“Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.”

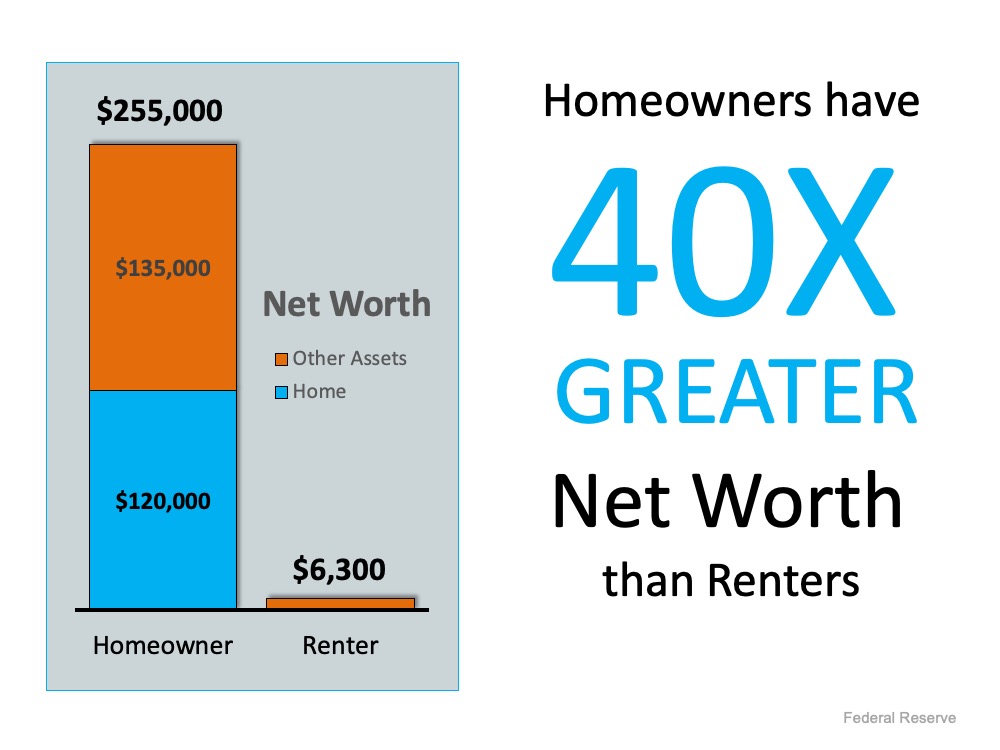

One of the best ways to build your family’s financial future is through homeownership. Recent data from the Federal Reserve indicates the net worth of a homeowner is actually over 40 times greater than that of a renter. Maybe it’s time to start thinking about buying a home, especially when they’re so affordable in today’s market.

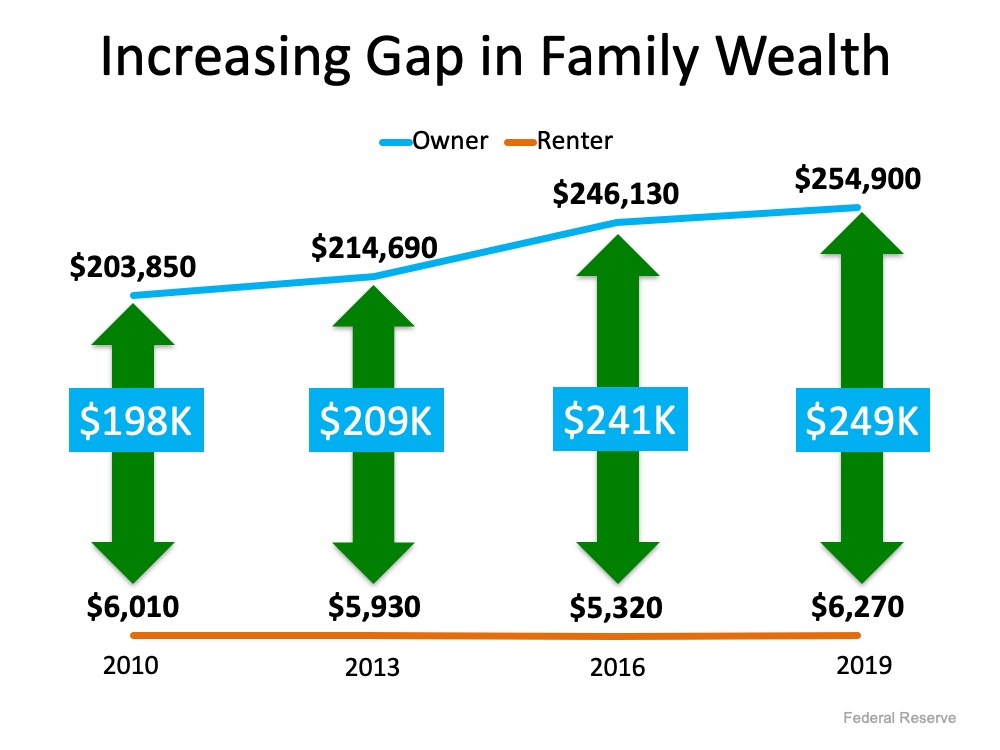

Every three years the Survey of Consumer Finances shows the breakdown of how owning a home helps build financial security. In the graph below, we see that the average net worth of homeowners continues to grow, while the net worth of renters tends to hold fairly steady and be significantly lower than that of homeowners. The gap between owning and renting just keeps getting wider over time, making homeownership more and more desirable for those who are ready.

Owning a home is a great way to build family wealth.

For many families, homeownership serves as a form of ‘forced savings.’ Every time you pay your mortgage, you’re contributing to your net worth by increasing the equity you have in your home (See chart below): The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

The impact of home equity is part of why Gallup reports that Americans picked real estate as the best long-term investment for the seventh year in a row. According to this year’s survey, 35% of Americans chose real estate over stocks, savings accounts, gold, and bonds.

Today, there are great opportunities available for those planning to buy a home. The housing market has made a full recovery, and all-time low interest rates are giving homebuyers a big boost in purchasing power. If you’re ready, buying a home this fall can set you up to increase your net worth and create a safety net for your family’s future.

Bottom Line

To learn how you can use your monthly housing cost to build your family’s net worth, let’s connect so you have a trusted professional to guide you through the homebuying process.

To view original article, visit Keeping Current Matters.

Are There Actually More Homes for Sale Right Now?

If you’re looking to buy, you may have slightly more options than you did in recent months, but you still need to brace for low inventory.

Is Your House the Top Thing on a Buyer’s Wish List this Holiday Season?

Anyone shopping for a new home between Thanksgiving and New Year’s is likely going to be a serious buyer.

People Are Still Moving, Even with Today’s Affordability Challenges

It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

The Latest 2024 Housing Market Forecast

The housing market is expected to be more active in 2024 and that may be in part because there will always be people whose lives change and need to move.

Thinking About Using Your 401(k) To Buy a Home?

Before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert.

Homeowner Net Worth Has Skyrocketed

Buying a home can be a great way to grow your net worth, since home values have a tendency to rise over time, meaning you have more equity.