“Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.”

The link between financial security and homeownership is especially important today as inflation rises. But many people may not realize just how much owning a home contributes to your overall net worth. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability.”

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.

Owning a Home Is a Building Block for Financial Success

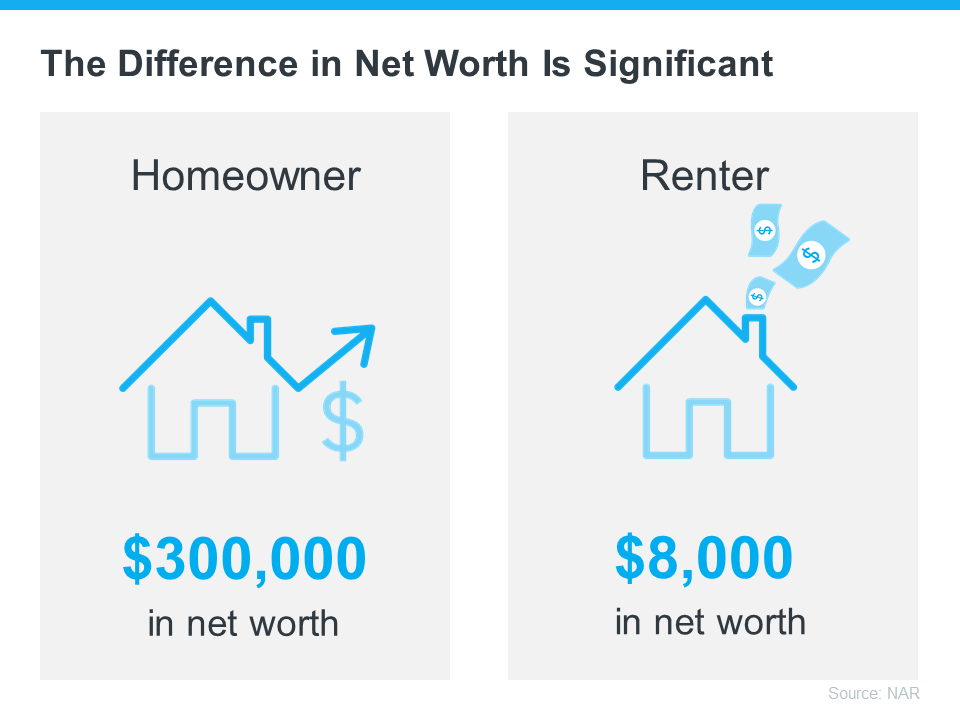

A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter (see visual below):

The results from this report show that owning a home is a key piece to the puzzle when building your overall net worth.

Equity Gains Can Substantially Boost a Homeowner’s Net Worth

The net worth gap between owners and renters exists in large part because homeowners build equity. As a homeowner, your equity grows as your home appreciates in value and you make your mortgage payments each month.

In other words, when you own your home, you have the benefit of your mortgage payment acting as a contribution to a forced savings account. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month.

To sum it up, NAR says it simply:

“Homeownership has always been an important way to build wealth.”

Bottom Line

The gap between a homeowner’s net worth and a renter’s shows how truly foundational homeownership is to wealth-building. If you’re ready to start on your journey to homeownership, let’s connect today.

To view original article, visit Keeping Current Matters.

How Changing Mortgage Rates Can Affect You

It’s critical to lean on your expert real estate advisors to explore your mortgage options and understand what impacts mortgage rates.

Get Ready: The Best Time To List Your House Is Almost Here

If you’re thinking about selling this spring, it’s time to get moving – the best week to list your house is fast approaching.

We’re in a Sellers’ Market. What Does That Mean?

Right now, there are still buyers who are ready, willing, and able to purchase a home. List your home at the right price 🙂

Why Buying a Home Is a Sound Decision

Experts aren’t forecasting a drastic fall in home prices nationally, even though some markets will see home price appreciation while others may depreciate.

How Homeownership is Life Changing for Many Women

The financial security and independence homeownership provides can be life changing.

The Role of Access in Selling Your House

As today’s housing market changes, be sure to work with your local agent to give buyers as much access as you can to your house when you sell.