“In real estate, pending home sales is a key indicator in determining the strength of the housing market.”

According to NAR, the Pending Home Sales Index (PHS) is:

“A leading indicator of housing activity, measures housing contract activity, and is based on signed real estate contracts for existing single-family homes, condos, and co-ops. Because a home goes under contract a month or two before it is sold, the Pending Home Sales Index generally leads Existing-Home Sales by a month or two.”

In real estate, pending home sales is a key indicator in determining the strength of the housing market. As mentioned before, it measures how many existing homes went into contract in a specific month. When a buyer goes through the steps to purchase a home, the final one is the closing. On average, that happens about two months after the contract is signed, depending on how fast or slow the process takes in each state.

Why is this rebound important?

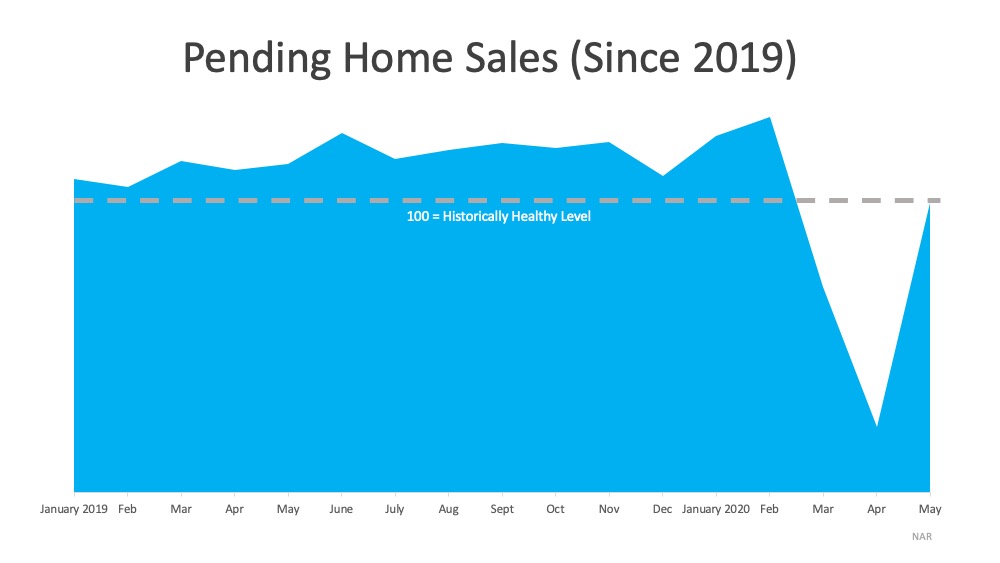

With the COVID-19 pandemic and a shutdown of the economy, we saw a steep two-month decline in the number of houses that went into contract. In May, however, that number increased dramatically (See graph below): This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

This jump means buyers are back in the market and purchasing homes right now. Lawrence Yun, Chief Economist at NAR mentioned:

“This has been a spectacular recovery for contract signings and goes to show the resiliency of American consumers and their evergreen desire for homeownership…This bounce back also speaks to how the housing sector could lead the way for a broader economic recovery.”

But in order to continue with this trend, we need more houses for sale on the market. Yun continues to say:

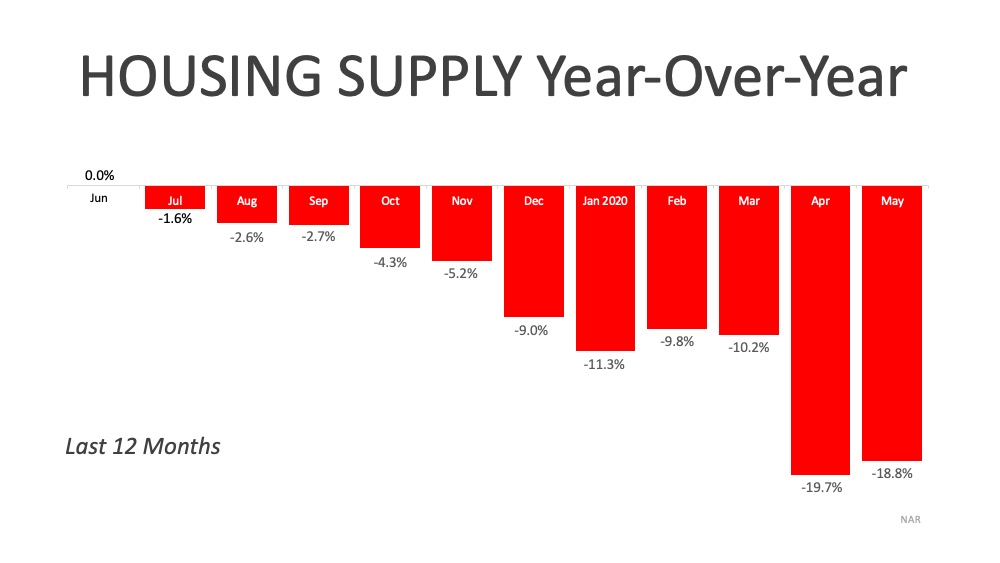

“More listings are continuously appearing as the economy reopens, helping with inventory choices…Still, more home construction is needed to counter the persistent underproduction of homes over the past decade.”

As we move through the year, we’ll see an increase in the number of houses being built. This will help combat a small portion of the inventory deficit. The lack of overall inventory, however, is still a challenge, and it is creating an opportunity for homeowners who are ready to sell. As the graph below shows, during the last 12 months, the supply of homes for sale has been decreasing year-over-year and is not keeping up with the demand from homebuyers.

Bottom Line

If you decided not to sell this spring due to the health crisis, maybe it’s time to jump back into the market while buyers are actively looking for homes. Let’s connect today to determine your best move forward.

To view original article, visit Keeping Current Matters.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.

The Best Week To List Your House Is Almost Here

The third week of April brings the best combination of housing market factors for sellers.