“Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.”

The link between financial security and homeownership is especially important today as inflation rises. But many people may not realize just how much owning a home contributes to your overall net worth. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability.”

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.

Owning a Home Is a Building Block for Financial Success

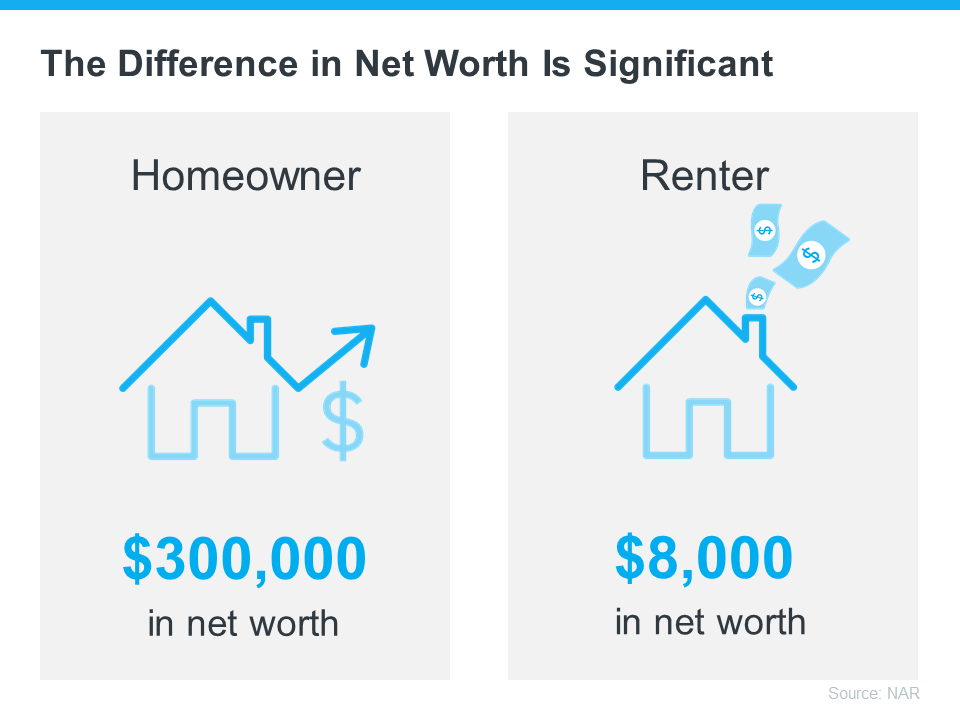

A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter (see visual below):

The results from this report show that owning a home is a key piece to the puzzle when building your overall net worth.

Equity Gains Can Substantially Boost a Homeowner’s Net Worth

The net worth gap between owners and renters exists in large part because homeowners build equity. As a homeowner, your equity grows as your home appreciates in value and you make your mortgage payments each month.

In other words, when you own your home, you have the benefit of your mortgage payment acting as a contribution to a forced savings account. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month.

To sum it up, NAR says it simply:

“Homeownership has always been an important way to build wealth.”

Bottom Line

The gap between a homeowner’s net worth and a renter’s shows how truly foundational homeownership is to wealth-building. If you’re ready to start on your journey to homeownership, let’s connect today.

To view original article, visit Keeping Current Matters.

Should I Wait for Mortgage Rates To Come Down Before I Move?

When rates come down, more people are going to get back into the market leading to more competition.

Should I Move with Today’s Mortgage Rates?

While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

The Top 5 Reasons You Need a Real Estate Agent when Buying a Home

Keep in mind, every time you make a big decision in your life, especially a financial one, you need an expert on your side.

Don’t Let Your Student Loans Delay Your Homeownership Plans

You don’t have to figure this out on your own. The best way to make a decision about your goals and next steps is to talk to the professionals.

Boomers Moving Will Be More Like a Gentle Tide Than a Tsunami

While not all baby boomers are looking to sell their homes and move – the ones who do won’t all do it at the same time.

The Best Week To List Your House Is Almost Here

The third week of April brings the best combination of housing market factors for sellers.