put you in a position to act fast when you’re ready to make your move.

What does this mean for sellers?

If you’re thinking of selling your house, know that the motivation for buyers to purchase right now is as high as ever with rates where they are today. Selling now before other sellers come to market in your neighborhood this summer might put your house high on the list for many buyers. Homebuyers are clearly in the mood to buy, and with today’s safety guidelines and precautions in place to show your house, confidence is also on your side.

Bottom Line

Whether you’re looking to buy or sell, there’s great motivation to be in the housing market, especially with mortgage rates hovering at this historic all-time low. Let’s connect today to make sure you’re ready to make your move.

To view original article, visit Keeping Current Matters.

What You Can Do When Mortgage Rates Are a Moving Target

You can get the best rate possible in today’s market by controlling your credit score, loan type, and loan term..

Are You Saving Up to Buy a Home? Your Tax Refund Can Help

If you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home.

Don’t Miss This Prime Spring Window To Sell Your House

By targeting late spring, sellers can get their home listed when the most shoppers are looking.

4 Ways to Make an Offer That Stands Out This Spring

If you’re serious about landing a home you’ll love, you need a smart strategy that includes a working with a great agent.

Pre-Approval Isn’t Commitment – It’s Clarity

Pre-approval isn’t about jumping the gun or rushing your timeline. It’s about making sure you’re ready when it’s go-time.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.