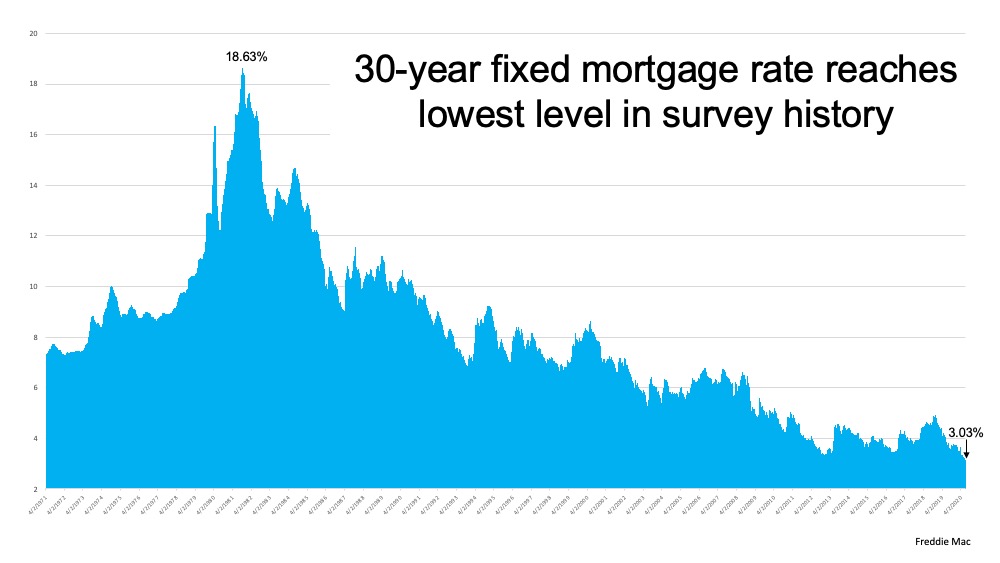

” Last week’s reported mortgage rate reached the lowest point in the history of the survey, which dates back to 1971.”

Over the past several weeks, Freddie Mac has reported the average 30-year fixed mortgage rate dropping to record lows, all the way down to 3.03%. Last week’s reported rate reached the lowest point in the history of the survey, which dates back to 1971 (See graph below):

What does this mean for buyers?

This is huge for homebuyers. Those currently taking advantage of the increasing affordability that comes with historically low interest rates are winning big. According to Sam Khater, Chief Economist at Freddie Mac:

“The summer is heating up as record low mortgage rates continue to spur homebuyer demand.”

In addition, move.com notes:

“Summer home buying season is off to a roaring start. As buyers flooded into the market, realtor.com® monthly traffic hit an all-time high of 86 million unique users in June 2020, breaking May’s record of 85 million unique users. Realtor.com® daily traffic also hit its highest level ever of 7 million unique users on June 25, signaling that despite the global pandemic buyers are ready to make a purchase.”

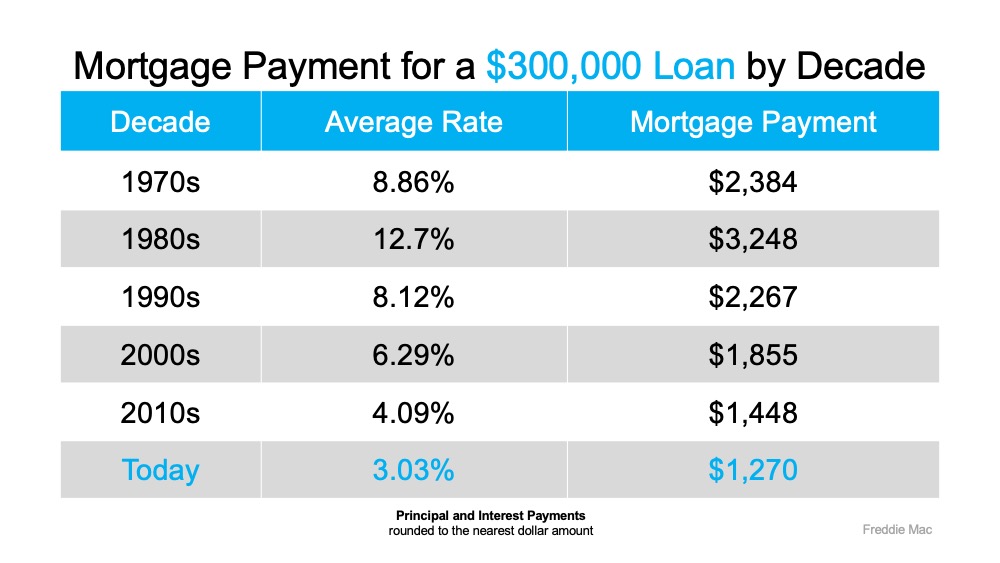

Clearly, buyers are capitalizing on today’s low rates. As shown in the chart below, the average monthly mortgage payment decreases significantly when rates are as low as they are today. A lower monthly payment means savings that can add up significantly over the life of a home loan. It also means that qualified buyers may be able to purchase more home for their money. Maybe that’s a bigger home than what they’d be able to afford at a higher rate, an increasingly desirable option considering the amount of time families are now spending at home given today’s health crisis.

A lower monthly payment means savings that can add up significantly over the life of a home loan. It also means that qualified buyers may be able to purchase more home for their money. Maybe that’s a bigger home than what they’d be able to afford at a higher rate, an increasingly desirable option considering the amount of time families are now spending at home given today’s health crisis.

Bottom Line

If you’re in a position to buy a home this year, let’s connect to initiate the process while mortgage rates are historically low.

To view original article, visit Keeping Current Matters.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.